Capital One 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 112

At the time a loan is placed on nonaccrual status, interest and fees accrued but not collected are systematically reversed and charged

against income. Interest payments received on nonaccrual loans are applied to principal if there is doubt as to the collectibility of the

principal; otherwise, these receipts are recorded as interest income. A loan remains in nonaccrual status until it is current as to

principal and interest and the borrower demonstrates the ability to fulfill the contractual obligation.

Upon foreclosure or repossession, loans are adjusted, if necessary, to the estimated fair value of the underlying collateral and

transferred to other assets, net of a valuation allowance for selling costs. We estimate market values primarily based on appraisals

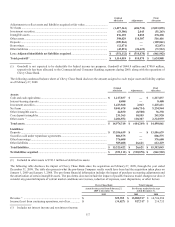

when available or quoted market prices on liquid assets. At December 31, 2009 and 2008, the balance of foreclosed assets and

repossessed assets were $233.7 million and $89.0 million, respectively, and $24.5 million and $65.6 million, respectively.

Charge-offs and Delinquencies

Commercial and small business loans are considered past due or delinquent based on contractual terms. Principal amounts charge-off

when amounts are deemed uncollectible and interest is reversed and charged against income when the loans are placed on nonaccrual

status.

Credit card loans charge-off at 180 days past the statement cycle date and other consumer loans generally charge-off at 120 days past

due or upon repossession of collateral. The entire balance of an account is contractually delinquent if the minimum payment is not

received by the specified due date on the customer’s billing statement. Bankruptcies charge-off within 30 days of notification and

deceased accounts charge-off within 60 days of notification. Fraudulent amounts are charged to non-interest expense after a 60 day

investigation period.

Net charge-offs represent principal losses net of current period principal recoveries. Principal losses exclude accrued and unpaid

interest income and fees and fraud losses. Interest income and fees accrued and not collected are reversed when the loan charges off or

when placed in nonaccrual status. Costs to recover previously charged-off loans are recorded as collection expenses in other non-

interest expense.

Allowance for Loan and Lease Losses

The allowance for loan and lease losses is maintained at the amount estimated to be sufficient to absorb probable principal losses, net

of principal recoveries (including recovery of collateral), inherent in the existing reported loan portfolios. The provision for loan and

lease losses is the periodic cost of maintaining an adequate allowance. The amount of allowance necessary is based on distinct

allowance methodologies depending on the type of loans which include specifically identified criticized loans, migration analysis,

forward loss curves and historical loss trends. In evaluating the sufficiency of the allowance for loan and lease losses, management

takes into consideration many factors including, but not limited to: recent trends in delinquencies and charge-offs including bankrupt,

deceased and recovered amounts; forecasting uncertainties and size of credit risks; the degree of risk inherent in the composition of the

loan portfolio; economic conditions; legal and regulatory guidance; credit evaluations and underwriting policies; seasonality; and the

value of collateral supporting the loans. To the extent credit experience is not indicative of future performance or other assumptions

used by management do not prevail, loss experience could differ significantly, resulting in either higher or lower future provision for

loan and lease losses, as applicable. The evaluation process for determining the adequacy of the allowance for loan losses and the

periodic provisioning for estimated losses is undertaken on a quarterly basis, but may increase in frequency should conditions arise

that would require the Company’s prompt attention. Conditions giving rise to such action are business combinations or other

acquisitions or dispositions of large quantities of loans, dispositions of non-performing and marginally performing loans by bulk sale

or any development which may indicate a significant trend.

Commercial and small business loans are considered to be impaired in accordance with the provisions of ASC 310-10/SFAS 114

when it is probable that all amounts due in accordance with the contractual terms will not be collected. Specific allowances are

determined in accordance with ASC 310-10/SFAS 114. Impairment is measured based on the present value of the loan’s expected

cash flows, the loan’s observable market price or the fair value of the loan’s collateral, if loan is collateral dependent.

For purposes of determining impairment, consumer loans are collectively evaluated as they are considered to be comprised of large

groups of smaller-balance homogeneous loans and therefore are not individually evaluated for impairment under the provisions of

ASC 310-10/SFAS 114.

Troubled debt restructurings (“TDR”) occur when the Company agrees to significantly modify the original terms of a loan due to the

deterioration in the financial condition of the borrower. During 2009, the Company modified $279.6 million of loans which are

considered TDR’s. The income statement impact for the TDR’s was not material. The Company did not have any material TDR’s in

2008.