Capital One 2009 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

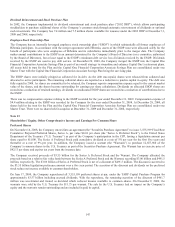

Note 17

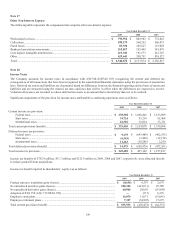

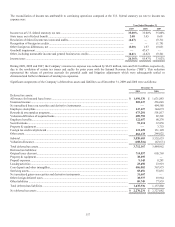

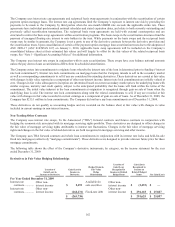

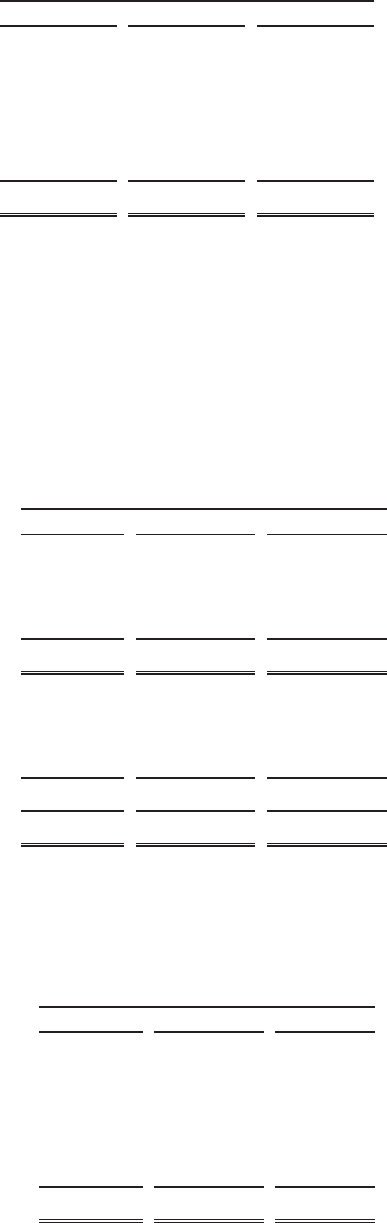

Other Non-Interest Expense

The following table represents the components that comprise other non-interest expense:

Year Ended December 31

2009 2008

2007

Professional services ........................................................................................................ $ 795,952 $ 805,902 $ 772,022

Collections ....................................................................................................................... 599,179 568,552 560,075

Fraud losses ..................................................................................................................... 85,938 105,627 123,028

Bankcard association assessments ................................................................................... 215,017 195,469 181,076

Core deposit intangible amortization ............................................................................... 215,941 191,573 212,107

Other ................................................................................................................................ 628,643 290,751 538,527

Total ................................................................................................................................. $ 2,540,670 $ 2,157,874 $ 2,386,835

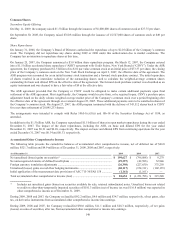

Note 18

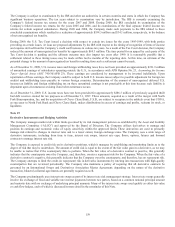

Income Taxes

The Company accounts for income taxes in accordance with ASC740-10/SFAS 109, recognizing the current and deferred tax

consequences of all transactions that have been recognized in the consolidated financial statements using the provisions of enacted tax

laws. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and

liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse.

Valuation allowances are recorded to reduce deferred tax assets to an amount that is more likely than not to be realized.

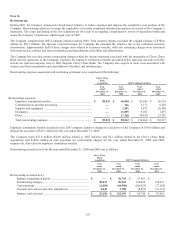

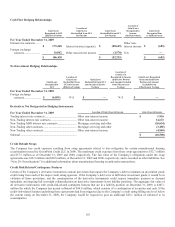

Significant components of the provision for income taxes attributable to continuing operations were as follows:

Year Ended December 31

2009 2008

2007

Current income tax provision:

Federal taxes ................................................................................................................. $ 278,304 $ 1,068,846 $ 1,613,909

State taxes ..................................................................................................................... 34,724 53,218 82,468

International taxes ......................................................................................................... 22,382 32,014 53,721

Total current provision (benefit) ............................................................................................ $ 335,410 $ 1,154,078 $ 1,750,098

Deferred income tax provision:

Federal taxes ................................................................................................................. $ 9,175 $ (643,488) $ (462,193)

State taxes ..................................................................................................................... (6,363) (3,202) (12,318)

International taxes ......................................................................................................... 11,263 (10,286) 2,250

Total deferred provision (benefit) .......................................................................................... $ 14,075 $ (656,976) $ (472,261)

Total income tax provision .....................................................................................................$ 349,485 $ 497,102 $ 1,277,837

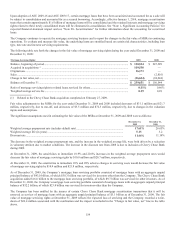

Income tax benefits of $792.9 million, $31.7 million and $121.9 million in 2009, 2008 and 2007, respectively, were allocated directly

to reduce goodwill from acquisitions.

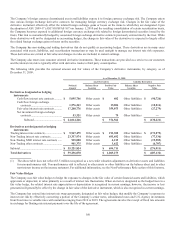

Income tax benefit reported in shareholders’ equity was as follows:

Year Ended December 31

2009

2008 2007

Foreign currency translation gains (losses) .............................................................................

.

$ (8,634) $ 6,597 $ 2,679

N

et unrealized securities gains (losses)...................................................................................

.

520,302 (421,011) 25,780

N

et unrealized derivative gains (losses) ..................................................................................

.

60,904 28,095 (63,804)

Adoption of FAS 158 (ASC 715/SFAS 158) ..........................................................................

.

— (317) 6,378

Employee stock plans .............................................................................................................

.

16,074 11,071 (53,041)

Employee retirement plans .....................................................................................................

.

7,307 (54,907) 17,675

Total current provision (benefit) .............................................................................................

.

$ 595,953 $ (430,472) $ (64,333)