Capital One 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

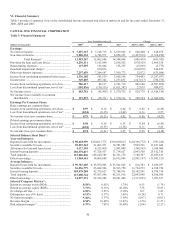

52

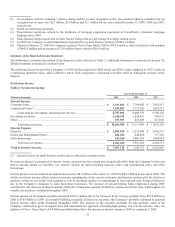

Interest expense declined by $995.8 million from 2008. Approximately half of this decline occurred in our interest bearing deposits

due to a decline in average rate from 3.04% in 2008 to 2.03% during 2009. In addition the Company’s average other borrowings

declined by $7.3 billion driven by a decrease of FHLB debt and run-off of auto securitizations during 2009. The remainder of the

decrease occurred in the Company’s Senior and Subordinated notes where the Company took advantage of lower interest rates.

Average senior and subordinated rates declined to 3.02% for 2009 from 5.01% in 2008.

For the year ended December 31, 2009, reported net interest income increased 7.7%, or $548.4 million, compared to 2008. The

increase was largely driven by the decrease in deposit related expenses, maturities of outstanding notes and run-off of auto

securitizations during 2009. Net interest margin decreased slightly by 8 basis points to 5.30% for the year ended December 31, 2009.

For the year ended December 31, 2008, reported net interest income increased 9.5%, or $618.9 million. Interest income on loans held

for investment decreased modestly to $9.46 billion from $9.50 billion at the end of 2007 as the increase in average loans held for

investment from $93.5 billion to $99.0 billion was offset by the impact of increasing delinquencies which caused our revenue

suppression to increase to $1.9 billion from $1.1 billion in 2007, and by lower interest rates on our variable rate products as interest

rates declined throughout the year.

Interest income on securities available for sale increased $273.0 million driven by increases in the average portfolio from $18.9 billion

to $25.0 billion in 2008 while yields remained stable. The increase in the securities available for sale portfolio came as the Company

continued to grow its deposit base and maintained our approach of holding high quality, low risk investments rather than taking

excessive credit risk to generate incremental earnings. While interest rates declined throughout 2008, the Company maintained stable

yields in growing the securities portfolio by taking advantage of market illiquidity to purchase securities at an attractive yield.

Interest expense on interest-bearing deposits decreased $394.3 million from 2007. The average balance on interest-bearing deposits

increased to $82.7 billion from $74.0 billion while the yield decreased to 3.04% in 2008 from 3.94% as the Federal Reserve reduced

the federal funds rate throughout 2008.

For additional information, see “Table A – Statement of Average Balances, Income and Expense, Yields and Rates” and “Table B –

Interest Variance Analysis” for further details.

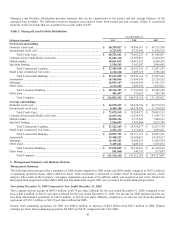

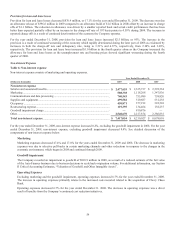

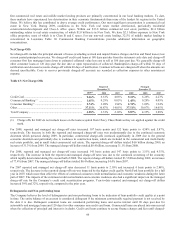

Table 5: Non-interest income

Non-Interest Income

Year Ended December 31,

(Dollars in thousands)

2009 2008

2007

Non-interest income

Servicing and securitizations .............................................................................................

.

$ 2,279,826 $ 3,384,468 $ 4,840,677

Service charges and other customer-related fees ...............................................................

.

1,997,013 2,232,363 2,057,854

Mortgage servicing and other ............................................................................................

.

14,729 105,038 166,776

Interchange ........................................................................................................................

.

501,798 562,117 500,484

N

et impair

m

ent losses recognized in earnings ..................................................................

.

(31,951) (10,916) —

Other ..................................................................................................................................

.

524,737 470,901 488,432

Total non-interest income ...............................................................................................

.

$ 5,286,152 $ 6,743,971 $ 8,054,223

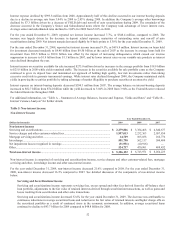

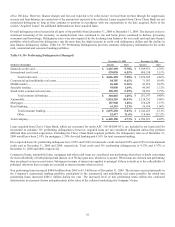

Non-interest income is comprised of servicing and securitizations income, service charges and other customer-related fees, mortgage

servicing and other, interchange income and other non-interest income.

For the year ended December 31, 2009, non-interest income decreased 21.6% compared to 2008. For the year ended December 31,

2008, non-interest income decreased 16.3% compared to 2007. See detailed discussion of the components of non-interest income

below.

Servicing and Securitizations Income

Servicing and securitizations income represents servicing fees, excess spread and other fees derived from the off-balance sheet

loan portfolio, adjustments to the fair value of retained interests derived through securitization transactions, as well as gains and

losses resulting from securitization and other sales transactions.

Servicing and securitizations income decreased 32.6% for the year ended December 31, 2009. The decrease was attributable to

continuous reductions in average securitized loans and reduction in the fair value of retained interests and higher charge offs on

the securitized portfolio as a result of continued stress in the economic environment. In addition, average securitized loans

continued to decline to $43.7 billion for 2009 compared to $48.8 billion for 2008.