Capital One 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

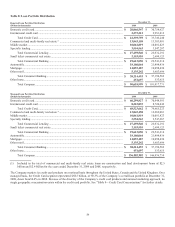

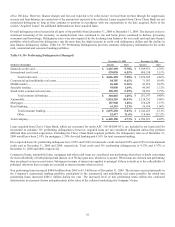

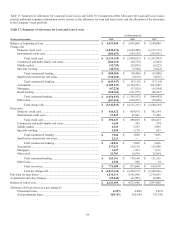

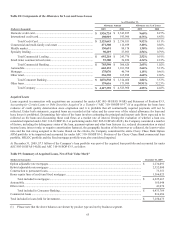

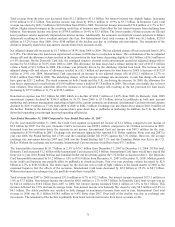

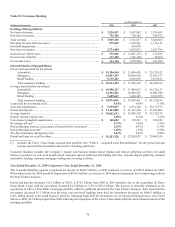

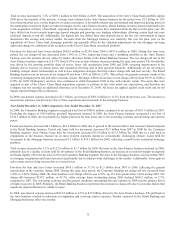

Table 18: Components of the Allowance for Loan and Lease Losses

As of December 31,

Allowance Amount Allowance as a % of Loans

(Dollars in thousands)

2009 2008 2009

2008

Domestic credit card ................................................................................. $ 1,926,724 $ 2,543,855 9.60% 8.27%

International credit card ............................................................................ 198,919 193,096 8.75% 6.45%

Total Credit Card ............................................................................ $ 2,125,643 $ 2,736,951 9.52% 8.11%

Commercial and multi-family real estate ................................................. 471,308 116,699 3.40% 0.88%

Middle market .......................................................................................... 130,691 99,178 1.30% 0.98%

Specialty lending ...................................................................................... 90,219 27,893 2.54% 0.79%

Total Commercial Lending ............................................................. $ 692,218 $ 243,770 2.52% 0.91%

Small ticket commercial real estate .......................................................... 93,380 56,850 4.34% 2.18%

Total Commercial Banking ............................................................. $ 785,598 $ 300,620 2.65% 1.02%

Automobile ............................................................................................... 665,132 1,101,708 3.66% 5.13%

Mortgage .................................................................................................. 175,076 46,794 1.18% 0.46%

Other retail ................................................................................................ 236,330 165,898 4.60% 2.96%

Total Consumer Banking ................................................................ $ 1,076,538 $ 1,314,400 2.82% 3.53%

Other loans ............................................................................................... 139,616 171,989 30.91% 32.23%

Total Company ............................................................................... $ 4,127,395 $ 4,523,960 4.55% 4.48%

Acquired Loans

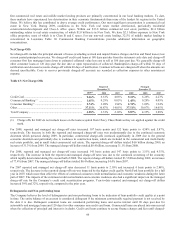

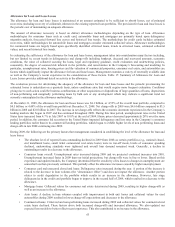

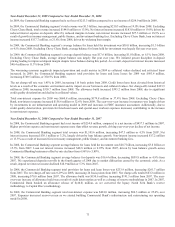

Loans acquired in connection with acquisitions are accounted for under ASC 805-10/SFAS 141(R) and Statement of Position 03-3,

Accounting for Certain Loans or Debt Securities Acquired in a Transfer (“ASC 310-10/SOP 03-3”) if at acquisition the loans have

evidence of credit quality deterioration since origination and it is probable that all contractually required payments will not be

collected. Under both statements, acquired loans are recorded at fair value and the carry-over of the related allowance for loan and

lease losses is prohibited. Determining fair value of the loans involves estimating the principal and interest cash flows expected to be

collected on the loans and discounting those cash flows at a market rate of interest. During the evaluation of whether a loan was

considered impaired under ASC 310-10/SOP 03-3 or performing under ASC 805-10/SFAS 141(R), the Company considered a number

of factors, including the delinquency status of the loan, payment options and other loan features (i.e. reduced documentation or stated

income loans, interest only, or negative amortization features), the geographic location of the borrower or collateral, the loan-to-value

ratio and the risk rating assigned to the loans. Based on the criteria, the Company considered the entire Chevy Chase Bank Option

ARM portfolio to be impaired and accounted for under ASC 310-10/SOP 03-3. Portions of the Chevy Chase Bank commercial loan

portfolio, HELOC portfolio and the fixed mortgage portfolio were also considered impaired.

At December 31, 2009, $7.3 billion of the Company’s loan portfolio was part of the acquired loan portfolio and accounted for under

ASC 805-10/SFAS 141(R) and ASC 310-10/SOP 03-3, as follow:

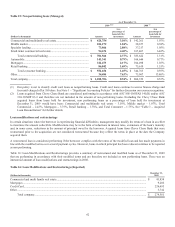

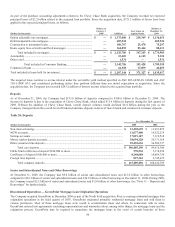

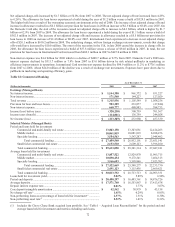

Table 19: Summary of Acquired Loans, Net of Fair Value Mark(1)

(Dollars in thousands) December 31, 2009

Option adjustable rate mortgages ................................................................................................................................

.

$ 2,234,091

Hybrid adjustable rate mortgages ...............................................................................................................................

.

2,352,000

Construction to permanent loans .................................................................................................................................

.

75,551

Home equity lines of credit and fixed mortgages .......................................................................................................

.

1,564,025

Total included in mortgages ..............................................................................................................................

.

$ 6,225,667

Automobile .................................................................................................................................................................

.

165,048

Other retail ..................................................................................................................................................................

.

43,074

Total included in Consumer Banking ................................................................................................................

.

$ 6,433,789

Commercial loans .......................................................................................................................................................

.

816,686

Total included in loans held for investment ................................................................................................................

.

$ 7,250,475

(1) Please note that the above balances are shown by product type and not by business segment.