Capital One 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

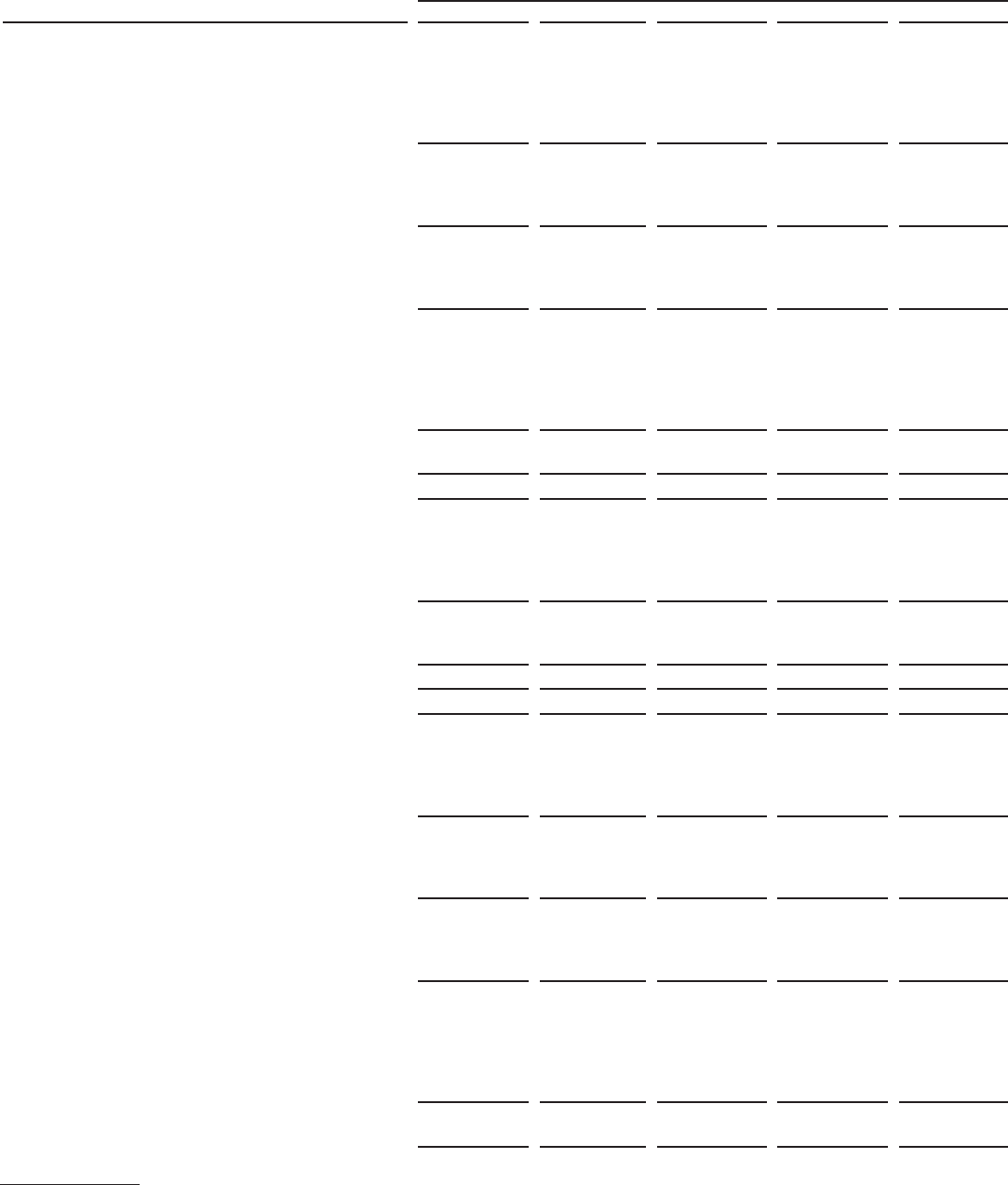

90

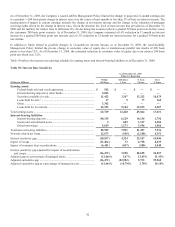

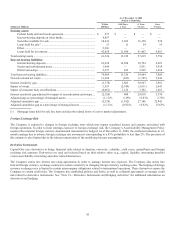

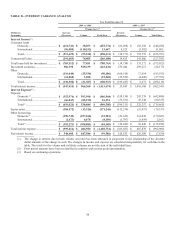

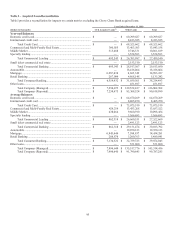

Year Ended December 31

(Dollars in thousands)

2009(2) 2008 2007(3) 2006

2005

Average Balances:

Reported loans held for investment:

Consumer loans ...........................................................

Credit cards ......................................................

Domestic ................................................ $ 18,268,382 $ 16,387,284 $ 15,408,732 $ 17,364,645 $ 15,468,014

International ........................................... 2,543,739 3,197,974 2,983,401 3,230,287 3,531,767

Total credit card ..................................... $ 20,812,121 $ 19,585,258 $ 18,392,133 $ 20,594,932 $ 18,999,781

Installment loans ...............................................

