Capital One 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

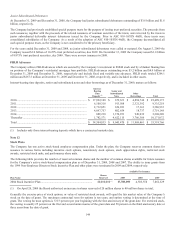

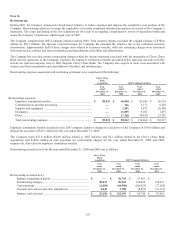

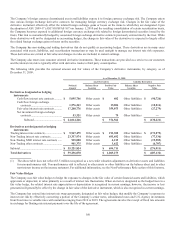

The Company’s pension plans and the other postretirement benefit plans were valued using a December 31 measurement date.

The Company’s policy is to amortize prior service amounts on a straight-line basis over the average remaining years of service to full

eligibility for benefits of active plan participants.

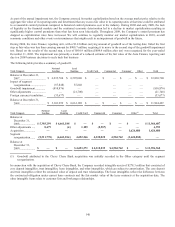

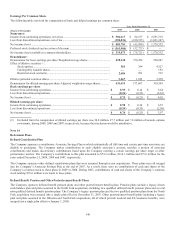

The following table sets forth, on an aggregated basis, changes in the benefit obligations and plan assets, how the funded status is

recognized in the balance sheet, and the components of net periodic benefit cost.

Pension Benefits Postretirement Benefits

2009 2008

2009 2008

Change in benefit obligation:

Benefit obligation at beginning of year .............................................................

.

$ 189,751 $ 207,926 $ 73,700 $ 59,783

Impact of adopting the measurement date provisions for post retirement

benefits of ASC 715-20/SFAS 158 of the Codification ...............................

.

— — — 906

Service cost .......................................................................................................

.

1,635 2,500 1,546 1,687

Interest cost .......................................................................................................

.

10,684 11,941 4,400 3,605

Plan participant contributions ...........................................................................

.

— — — 635

Benefits paid .....................................................................................................

.

(21,187) (11,340) (3,590) (4,468)

N

et actuarial loss (gain) ....................................................................................

.

9,330 3,381 (9,243) 11,552

Settlements ........................................................................................................

.

— (24,657) — —

Benefit obligation at end of year .......................................................................

.

$ 190,213 $ 189,751 $ 66,813 $ 73,700

Change in plan assets:

Fair value of plan assets at beginning of year ...................................................

.

$ 192,605 $ 308,335 $ 6,981 $ 8,356

Actual return on plan assets ..............................................................................

.

40,378 (80,678) 275 (1,375)

Employer contributions .....................................................................................

.

869 945 3,590 3,833

Plan participant contributions ...........................................................................

.

— — — 635

Settlements ........................................................................................................

.

— (24,657) — —

Benefits paid .....................................................................................................

.

(21,187) (11,340) (3,590) (4,468)

Fair value of plan assets at end of year .............................................................

.

$ 212,665 $ 192,605 $ 7,256 $ 6,981

Funded status at end of year ..............................................................................

.

$ 22,452 $ 2,854 $ (59,556) $ (66,719)

Balance Sheet Presentation:

Other assets .......................................................................................................

.

$ 33,588 $ 13,316 $ — $ —

Other liabilities .................................................................................................

.

(11,136) (10,462) (59,556) (66,719)

N

et amount recognized at end of yea

r

...............................................................

.

$ 22,452 $ 2,854 $ (59,556) $ (66,719)

Accumulated benefit obligation at end of year .............................................

.

$ 190,213 $ 189,751 n/a n/a

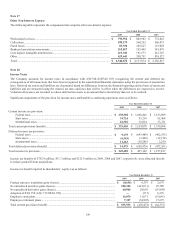

Components of net periodic benefit cost:

Service cost .......................................................................................................

.

$ 1,635 $ 2,500 $ 1,546 $ 1,687

Interest cost .......................................................................................................

.

10,684 11,941 4,400 3,605

Expected return on plan assets ..........................................................................

.

(13,407) (21,091) (448) (608)

Amortization of transition obligation, prior service credit, and net actuarial

loss ...............................................................................................................

.

1,478 — (7,593) (7,959)

Settlement loss recognized ................................................................................

.

— 10,829 — —

N

et periodic benefit cos

t

...................................................................................

.

$ 390 $ 4,179 $ (2,095) $ (3,275)

Changes recognized in other comprehensive income, pretax:

N

et actuarial gain (loss) ....................................................................................

.

$ 17,641 $ (105,150) $ 9,070 $ (13,535)

Reclassification adjustments for amounts recognized in net periodic benefit

cost ...............................................................................................................

.

1,478 10,829 (7,593) (9,748)

Total recognized in other comprehensive income .............................................

.

$ 19,119 $ (94,321) $ 1,477 $ (23,283)