Capital One 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

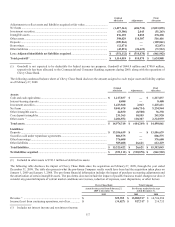

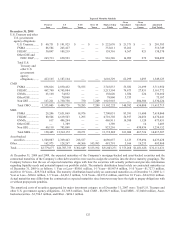

The carrying amount of these loans is included in the balance sheet amounts of loans held for investment at December 31, 2009 and is

as follows:

Impaired

Loans Non-Impaired

Loans

Total Loans

Outstanding Balance ...............................................................................................

.

$ 7,113,749 $ 2,150,197 $ 9,263,946

Carrying Amount ....................................................................................................

.

$ 5,255,850 $ 1,994,625 $ 7,250,475

Accretable Yield Activity

Impaired

Loans Non-Impaired

Loans

Total Loans

Balance at January 1, 2009 .....................................................................................

.

$ — $ — $ —

Additions ................................................................................................................

.

1,860,697 499,245 2,359,942

Accretion ................................................................................................................

.

(209,604) (83,587) (293,191)

Balance at December 31, 2009 ...............................................................................

.

$ 1,651,093 $ 415,658 $ 2,066,751

Expected Principal Losses

Impaired

Loans Non-Impaired

Loans

Total Loans

Balance at January 1, 2009 .....................................................................................

.

$ — $ — $ —

Additions ................................................................................................................

.

2,053,501 153,643 2,207,144

Principal losses .......................................................................................................

.

(335,636) (35,691) (371,327)

Balance at December 31, 2009 ...............................................................................

.

$ 1,717,865 $ 117,952 $ 1,835,817

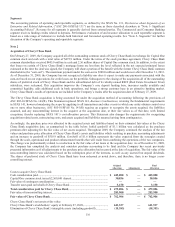

Note 4

Discontinued Operations

Shutdown of Mortgage Origination Operations of Wholesale Mortgage Banking Unit

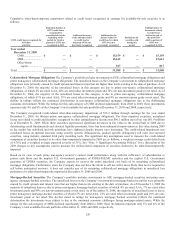

In the third quarter of 2007, the Company shut down the mortgage origination operations for GreenPoint of its wholesale mortgage

banking unit, GreenPoint Mortgage (“GreenPoint”). GreenPoint was acquired by the Company in December 2006 as part of the North

Fork acquisition. The results of the mortgage origination operations of GreenPoint have been accounted for as a discontinued

operation and have been removed from the Company’s results from continuing operations for the year ended December 31, 2009,

2008 and 2007. The Company will have no significant continuing involvement in the operations of the originate and sell business of

GreenPoint.

The loss from discontinued operations for the years ended December 31, 2009, 2008 and 2007 includes an expense of $162.3 million,

$103.7 million and $84.5 million, respectively, recorded in non-interest expense, for representations and warranties provided by the

Company on loans previously sold to third parties by GreenPoint’s mortgage origination operation. The expense for representations

and warranties is offset by a valuation adjustment for expected returns of spread account funding for certain securitization

transactions.

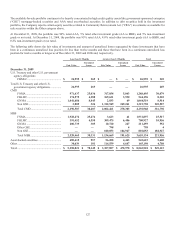

The following is summarized financial information for discontinued operations related to the closure of the Company’s wholesale

mortgage banking unit:

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Year Ended

December 31,

2007

N

et interest income (loss) ............................................................................................

.

$ (2,306) $ 6,939 $ 62,402

N

on-interest income .....................................................................................................

.

31,675 5,544 140,245

Provision for loan and lease losses ..............................................................................

.

— — 80,151

N

on-interest expense ....................................................................................................

.

188,805 214,957 1,358,719

Income tax benefit .......................................................................................................

.

(56,600) (71,959) (214,836)

Loss from discontinued operations, net of taxes ......................................................

.

$ (102,836) $ (130,515) $ (1,021,387)