Capital One 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

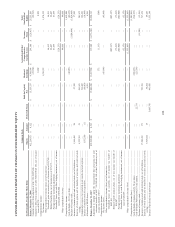

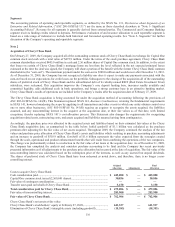

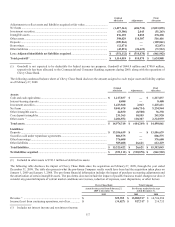

The Company expects to record a $3.0 billion cumulative effect adjustment in stockholders equity for the adoption of ASU 2009-16

(ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167). The table below summarizes the estimated impact on certain of the

Company’s regulatory capital ratios assuming the new standards have been adopted on December 31, 2009:

Ratio as Reported

on December 31,

2009 Pro Forma Ratio

Difference

Tier 1 Capital .............................................................................

.

13.75% 9.93% 3.82%

Total Capital ..............................................................................

.

17.70% 17.58% 0.12%

Tier 1 Leverage .........................................................................

.

10.28% 5.84% 4.44%

Effective during 2009

In September 2009, the FASB issued ASU No. 2009-08, Earnings per Share- Amendments to Section 260-10-S99 (SEC Update)

(“ASU 2009-08”), which provided corrections to various parts of the Codification regarding EPS. ASU 2009-08 is effective

immediately upon being issued. The initial adoption of ASU 2009-08 did not have an impact on the consolidated earnings or financial

position of the Company as the update amended the reference between the Codification and pre-Codification references.

In September 2009, the FASB issued ASU No. 2009-07, Accounting for Various Topics- Technical Corrections to SEC Paragraphs

(SEC Update) (“ASU 2009-07”), which provided corrections to various parts of the Codification including Regulation S-X. ASU

2009-07 is effective immediately upon being issued. The initial adoption of ASU 2009-07 did not have an impact on the consolidated

earnings or financial position of the Company as the update amended the reference between the Codification and pre-Codification

references.

In August 2009, the FASB issued ASU No. 2009-05, Fair Value Measurements and Disclosures (Topic 820) - Measuring Liabilities

at Fair Value (“ASU 2009-05”), which provided additional details on calculating the fair value of liabilities. ASU 2009-05 is effective

immediately upon being issued. The initial adoption of ASU 2009-05 did not have an impact on the consolidated earnings or financial

position of the Company as the Company already uses the prescribed valuation techniques within ASU 2009-05.

In August 2009, the FASB issued ASU No. 2009-03, SEC Update- Amendments to Various Topics Containing SEC Staff Accounting

Bulletins (SEC Update) (“ASU 2009-03”), which provided corrections to various parts of the Codification. ASU 2009-03 is effective

immediately upon being issued. The initial adoption of ASU 2009-03 did not have an impact on the consolidated earnings or financial

position of the Company as the update amended the reference between the Codification and pre-Codification references.

On June 30, 2009, the FASB issued ASU No. 2009-02, Omnibus Update- Amendments to Various Topics for Technical Corrections

(“ASU 2009-02”), which provided corrections to various parts of the Codification. ASU 2009-02 is effective immediately upon being

issued. The initial adoption of ASU 2009-02 did not have an impact on the consolidated earnings or financial position of the Company

as the update amended the reference between the Codification and pre-Codification references.

On June 30, 2009, the FASB issued ASU No. 2009-01, Topic 105- Generally Accepted Accounting Principles- amendments based on-

Statement of Financial Accounting Standards No. 168- The FASB Accounting Standards Codification and Hierarchy of Generally

Accepted Accounting Principles (“ASU 2009-01”), which made the Codification effective for interim and annual periods ending after

September 15, 2009, and will supersede all existing non-SEC accounting and reporting standards. All non-grandfathered non-SEC

accounting literature not included in the Codification will become nonauthoritative. Once ASU 2009-01 is effective, the FASB will no

longer issue updates in the form of statements, FASB Staff Positions, or Emerging Issues Task Force Abstracts; rather it will issue

ASUs. The initial adoption of the FASB’s Accounting Standards Codification did not have an impact on the consolidated earnings or

financial position of the Company because it only amends the referencing to existing accounting standards.

On May 28, 2009, the FASB issued SFAS No. 165, Subsequent Events (“ASC 855-10/SFAS 165”). This Statement establishes general

standards of accounting for and disclosing events that occur after the balance sheet date, but prior to the issuance of financial

statements. The Statement requires companies to disclose subsequent events as defined within ASC 855-10/SFAS 165 and disclose the

date through which subsequent events have been evaluated. The Statement is effective for interim and annual periods ending after

June 15, 2009. The adoption of ASC 855-10/SFAS 165 occurred during the second quarter of 2009 and did not have a material effect

on consolidated earnings or financial position of the Company. See “Note 28- Subsequent Events” for additional details.

On April 9, 2009, the FASB issued FASB Staff Position (“FSP”) No. FAS 157-4, Determining Whether a Market Is Not Active and a

Transaction is Not Distressed (“ASC 820-10-65-4/FSP 157-4”), which provides additional guidance on determining whether a market

for a financial asset is not active and a transaction is not distressed for fair value measurements under SFAS No. 157, Fair Value

Measurements (“ASC 820-10/SFAS 157”). The adoption of ASC 820-10-65-4/FSP 157-4 occurred during the second quarter of 2009,

and did not have a material effect on the consolidated earnings and financial position of the Company.