Capital One 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

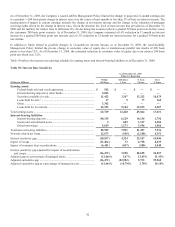

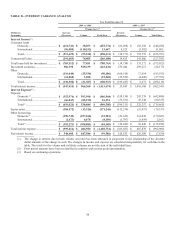

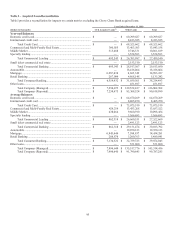

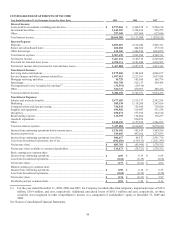

TABLE C—MANAGED LOAN PORTFOLIO

Year Ended December 31

(Dollars in thousands)

2009(2) 2008 2007 2006

2005

Year-End Balances:

Reported loans held for investment:

Consumer loans ...........................................................

Credit cards ......................................................

Domestic ................................................ $ 13,373,383 $ 20,623,950 $ 17,446,876 $ 20,211,627 $ 18,637,924

International ........................................... 2,229,321 2,872,293 3,657,034 3,206,528 3,359,471

Total credit card ..................................... $ 15,602,704 $ 23,496,243 $ 21,103,910 $ 23,418,155 $ 21,997,395

Installment loans ...............................................

Domestic ................................................ 6,693,165 10,130,677 10,474,683 7,380,910 5,726,863

International ........................................... 43,890 119,320 354,556 637,982 551,460

Total installment loans ........................... $ 6,737,055 $ 10,249,997 $ 10,829,239 $ 8,018,892 $ 6,278,323

Auto loans ................................................................... 18,186,064 21,494,436 25,017,904 21,283,004 15,255,258

Mortgage loans ............................................................ 14,893,187 10,098,430 11,561,533 3,418,884 —

Retail Banking ............................................................ 5,135,242 5,603,696 5,659,411 4,482,196 —

Total consumer loans ............................................................. $ 60,554,252 $ 70,942,802 $ 74,171,997 $ 60,621,131 $ 43,530,976

Commercial loans ..................................................................

Commercial and multi-family real estate .................... 13,843,158 13,303,081 12,414,263 891,140 —

Middle Market ............................................................ 10,061,819 10,081,823 8,288,476 3,524,564 —

Specialty Lending ....................................................... 3,554,563 3,547,287 2,948,402 — —

Small ticket commercial real estate ............................. 2,153,510 2,609,123 3,396,100 — —

Total commercial loans ......................................................... $ 29,613,050 $ 29,541,314 $ 27,047,241 $ 4,415,704 $ —

Other loans

(

1

)

........................................................................ 451,697 533,655 585,789 31,475,304 16,316,705

Total reported loans held for investment ............................... $ 90,618,999 $ 101,017,771 $ 101,805,027 $ 96,512,139 $ 59,847,681

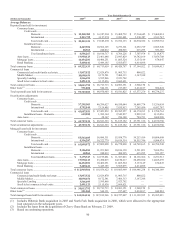

Securitization adjustments:

Consumer loans ...........................................................

Credit cards ......................................................

Domestic ................................................ 39,827,572 39,254,153 39,832,922 38,364,776 35,200,448

International ........................................... 5,950,624 5,729,029 7,645,332 7,906,309 6,740,949

Total credit card ..................................... $ 45,778,196 $ 44,983,182 $ 47,478,254 $ 46,271,085 $ 41,941,397

Installment loans – Domestic............................ 405,707 935,801 1,968,688 2,899,221 2,621,652

Auto loans ................................................................... — — 110,448 468,823 1,116,761

Total consumer loans ............................................................. $ 46,183,903 $ 45,918,983 $ 49,557,390 $ 49,639,129 $ 45,679,810

Total securitization adjustments ............................................ $ 46,183,903 $ 45,918,983 $ 49,557,390 $ 49,639,129 $ 45,679,810

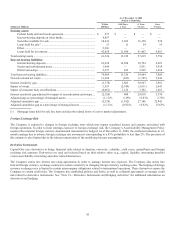

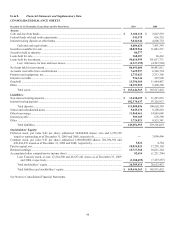

Managed loans held for investment:

Consumer loans ...........................................................

Credit cards ......................................................

Domestic ................................................ 53,200,955 59,878,103 57,279,798 58,576,403 53,838,372

International ........................................... 8,179,945 8,601,322 11,302,366 11,112,837 10,100,420

Total credit card ..................................... $ 61,380,900 $ 68,479,425 $ 68,582,164 $ 69,689,240 $ 63,938,792

Installment loans ...............................................

Domestic ................................................ 7,098,872 11,066,478 12,443,371 10,280,131 8,348,515

International ........................................... 43,890 119,320 354,556 637,982 551,460

Total installment loans ........................... $ 7,142,762 $ 11,185,798 $ 12,797,927 $ 10,918,113 $ 8,899,975

Auto loans ................................................................... 18,186,064 21,494,436 25,128,352 21,751,827 16,372,019

Mortgage loans ............................................................ 14,893,187 10,098,430 11,561,533 3,418,884 —

Retail Banking ............................................................ 5,135,242 5,603,696 5,659,411 4,482,196 —

Total consumer loans ............................................................. $ 106,738,155 $ 116,861,785 $ 123,729,387 $ 110,260,260 $ 89,210,786

Commercial loans

Commercial and multi-family real estate .................... 13,843,158 13,303,081 12,414,263 891,140 —

Middle Market ............................................................ 10,061,819 10,081,823 8,288,476 3,524,564 —

Specialty Lending ....................................................... 3,554,563 3,547,287 2,948,402 — —

Small ticket commercial real estate ............................. 2,153,510 2,609,123 3,396,100 — —

Total commercial loans ......................................................... $ 29,613,050 $ 29,541,314 $ 27,047,241 $ 4,415,704 $ —

Other loans

(

1

)

........................................................................ 451,697 533,655 585,789 31,475,304 16,316,705

Total managed loans held for investment .............................. $ 136,802,902 $ 146,936,754 $ 151,362,417 $ 146,151,268 $ 105,527,491