Capital One 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 120

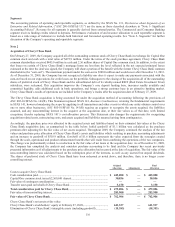

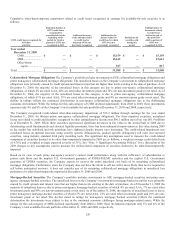

The Company’s mortgage origination operations of its wholesale mortgage banking unit had assets of approximately $23.8 million

and $35.0 million as of December 31, 2009 and 2008, respectively, consisting of $19.9 million and $19.3 million, respectively, of

mortgage loans held for sale and other related assets. The related liabilities consisted of obligations to fund these assets, and

obligations for representations and warranties provided by the Company on loans previously sold to third parties.

Note 5

Segments

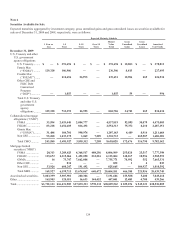

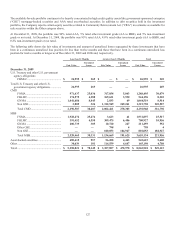

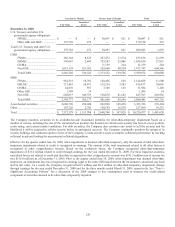

During 2009, the Company realigned its business segment reporting structure to better reflect the manner in which the performance of

the Company’s operations is evaluated. The Company now reports the results of its business through three operating segments: Credit

Card, Commercial Banking and Consumer Banking.

Segment results where presented have been recast for all periods presented. The three segments consist of the following:

• Credit Card includes the Company’s domestic consumer and small business card lending, domestic national small

business lending, national closed end installment lending and the international card lending businesses in Canada and the

United Kingdom.

• Commercial Banking includes the Company’s lending, deposit gathering and treasury management services to

commercial real estate and middle market customers. The Commercial Banking segment also includes the financial results

of a national portfolio of small ticket commercial real estate loans that are in run-off mode.

• Consumer Banking includes the Company’s branch based lending and deposit gathering activities for small business

customers as well as its branch based consumer deposit gathering and lending activities, national deposit gathering,

consumer mortgage lending and servicing activities and national automobile lending.

Chevy Chase Bank’s operations are included in the Commercial Banking and Consumer Banking segments beginning in the second

quarter 2009. Chevy Chase Bank’s operations for the first quarter of 2009 remain in the Other category due to the short duration since

acquisition. The Other category includes GreenPoint originated consumer mortgages originated for sale but held for investment since

originations were suspended in 2007, the results of corporate treasury activities, including asset-liability management and the

investment portfolio, the net impact of transfer pricing, brokered deposits, certain unallocated expenses, gains/losses related to the

securitization of assets, and restructuring charges related to the Company’s cost initiative and Chevy Chase Bank acquisition.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity with

U.S. GAAP. The following tables present information prepared from the Company’s internal management information systems, which

is maintained based on managed financial statement view and on a line of business level through allocations from the consolidated

financial results.