Capital One 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

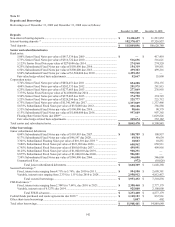

Note 11

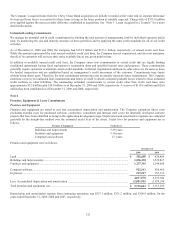

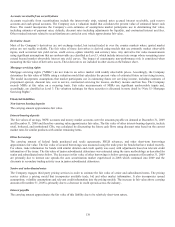

Deposits and Borrowings

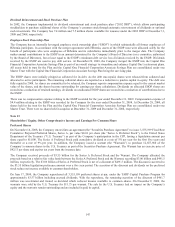

Borrowings as of December 31, 2009 and December 31, 2008 were as follows:

December 31, 2009

December 31, 2008

Deposits

N

on-interest bearing deposits....................................................................................................

.

$ 13,438,659 $ 11,293,852

Interest-bearing deposits (1) .......................................................................................................

.

102,370,437 97,326,937

Total deposits ............................................................................................................................

.

$ 115,809,096 $ 108,620,789

Senior and subordinated notes

Bank notes:

5.00% Senior Fixed Notes par value of $417,539 due 2009 ...........................................

.

$ — $ 417,419

5.75% Senior Fixed Notes par value of $516,722 due 2010 ...........................................

.

516,696 516,621

5.125% Senior Fixed Notes par value of $274,696 due 2014 .........................................

.

274,560 274,520

9.25% Subordinated Fixed Notes par value of $150,000 due 2010 .................................

.

154,319 159,851

6.50% Subordinated Fixed Notes par value of $500,000 due 2013 .................................

.

499,383 499,216

8.80% Subordinated Fixed Notes par value of $1,500,000 due 2019 ..............................

.

1,499,452 —

Fair value hedge-related basis adjustments .....................................................................

.

52,667 55,800

Corporation notes:

5.70% Senior Fixed Notes par value of $854,451 due 2011 ...........................................

.

854,288 854,135

4.80% Senior Fixed Notes par value of $282,335 due 2012 ...........................................

.

281,975 281,815

6.25% Senior Fixed Notes par value of $277,665 due 2013 ...........................................

.

277,049 276,903

7.375% Senior Fixed Notes par value of $1,000,000 due 2014 ......................................

.

995,548 —

5.50% Senior Fixed Notes par value of $375,005 due 2015 ...........................................

.

374,790 374,745

5.25% Senior Fixed Notes par value of $226,290 due 2017 ...........................................

.

225,777 225,712

6.75% Senior Fixed Notes par value of $1,341,045 due 2017 ........................................

.

1,337,849 1,337,466

5.875% Subordinated Fixed Notes par value of $350,000 due 2012 ...............................

.

355,108 356,888

5.35% Subordinated Fixed Notes par value of $100,000 due 2014 .................................

.

98,646 98,379

6.15% Subordinated Fixed Notes par value of $1,000,000 due 2016 ..............................

.

997,689 997,365

Floating Rate Senior Notes due 2009(2) ...........................................................................

.

— 1,029,826

Fair value hedge-related basis adjustments .....................................................................

.

249,674 552,182

Total senior and subordinated notes ..........................................................................................

.

$ 9,045,470 $ 8,308,843

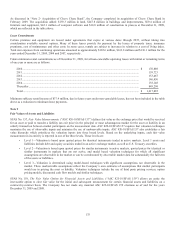

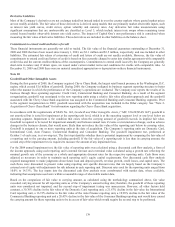

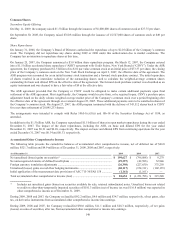

Other borrowings

Junior subordinated debentures

8.00% Subordinated Fixed Notes par value of $103,093 due 2027 .................................

.

$ 108,789 $ 108,937

8.17% Subordinated Fixed Notes par value of $46,547 due 2028 ...................................

.

49,564 49,639

3.301% Subordinated Floating Notes par value of $10,310 due 2033 (3) ........................

.

10,843 10,851

7.686% Subordinated Fixed Notes par value of $651,000 due 2036 ...............................

.

650,962 650,911

6.745% Subordinated Fixed Notes par value of $500,010 due 2037 ...............................

.

499,991 499,956

10.25% Subordinated Fixed Notes par value of $1,000,010 due 2039 ............................

.

988,291 —

8.875% Subordinated Fixed Notes par value of $1,000,010 due 2040 ............................

.

986,881 —

7.50% Subordinated Fixed Notes par value of $346,000 due 2066 .................................

.

346,000 346,000

Unamortized Fees ............................................................................................................

.

(972) (18,026)

Total junior subordinated debentures .....................................................................

.

$ 3,640,349 $ 1,648,268

Secured borrowings (4)

Fixed, interest rates ranging from 4.71% to 5.76%, due 2010 to 2011............................

.

$ 994,580 $ 2,698,381

Variable, interest rates ranging from 2.33% to 1.11% due 2010 to 2028 ........................

.

2,958,912 4,812,457

Total secured borrowings .......................................................................................

.

$ 3,953,492 $ 7,510,838

FHLB advances (5)

Fixed, interest rates ranging from 2.394% to 7.64%, due 2010 to 2023..........................

.

$ 2,308,460 $ 2,777,179

Variable, interest rate of 0.327% due 2014 .....................................................................

.

925,000 2,100,000

Total FHLB advances ............................................................................................

.

$ 3,233,460 $ 4,877,179

Federal funds purchased and resale agreements due 2010 (6) ...................................................

.

$ 1,140,103 $ 832,961

Other short-term borrowings .....................................................................................................

.

1,057 402

Total other borrowings ..............................................................................................................

.

$ 11,968,461 $ 14,869,648