Capital One 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

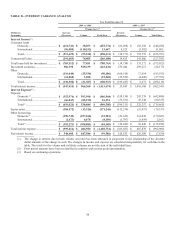

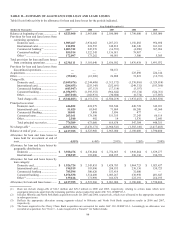

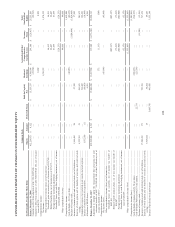

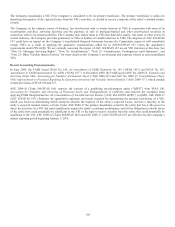

Table I – Acquired Loan Reconciliation

Table I provides a reconciliation for impacts on certain metrics excluding the Chevy Chase Bank acquired loans.

Year Ended December 31, 2009

(Dollars in thousands) CCB Acquired Loans(1) Other Loans

Total

Year-end Balances:

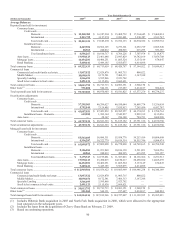

Domestic credit card .............................................................................. $ — $ 60,299,827 $ 60,299,827

International credit card ......................................................................... — 8,223,835 8,223,835

Total Credit Card .......................................................................... $ — $ 68,523,662 $ 68,523,662

Commercial and Multi-Family Real Estate ............................................ 380,055 13,463,103 13,843,158

Middle Market ....................................................................................... 315,488 9,746,331 10,061,819

Specialty lending .................................................................................... — 3,554,563 3,554,563

Total Commercial Lending .......................................................... $ 695,543 $ 26,763,997 $ 27,459,540

Small ticket commercial real estate ....................................................... — 2,153,510 2,153,510

Total Commercial Banking .......................................................... $ 695,543 $ 28,917,507 $ 29,613,050

Automobile ............................................................................................ — 18,186,064 18,186,064

Mortgage ................................................................................................ 6,287,838 8,605,349 14,893,187

Retail Banking ....................................................................................... 267,094 4,868,148 5,135,242

Total Consumer Banking .............................................................. $ 6,554,932 $ 31,659,561 $ 38,214,493

Other loans ............................................................................................. — 451,697 451,697

Total Company (Managed)........................................................... $ 7,250,475 $ 129,552,427 $ 136,802,902

Total Company (Reported) ........................................................... $ 7,250,475 $ 83,368,524 $ 90,618,999

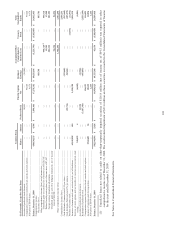

Average Balances:

Domestic credit card .............................................................................. $ — $ 64,670,269 $ 64,670,269

International credit card ......................................................................... — 8,405,250 8,405,250

Total Credit Card .......................................................................... $ — $ 73,075,519 $ 73,075,519

Commercial and Multi-Family Real Estate ............................................ 424,254 13,433,268 13,857,522

Middle Market ....................................................................................... 438,064 9,660,390 10,098,454

Specialty lending .................................................................................... — 3,566,693 3,566,693

Total Commercial Lending .......................................................... $ 862,318 $ 26,660,351 $ 27,522,669

Small ticket commercial real estate ....................................................... — 2,491,123 2,491,123

Total Commercial Banking .......................................................... $ 862,318 $ 29,151,474 $ 30,013,792

Automobile ............................................................................................ — 19,950,123 19,950,123

Mortgage ................................................................................................ 6,845,444 7,588,837 14,434,281

Retail Banking ....................................................................................... 288,878 5,200,763 5,489,641

Total Consumer Banking .............................................................. $ 7,134,322 $ 32,739,723 $ 39,874,045

Other loans ............................................................................................. — 551,060 551,060

Total Company (Managed)........................................................... $ 7,996,640 $ 135,517,776 $ 143,514,416

Total Company (Reported) ........................................................... $ 7,996,640 $ 91,790,645 $ 99,787,285