Capital One 2009 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

158

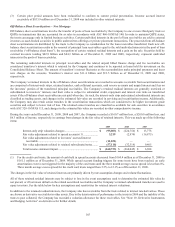

The Company has an acquired Federal net operating loss carryforward of $249.7 million attributable to Chevy Chase Bank that

expires in 2028. Under IRS rules, the Company’s ability to utilize this loss against future income is limited to $33 million per year.

The Company has state net operating loss carryforwards with a tax value of $113 million that expire from 2010 to 2029. The

Company has a foreign net operating loss carryforward of $15.3 million with no expiration date. The Company has foreign tax credit

carryforwards of $131.1 million that expire in 2014 through 2018.

The valuation allowance was increased by $40.8 million to adjust the tax benefit of certain state deferred tax assets and net operating

loss carryforwards to the amount the Company has determined is more likely than not to be realized.

The deferred tax liability for original issue discount represents interchange, late fees, cash advance fees and overlimit fees. These

items are generally treated as original issue discount (“OID”) for tax purposes and recognized over the life of the related credit card

receivables. These items are recognized in the income statement as income in the year earned. For income statement purposes, late

fees are reported as interest income, and interchange, cash advance fees and overlimit fees are reported as non-interest income.

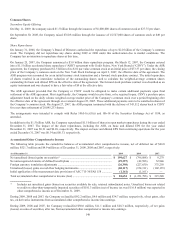

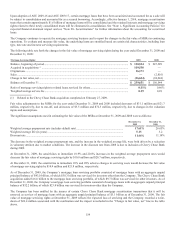

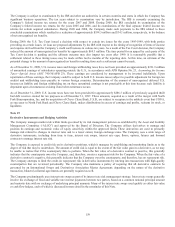

December 31

2009

2008

Deferred revenue:

OID—late fees ..........................................................................................................................................

.

$ 512,023 $ 774,403

OID—all other ..........................................................................................................................................

.

1,460,687 905,031

Gross deferred tax liability ........................................................................................................................

.

1,972,710 1,679,434

N

et federal deferred tax liability ...............................................................................................................

.

$ 714,557 $ 605,769

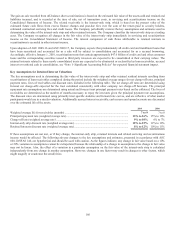

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, and Interpretation

of FASB Statement No. 109 (“ASC 740-10/FIN 48”), effective January 1, 2007. As a result of the adoption, the Company recorded a

$29.7 million reduction in retained earnings.

ASC 740-10/FIN 48 clarifies the accounting for uncertainty in income taxes, and prescribes a recognition threshold and measurement

attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC

740-10/FIN 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods,

disclosure, and transition.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits as a component of income tax expense.

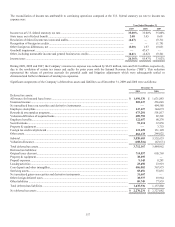

During 2009, 2008 and 2007, $(7.5) million, $30.5 million and $34.3 million, respectively, of net interest was included in income tax

expense. The accrued balance of interest and penalties related to unrecognized tax benefits is presented in the table below.

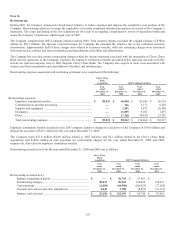

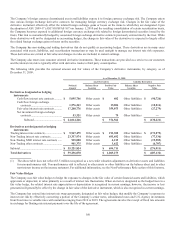

A reconciliation of the change in unrecognized tax benefits from January 1, 2008 to December 31, 2009 is as follows:

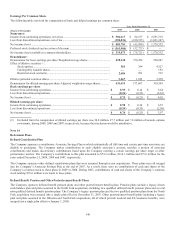

Gross

Unrecognized

Tax Benefits

Accrued

Interest and

Penalties

Gross Tax,

Interest and

Penalties

Balance at January 1, 2008 ............................................................................................... $ 540,502 $ 140,237 $ 680,739

Additions for tax positions related to the current year ...................................................... 21,185 — 21,185

Additions for tax positions related to prior years .............................................................. 49,255 46,985 96,240

Reductions for tax positions related to prior years due to IRS and other settlements ....... (53,879) (11,727) (65,606)

Additions for tax positions related to acquired entities in prior years, offset to

goodwill ....................................................................................................................... 13,563 498 14,061

Other reductions for tax positions related to prior years ................................................... (9,546) (174) (9,720)

Balance at December 31, 2008 ......................................................................................... $ 561,080 $ 175,819 $ 736,899

Additions for tax positions related to the current year ...................................................... 7,777 — 7,777

Additions for tax positions related to prior years .............................................................. 43,217 35,432 78,649

Reductions for tax positions related to prior years due to IRS and other settlements ....... (255,147) (110,059) (365,206)

Additions for tax positions related to acquired entities in prior years, offset to

goodwill ....................................................................................................................... 6,906 1,711 8,617

Reductions resulting from lapsing statutes of limitation ................................................... (4,941) (2,327) (7,268)

Balance at December 31, 2009 ......................................................................................... $ 358,892 $ 100,576 $ 459,468

Portion of balance at December 31, 2009 that, if recognized, would impact the

effective income tax rate .............................................................................................. $ 109,346 $ 66,919 $ 176,265