Capital One 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

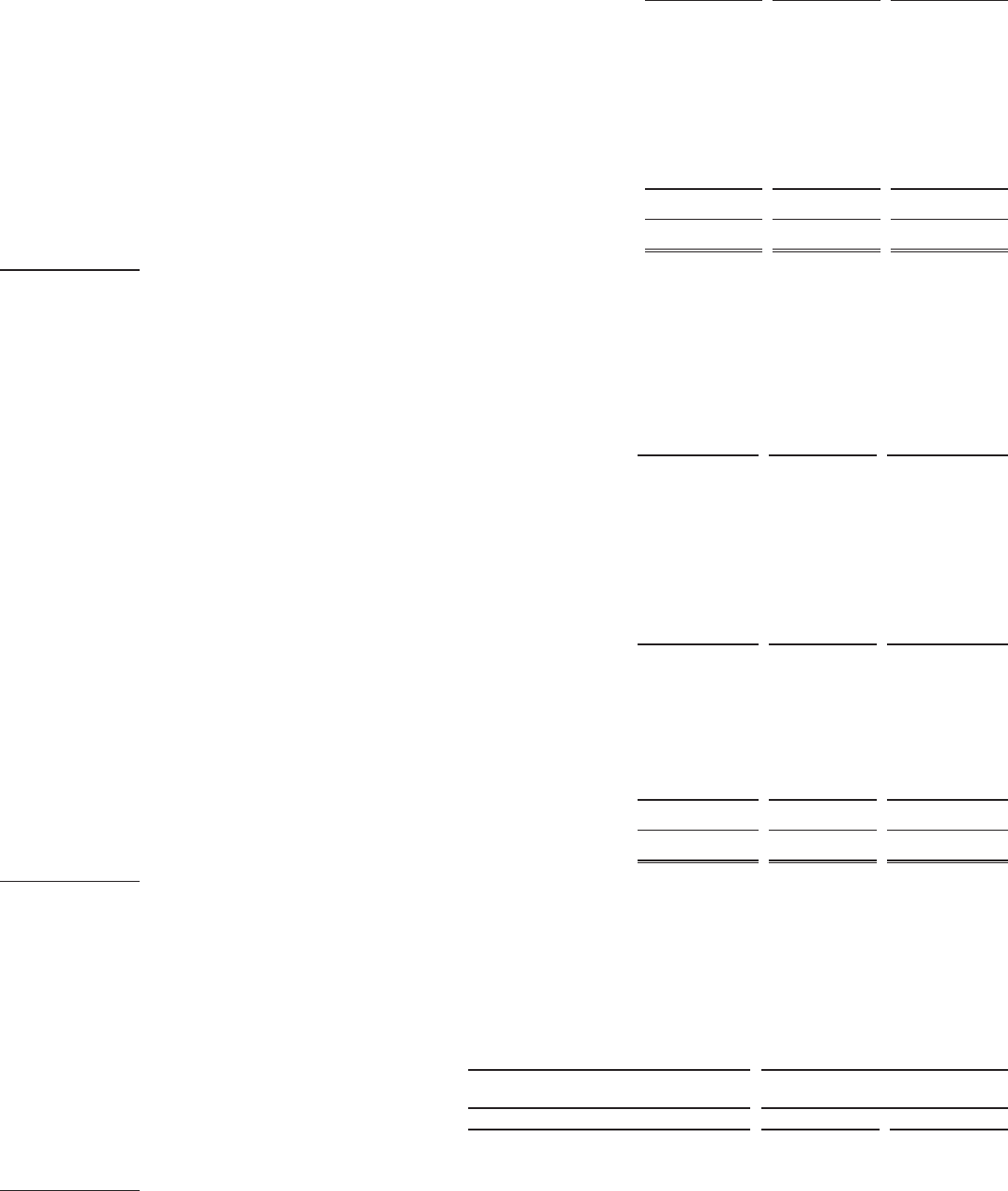

117

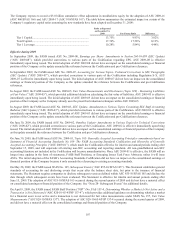

Original

Allocation Adjustments

Final

Allocation

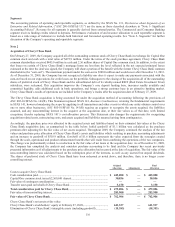

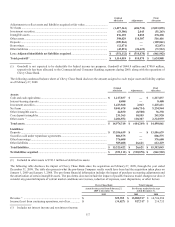

Adjustments to reflect assets and liabilities acquired at fair value: ...............................

