Capital One 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

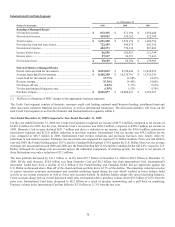

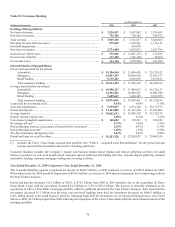

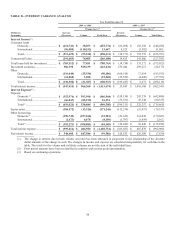

Table 27: Short Term Borrowings

(Dollars in Thousands)

Maximum

Outstanding

as of any

Month-End

Outstanding

as of

Year-End Average

Outstanding

Average

Interest

Rate

Year-End

Weighted

Average

Interest

Rate

2009:

Federal funds purchased and resale agreements ..........

.

$ 3,777,784 $ 1,140,103 $ 2,957,569 0.25% 0.11%

Other .................................................................................

.

— — — — N/A

Total ................................................................................. $ 1,140,103 $ 2,957,569 0.25% 0.11%

2008:

Federal funds purchased and resale agreements ................

.

$ 6,311,810 $ 832,961 $ 3,261,190 1.90% .0007%

Other (1) ..............................................................................

.

4,964,750 — 351,960 7.83 N/A

Total ...................................................................................

.

$ 832,961 $ 3,613,150 2.48% .0007%

(1) In 2008, the Company repaid certain borrowings under lines of credit associated with securitizations of auto consumer loans.

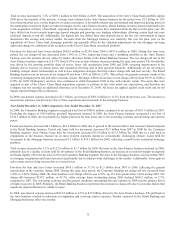

Government Programs The Company is eligible or may be eligible to participate in a number of U.S. Government programs designed

to support financial institutions and increase access to credit markets. The Company evaluates each of these programs and determines,

based on the costs and benefits of each program, whether to participate. During 2009, the Company participated in or was eligible to

participate in the U.S. Treasury Department’s Capital Purchase Program (“CPP”), the FDIC’s Temporary Liquidity Guarantee

Program (“TLGP”), the Federal Reserve’s Discount Window (the “Discount Window”) and the Federal Reserve’s Term Auction

Facility (“TAF”).

U.S. Treasury Department’s Capital Purchase Program On October 27, 2008, the Company announced its intention to take part in the

CPP. On November 14, 2008 the Company entered into an agreement (the “Securities Purchase Agreement”) to issue 3,555,199 Fixed

Rate Cumulative Perpetual Preferred Shares, Series A, par value $0.01 per share, liquidation preference $1,000 per share (the “Series

A Preferred Shares”), to the U.S. Treasury as part of the Company’s participation in the CPP. The Series A Preferred Stock paid

cumulative dividends at a rate of 5% per year for the first five years and thereafter at a rate of 9% per year. In addition, the Company

issued warrants (the “Warrants”) to purchase 12,657,960 of the Company’s common shares to the U.S. Treasury as part of the

Securities Purchase Agreement. The Company received proceeds of $3.55 billion for the Series A Preferred Shares and the Warrants.

On June 17, 2009, the Company repurchased all 3,555,199 Series A Preferred Shares, at par. The total amount repurchased, including

accrued dividends, was approximately $3.57 billion, compared to a book value of $3.1 billion. The difference represented unaccreted

discount of $461.7 million, which was recorded as a dividend in the second quarter of 2009, reducing income available to common

shareholders. On December 11, 2009, the Warrants were sold by the U.S. Treasury for $11.75 per warrant. The sale by the U.S.

Treasury had no impact on the Company’s equity and the Warrants remain outstanding and continue to be included in paid in capital.

Federal Reserve’s Discount Window The Discount Window allows eligible institutions to borrow funds from the Federal Reserve,

typically on a short-term basis, to meet temporary liquidity needs. Borrowers must post collateral, which can be made up of securities

or consumer or commercial loans. As of December 31, 2009, the Company was eligible to borrow up to $5.5 billion through the

Discount Window. The eligible amount is reduced dollar for dollar by borrowing under the TAF program. The Company did not

borrow funds from the Discount Window during 2009.

Federal Reserve’s Term Auction Facility The TAF is designed to help increase liquidity in the U.S. credit markets. The Federal

Reserve auctions collateral-backed short term loans under TAF. The auctions allow financial institutions to borrow funds at an interest

rate below the Federal Reserve’s discount rate. As of December 31, 2009, the Company was eligible to borrow up to $2.7 billion

under the TAF. The eligible amount is reduced dollar for dollar by borrowings made under the Discount Window. The Company did

not borrow funds through the TAF during 2009.

Trust Asset-Backed Securities Loan Facility In March of 2009, the Federal Reserve Bank of New York (“FRBNY”), the U.S. Treasury

and the Federal Reserve Board announced the launch of the TALF. TALF is a funding facility designed to help financial markets and

institutions meet the credit needs of households and small businesses to support overall economic growth by supporting the issuance

of ABS collateralized by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration, as well

as certain types of mortgage loans. The FRBNY will lend up to $200 billion to holders of certain AAA-rated ABS backed by newly

and recently originated consumer and small business loans, as well as CMBS, private-label residential MBS, and certain other ABS.

The FRBNY will lend an amount equal to the market value of the ABS less a discount and will be secured at all times by the ABS.

The Company has not issued any ABS through TALF as of December 31, 2009.