Capital One 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

163

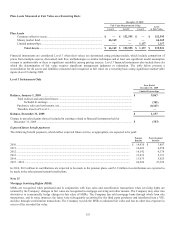

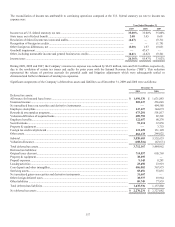

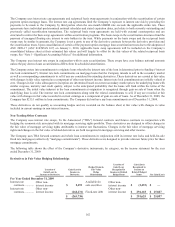

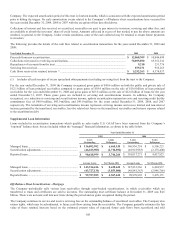

Cash Flow Hedging Relationships

Gain/(Loss)

Recognized in OCI

(Effective Portion)

Location of

Gain/(Loss)

Reclassified from OCI

into Income

Gain/(Loss)

Reclassified from OCI

into Income

Location of

Gain/(Loss)

Recognized in

Income

(Ineffectiveness)

Gain/(Loss)

Recognized Due

to Ineffectiveness

For Year Ended December 31, 2009

Interest rate contracts .......

$ 175,448 Interest income (expense) $ (88,665)

Other non-

interest income $ (685)

Foreign exchange

contracts ...................... 10,982 Other non-interest income (3,570) N/A —

$ 186,430 $ (92,235) $ (685)

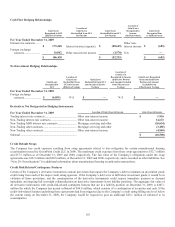

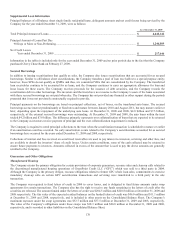

Net Investment Hedging Relationships

Gain/(Loss)

Recognized in

OCI

Location of

Gain/(Loss)

Reclassified from

OCI into Income

(Effective Portion)

Gain/(Loss)

Reclassified from OCI

into Income (Effective

Portion)

Location of

Gain/(Loss)

Recognized in Income

(Ineffective Portion

and Amount Excluded

from Effectiveness

Testing)

Gain/(Loss) Recognized

in Income (Ineffective

Portion and Amount

Excluded from

Effectiveness Testing)

For Year Ended December 31, 2009

Foreign exchange

contracts ....................... $ (6,855) N/A $ — N/A $ —

Derivatives Not Designated as Hedging Instruments

For Year Ended December 31, 2009 Location of Gain (Loss) in Income Gain (Loss) in Income

Trading interest rate contracts ...........................................

.

Other non-interest income $ 1,916

N

on-Trading interest rate contracts ...................................

.

Other non-interest income 14,672

N

on-Trading MSR interest rate contracts .........................

.

Mortgage servicing and other (26,634)

N

on-Trading other contracts .............................................

.

Mortgage servicing and other (3,485)

N

on-Trading other contracts .............................................

.

Other non-interest income (4,969)

Subtotal .............................................................................

.

$ (18,500)

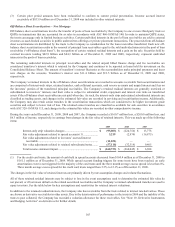

Credit Default Swaps

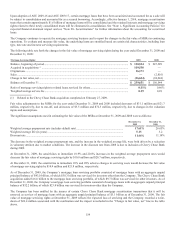

The Company has credit exposure resulting from swap agreements related to loss mitigation for certain manufactured housing

securitizations issued by GreenPoint Credit LLC in 2000. The maximum credit exposure from these swap agreements is $32.7 million

and $37.5 million as of December 31, 2009 and 2008, respectively. The fair value of the Company’s obligations under the swap

agreements was $18.3 million and $20.8 million, at December 31, 2009 and 2008, respectively, and is recorded as other liabilities. See

“Note 20- Securitizations” for additional information about manufactured housing securitization transactions.

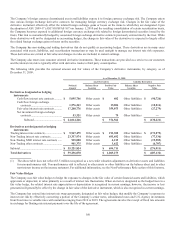

Credit Risk Related Contingency Features

Certain of the Company’s derivative instruments contain provisions that require the Company’s debt to maintain an investment grade

credit rating from each of the major credit rating agencies. If the Company’s debt were to fall below investment grade, it would be in

violation of those provisions, and the counterparties of the derivative instruments could request immediate payment or demand

immediate and ongoing full overnight collateralization on derivative instruments in net liability positions. The aggregate fair value of

all derivative instruments with credit-risk-related contingent features that are in a liability position on December 31, 2009, is $407.1

million for which the Company has posted collateral of $94.8 million, which consists of a combination of securities and cash. If the

credit-risk-related features underlying these agreements had been triggered due to the Company’s credit rating falling one level below

the current rating on December 31, 2009, the Company would be required to post an additional $28.1 million of collateral to its

counterparties.