Domestic ................................................ 8,467,304 10,562,105 8,273,301 6,692,719 6,565,520

International ........................................... 68,963 248,012 490,925 615,255 553,357

Total installment loans ........................... $ 8,536,267 $ 10,810,717 $ 8,764,226 $ 7,307,974 $ 7,118,877

Auto loans ................................................................... 19,950,123 23,461,648 23,893,829 19,742,169 13,056,708

Mortgage loans ............................................................ 14,434,281 10,406,251 11,805,524 5,135,149 674,047

Retail Banking ............................................................ 5,489,641 5,449,185 5,565,075 4,414,698

Total consumer loans ............................................................. $ 69,222,433 $ 69,713,059 $ 68,420,787 $ 57,194,922 $ 39,849,413

Commercial loans

Commercial and multi-family real estate .......................

.

13,857,522 12,829,870 11,905,715 800,822 —

Middle Market ............................................................ 10,098,454 9,172,541 7,404,313 3,167,348 —

Specialty Lending ....................................................... 3,566,693 3,595,866 2,923,702 — —

Small ticket commercial real estate ............................. 2,491,123 3,115,436 2,669,621 — —

Total commercial loans ......................................................... $ 30,013,792 $ 28,713,713 $ 24,903,351 $ 3,968,170 $ —

Other loans

(

1

)

........................................................................ 551,060 544,131 217,687 2,414,187 884,824

Total reported loans held for investment ............................... $ 99,787,285 $ 98,970,903 $ 93,541,825 $ 63,577,279 $ 40,734,237

Securitization adjustments:

Consumer loans ...........................................................

Credit cards ......................................................

Domestic ................................................ 37,295,303 40,299,027 40,550,044 36,888,774 35,336,054

International ........................................... 5,792,548 7,124,805 7,835,913 7,285,459 6,452,707

Total credit card ..................................... $ 43,087,851 $ 47,423,832 $ 48,385,957 $ 44,174,233 $ 41,788,761

Installment loans – Domestic............................ 639,280 1,389,164 2,542,837 2,828,332 1,133,036

Auto loans ................................................................... — 28,367 256,388 748,751 1,608,989

Total consumer loans ............................................................. $ 43,727,131 $ 48,841,363 $ 51,185,182 $ 47,751,316 $ 44,530,786

Total securitization adjustments ............................................ $ 43,727,131 $ 48,841,363 $ 51,185,182 $ 47,751,316 $ 44,530,786

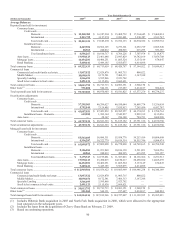

Managed loans held for investment:

Consumer loans ...........................................................

Credit cards ......................................................

Domestic ................................................ 55,563,685 56,686,311 55,958,776 54,253,419 50,804,068

International ........................................... 8,336,287 10,322,779 10,819,314 10,515,746 9,984,474

Total credit card ..................................... $ 63,899,972 $ 67,009,090 $ 66,778,090 $ 64,769,165 $ 60,788,542

Installment loans ...............................................

Domestic ................................................ 9,106,584 11,951,869 10,816,138 9,521,051 7,698,556

International ........................................... 68,963 248,012 490,925 615,255 553,357

Total installment loans ........................... $ 9,175,547 $ 12,199,881 $ 11,307,063 $ 10,136,306 $ 8,251,913

Auto loans ................................................................... 19,950,123 23,490,015 24,150,217 20,490,920 14,665,697

Mortgage loans ............................................................ 14,434,281 10,406,251 11,805,524 5,135,149 674,047

Retail Banking ............................................................ 5,489,641 5,449,185 5,565,075 4,414,698 —

Total consumer loans ............................................................. $ 112,949,564 $ 118,554,422 $ 119,605,969 $ 104,946,238 $ 84,380,199

Commercial loans

Commercial and multi-family real estate .........................

.

13,857,522 12,829,870 11,905,715 800,822 —

Middle Market ............................................................ 10,098,454 9,172,541 7,404,313 3,167,348 —

Specialty Lending ....................................................... 3,566,693 3,595,866 2,923,702 — —

Small ticket commercial real estate ............................. 2,491,123 3,115,436 2,669,621 — —

Total commercial loans ......................................................... $ 30,013,792 $ 28,713,713 $ 24,903,351 $ 3,968,170 $ —

Other loans

(

1

)

........................................................................ 551,060 544,131 217,687 2,414,187 844,824

Total managed loans held for investment .............................. $ 143,514,416 $ 147,812,266 $ 144,727,007 $ 111,328,595 $ 85,265,023

(1) Includes Hibernia Bank acquisition in 2005 and North Fork Bank acquisition in 2006, which were allocated to the appropriate

loan categories in the subsequent years.

(2) Includes the loans from the acquisition of Chevy Chase Bank on February 27, 2009.

(3) Based on continuing operations.