N

et loans ....................................................................................................................... (1,427,161) (606,734) (2,033,895)

Investment securities ..................................................................................................... (53,306) 2,043 (51,263)

Intangible assets ............................................................................................................ 276,195 2,055 278,250

Other assets ................................................................................................................... 398,029 118,387 516,416

Deposits ........................................................................................................................ (109,861) — (109,861)

Borrowings ................................................................................................................... (12,871) — (12,871)

Other liabilities ............................................................................................................. (45,291) (26,621) (71,912)

Less: Adjusted identifiable net liabilities acquired .................................................. $ (351,112) $ (510,870) $ (861,982)

Total goodwill(1) ........................................................................................................... $ 1,114,018 $ 510,870 $ 1,624,888

(1) Goodwill is not expected to be deductible for federal income tax purposes. Goodwill of $844.9 million and $780.0 million,

respectively has been allocated to the Commercial and Consumer Banking segments during 2009, along with the operations of

Chevy Chase Bank.

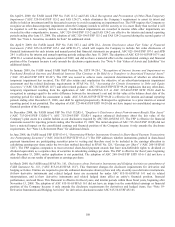

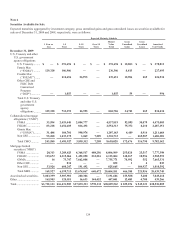

The following condensed balance sheet of Chevy Chase Bank discloses the amount assigned to each major asset and liability caption

as of February 27, 2009.

Original

Allocation Adjustments

Final

Allocation

Assets:

Cash and cash equivalents ..........................................................................................

.

$ 1,217,837 $ — $ 1,217,837

Interest-bearing deposits .............................................................................................

.

8,480 — 8,480

Investment securities ...................................................................................................

.

1,423,568 2,043 1,425,611

N

et loans .....................................................................................................................

.

9,841,678 (606,734) 9,234,944

Other Intangible assets ................................................................................................

.

44,830 (8,500) 36,330

Core deposit intangibles ..............................................................................................

.

231,365 10,555 241,920

Other assets (1) .............................................................................................................

.

2,206,552 118,387 2,324,939

Total assets ................................................................................................................ $ 14,974,310 $ (484,249) $ 14,490,061

Liabilities:

Deposits ......................................................................................................................

.

$ 13,556,639 $ — $ 13,556,639

Securities sold under repurchase agreements ..............................................................

.

806,575 — 806,575

Other borrowings ........................................................................................................

.

376,600 — 376,600

Other liabilities ...........................................................................................................

.

585,608 26,621 612,229

Total liabilities ........................................................................................................... $ 15,325,422 $ 26,621 $ 15,352,043

Net liabilities acquired ..............................................................................................

.

$ (351,112) $ (510,870) $ (861,982)

(1) Included in other assets is $743.1 million of deferred tax assets.

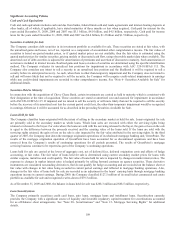

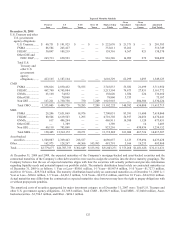

The following table discloses the impact of Chevy Chase Bank since the acquisition on February 27, 2009, through the year ended

December 31, 2009. The table also presents what the pro-forma Company results would have been had the acquisition taken place on

January 1, 2009 and January 1, 2008. The pro forma financial information includes the impact of purchase accounting adjustments and

the amortization of certain intangible assets. The pro-forma does not include the impact of possible business model changes nor does it

consider any potential impacts of current market conditions on revenues, reduction of expenses, asset dispositions, or other factors.

Chevy Chase Bank Total Company

Actual for the period from February 27,

2009 to December 31, Pro-Forma results for the year

ended December 31,

2009 2009

2008

Revenue (1) .............................................................................. $ 529,355 $ 13,000,917 $ 14,706,288

Income (loss) from continuing operations, net of tax ............. $ (34,827) $ 927,317 $ 216,755

(1) Includes net interest income and non interest income.