Capital One 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 138

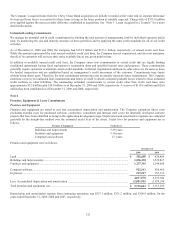

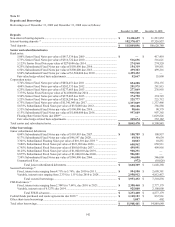

Accounts receivable from securitizations

Accounts receivable from securitizations include the interest-only strip, retained notes accrued interest receivable, cash reserve

accounts and cash spread accounts. The Company uses a valuation model that calculates the present value of estimated future cash

flows. The model incorporates the Company’s own estimates of assumptions market participants use in determining fair value,

including estimates of payment rates, defaults, discount rates including adjustments for liquidity, and contractual interest and fees.

Other retained interests related to securitizations are carried at cost, which approximates fair value.

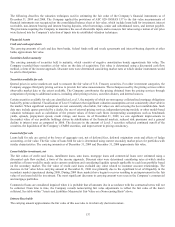

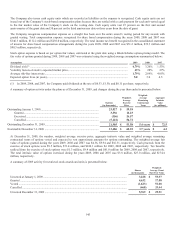

Derivative Assets

Most of the Company’s derivatives are not exchange traded, but instead traded in over the counter markets where quoted market

prices are not readily available. The fair value of those derivatives is derived using models that use primarily market observable

inputs, such as interest rate yield curves, credit curves, option volatility and currency rates. Any derivative fair value measurements

using significant assumptions that are unobservable are classified as Level 3, which include interest rate swaps whose remaining terms

extend beyond market observable interest rate yield curves. The impact of counterparty non-performance risk is considered when

measuring the fair value of derivative assets. These derivatives are included in other assets on the balance sheet.

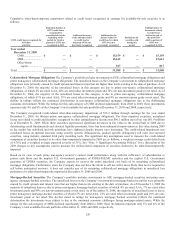

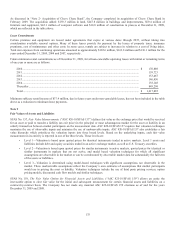

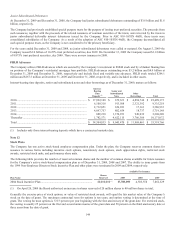

Mortgage servicing rights

Mortgage servicing rights (“MSRs”) do not trade in an active market with readily observable prices. Accordingly, the Company

determines the fair value of MSRs using a valuation model that calculates the present value of estimated future net servicing income.

The model incorporates assumptions that market participants use in estimating future net servicing income, including estimates of

prepayment spreads, discount rate, cost to service, contractual servicing fee income, ancillary income and late fees. The Company

records MSRs at fair value on a recurring basis. Fair value measurements of MSRs use significant unobservable inputs and,

accordingly, are classified as Level 3. The valuation technique for these securities is discussed in more detail in “Note 15- Mortgage

Servicing Rights”.

Financial Liabilities

Non-interest bearing deposits

The carrying amount approximates fair value.

Interest-bearing deposits

The fair values of savings, NOW accounts and money market accounts were the amounts payable on demand at December 31, 2009

and December 31, 2008 and therefore carrying value approximates fair value. The fair value of other interest-bearing deposits, include

retail, brokered, and institutional CDs, was calculated by discounting the future cash flows using discount rates based on the current

market rates for similar products with similar remaining terms.

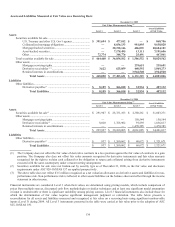

Other borrowings

The carrying amount of federal funds purchased and resale agreements, FHLB advances, and other short-term borrowings

approximates fair value. The fair value of secured borrowings was measured using the trade price for bonds that have traded recently.

For others, trade information for bonds with similar duration and credit quality was used, with adjustments based on relevant credit

information of the issuer. The fair value of junior subordinated debentures was estimated using the same methodology as described for

senior and subordinated notes below. The decreases in fair value of other borrowings is below carrying amounts at December 31, 2009

are primarily due to interest rate spreads the auto securitization market experienced in 2008 which continued into 2009 and the

discounts in secondary trading activity seen in junior subordinated debentures.

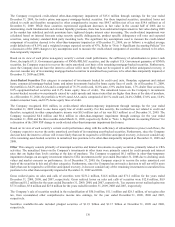

Senior and subordinated notes

The Company engages third party pricing services in order to estimate the fair value of senior and subordinated notes. The pricing

service utilizes a pricing model that incorporates available trade, bid and other market information. It also incorporates spread

assumptions, volatility assumptions and relevant credit information into the pricing models. The increase in fair value above carrying

amount at December 31, 2009 is primarily due to a decrease in credit spreads across the industry.

Interest payable

The carrying amount approximates the fair value of this liability due to its relatively short-term nature.