Capital One 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

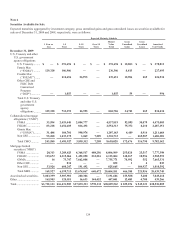

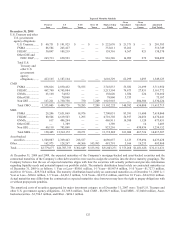

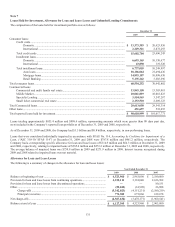

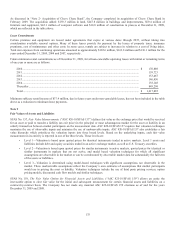

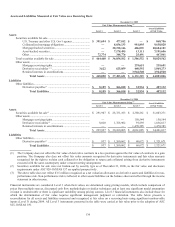

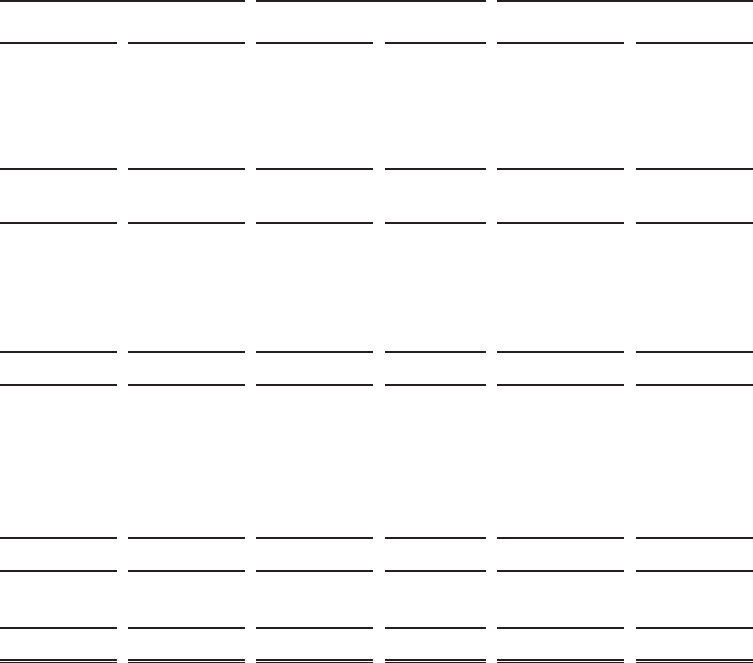

Less than 12 Months Greater than 12 Months Total

Fair Value

Unrealized

Losses Fair Value Unrealized

Losses Fair Value

Unrealized

Losses

December 31, 2008

U.S. Treasury and other U.S.

government agency obligations

FHMLC ......................................

.

$ — $ — $ 30,097 $ 821 $ 30,097 $ 821

Other GSE and DGP ..................

.

179,728 272 — — 179,728 272

Total U.S. Treasury and other U.S.

government agency obligations ......

.

179,728 272 30,097 821 209,825 1,093

CMO

FNMA ........................................

.

266,344 8,125 367,472 13,574 633,816 21,699

FHMLC ......................................

.

307,667 2,445 729,283 25,406 1,036,950 27,851

GNMA .......................................

.

— — 11,159 224 11,159 224

Non GSE ....................................

.

1,652,139 523,952 265,608 80,354 1,917,747 604,306

Total CMO .................................

.

2,226,150 534,522 1,373,522 119,558 3,599,672 654,080

MBS

FNMA ........................................

.

982,232 10,782 160,456 818 1,142,688 11,600

FHLMC ......................................

.

721,443 20,671 155,234 3,385 876,677 24,056

GNMA .......................................

.

24,876 957 7,108 163 31,984 1,120

Other GSE ..................................

.

1,389 14 — — 1,389 14

Non GSE ....................................

.

668,837 349,753 158,870 81,183 827,707 430,936

Total MBS..................................

.

2,398,777 382,177 481,668 85,549 2,880,445 467,726

Asset-backed securities .......................

.

2,660,798 194,024 692,928 145,470 3,353,726 339,494

Other ....................................................

.

107,126 2,705 120,183 16,530 227,309 19,235

Total ....................................................

.

$ 7,572,579 $ 1,113,700 $ 2,698,398 $ 367,928 $ 10,270,977 $ 1,481,628

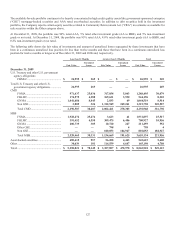

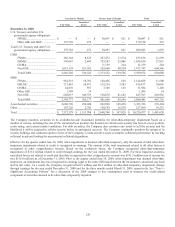

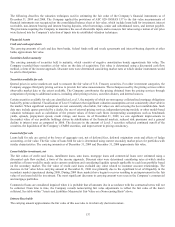

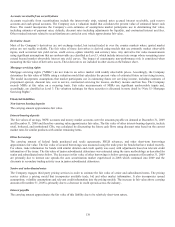

The Company monitors securities in its available-for-sale investment portfolio for other-than-temporary impairment based on a

number of criteria, including the size of the unrealized loss position, the duration for which each security has been in a loss position,

credit rating, and current market conditions. For debt securities, the Company also considers any intent to sell the security and the

likelihood it will be required to sell the security before its anticipated recovery. The Company continually monitors the ratings of its

security holdings and conducts regular reviews of the Company’s credit-sensitive assets to monitor collateral performance by tracking

collateral trends and looking for any potential collateral degradation.

Effective for the quarter ended June 30, 2009, when impairment is deemed other-than-temporary, only the amount of total other-than-

temporary impairment related to credit is recognized in earnings. The amount of the total impairment related to all other factors is

recognized in other comprehensive income. Based on the evaluation above, the Company recognized other-than-temporary

impairment of $31.6 million related to credit through earnings for the year ended December 31, 2009. For these impaired securities,

unrealized losses not related to credit and therefore recognized in other comprehensive income was $181.3 million (net of income tax

was $116.8 million) as of December 31, 2009. Prior to the quarter ended June 30, 2009, when impairment was deemed other-than-

temporary, an impairment loss was recognized in earnings equal to the entire difference between the investment’s amortized cost basis

and its fair value. As a result, the Company recognized $10.9 million and $0.4 million of other-than-temporary impairment charges

through earnings for the year ended December 31, 2008 and for the three months ended March 31, 2009, respectively. See “Note 1-

Significant Accounting Policies” for a discussion of the 2009 changes to key assumptions used to measure the credit-related

component of securities deemed to be other-than-temporarily impaired.