Capital One 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

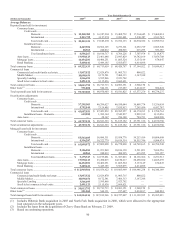

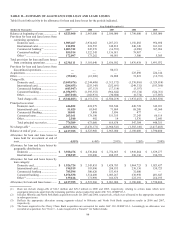

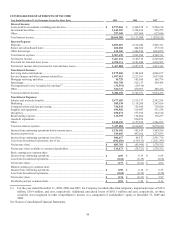

TABLE H—SUMMARY OF ALLOWANCE FOR LOAN AND LEASE LOSSES

Table H sets forth activity in the allowance for loan and lease losses for the periods indicated.

Year Ended December 31

(Dollars In Thousands)

2009(4)

2008 2007 2006

2005

Balance at be

g

innin

g

of

y

ea

r

................... $ 4,523,960 $ 2,963,000 $ 2,180,000 $ 1,790,000 $ 1,505,000

Provision for loan and lease losses fro

m

continuing operations:

Domestic car

d

................................ 1,985,467 2,934,662 1,287,251 1,156,882 954,698

International car

d

........................... 212,891 224,595 148,812 240,349 163,103

Commercial banking (3) .................. 1,003,742 245,976 (16,553) (4,280) 367,966

Consumer bankin

g

(3) ..................... 855,914 1,522,545 1,136,011 79,987

—

Othe

r

(3) ........................................... 172,097 173,262 80,981 3,500 5,305

Total provision for loan and lease losses

from continuin

g

operations ................ $ 4,230,111 $ 5,101,040 $ 2,636,502 $ 1,476,438 $ 1,491,072

Provision for loan and lease losses fro

m

discontinued operations ...................... —

—

80,151

—

—

Acquisitions ............................................ —

—

—

225,890 224,144

Othe

r

....................................................... (59,042) (61,909) 26,888 72,821 (12,731)

Charge-offs:

Domestic car

d

................................ (3,049,676) (2,244,488) (1,315,172) (1,576,016) (1,329,818)

International car

d

........................... (284,453) (255,145) (252,691) (249,332) (193,360)

Comme

r

cial banking ..................... (443,947) (87,115) (17,114) (5,197)

—

Consumer bankin

g

......................... (1,356,937) (1,395,552) (964,642) (93,134) (324,761)

Othe

r

.............................................. (207,010) (168,931) (30,600) (8,774) (17,897)

Total charge-offs ........................... $ (5,342,023) $ (4,151,231) $ (2,580,219) $ (1,932,453) $ (1,865,836)

Principal recoveries:

Domestic car

d

................................ 446,822 424,979 392,544 449,728 342,031

International car

d

........................... 51,825 65,041 71,869 68,280 43,560

Commercial Bankin

g

..................... 10,041 3,868 3,896 477

—

Consumer loans ............................. 263,161 178,190 151,355 27,243 60,119

Othe

r

.............................................. 2,540 982 14 1,576 2,641

Total principal recoveries .............. 774,389 673,060 619,678 547,304 448,351

N

et charge-offs(1) .................................... (4,567,634) (3,478,171) (1,960,541) (1,385,149) (1,417,485)

Balance at end of year ............................. $ 4,127,395 $ 4,523,960 $ 2,963,000 $ 2,180,000 $ 1,790,000

Allowance for loan and lease losses to

loans held for investment at end o

f

y

ea

r

..................................................... 4.55% 4.48% 2.91% 2.26% 2.99%

Allowance for loan and lease losses by

geographic distribution:

Domestic ....................................... $ 3,928,476 $ 4,330,864 $ 2,754,065 $ 1,949,864 $ 1,639,277

International .................................. 198,919 193,096 208,935 230,136 150,723

Allowance for loan and lease losses by

loan cate

g

or

y

:

Domestic car

d

................................ $ 1,926,724 $ 2,543,855 $ 1,428,703 $ 1,064,723 $ 1,023,437

International car

d

........................... 198,919 193,096 208,935 230,136 150,723

Commercial bankin

g

..................... 785,598 300,620 153,419 32,000

—

Consumer bankin

g

......................... 1,076,538 1,314,400 1,005,267 630,950 401,647

Othe

r

(2) ........................................... 139,616 171,989 166,676 222,191 214,193

Allowance for loan and lease losses ....... $ 4,127,395 $ 4,523,960 $ 2,963,000 $ 2,180,000 $ 1,790,000

(1) Does not include charge-offs of $22.3 million and $29.2 million in 2006 and 2005, respectively, relating to certain loans which were

segregated into pools apart from the remaining portfolio and accounted for under ASC 310-10/SOP 03-3.

(2) Includes Hibernia and North Fork Bank acquisition results for 2005 and 2006, respectively, which were allocated to the appropriate segments

in subsequent years.

(3) Reflects the appropriate allocation among segments related to Hibernia and North Fork Bank acquisition results in 2006 and 2007,

respectively.

(4) The loans acquired in the Chevy Chase Bank acquisition are accounted for under ASC 310-10/SOP 03-3. Accordingly no allowance was

recorded at acquisition. See “Note 3 – Loans Acquired in a Transfer” for further details.