Capital One 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

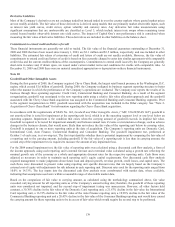

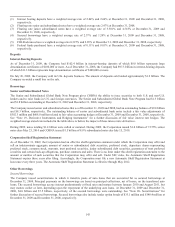

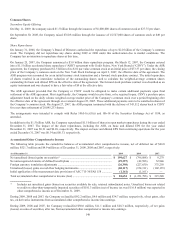

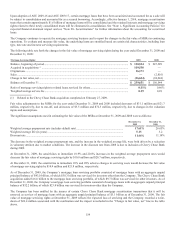

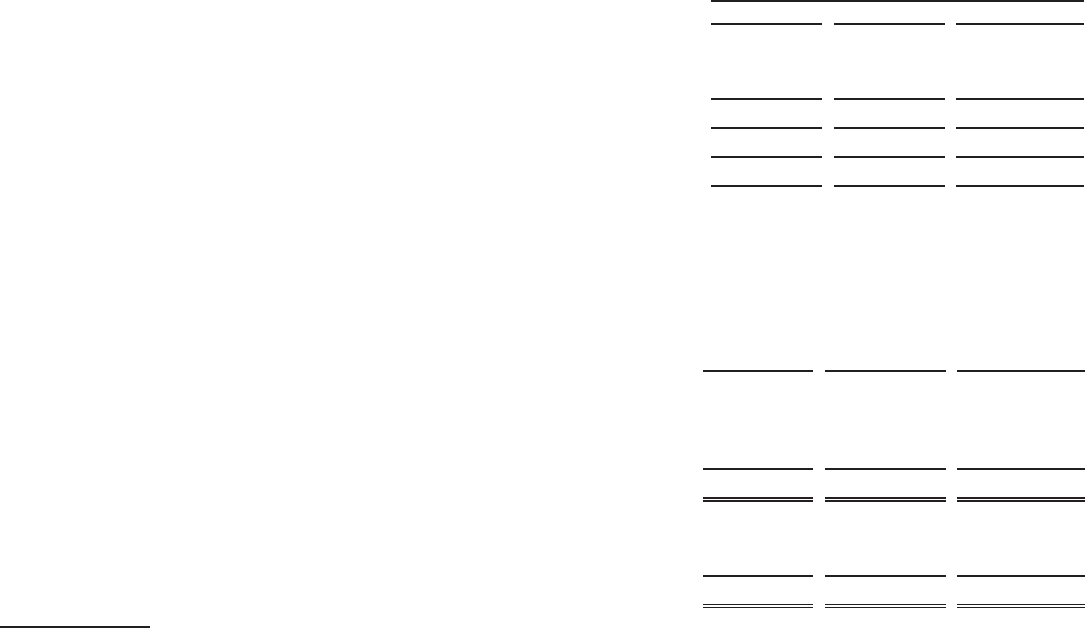

Earnings Per Common Share

The following table sets forth the computation of basic and diluted earnings per common share:

Year Ended December 31

(Shares in Thousands) 2009 2008

2007

Numerator:

Income from continuing operations, net of tax ................................................................

.

$ 986,617 $ 84,517 $ 2,591,719

Loss from discontinued operations, net of tax .................................................................

.

(102,836 ) (130,515 ) (1,021,387 )

N

et income (loss) .............................................................................................................

.

$ 883,781 $ (45,998 ) $ 1,570,332

Preferred stock dividends and accretion of discount ........................................................

.

$ (563,908 ) $ (32,723 ) $ —

N

et income (loss) available to common shareholders ......................................................

.

$ 319,873 $ (78,721 ) $ 1,570,332

Denominator:

Denominator for basic earnings per share-Weighted-average shares ..............................

.

428,148 376,282 390,287

Effect of dilutive securities (1) :

Stock options ..........................................................................................................

.

581 394 4,327

Contingently issuable shares ..................................................................................

.

— — 192

Restricted stock and units .......................................................................................

.

2,686 991 739

Dilutive potential common shares ................................................................................... 3,267 1,385 5,258

Denominator for diluted earnings per share-Adjusted weighted-average shares ............ 431,415 377,667 395,545

Basic earnings per share

Income from continuing operations ................................................................................ $ 0.99 $ 0.14 $ 6.64

Loss from discontinued operations ................................................................................. (0.24

)

(0.35 ) (2.62 )

N

et income (loss) ............................................................................................................ $ 0.75 $ (0.21 ) $ 4.02

Diluted earnings per share

Income from continuing operations ................................................................................ $ 0.98 $ 0.14 $ 6.55

Loss from discontinued operations ................................................................................. (0.24

)

(0.35 ) (2.58 )

N

et inco

m

e (loss) ............................................................................................................ $ 0.74 $ (0.21 ) $ 3.97

(1) Excluded from the computation of diluted earnings per share was 34.8 million, 27.7 million and 7.4 million of awards, options

or warrants, during 2009, 2008 and 2007, respectively, because their inclusion would be antidilutive.

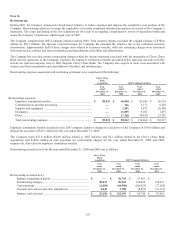

Note 14

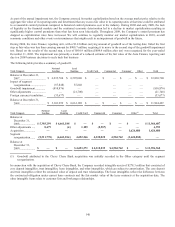

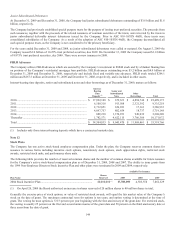

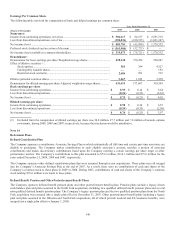

Retirement Plans

Defined Contribution Plan

The Company sponsors a contributory Associate Savings Plan in which substantially all full-time and certain part-time associates are

eligible to participate. The Company makes contributions to each eligible associate’s account, matches a portion of associate

contributions and makes discretionary contributions based upon the Company meeting a certain earnings per share target or other

performance metrics. The Company’s contributions to this plan amounted to $79.5 million, $110.3 million and $73.6 million for the

years ended December 31, 2009, 2008 and 2007, respectively.

The Company sponsors other defined contribution plans that were assumed through recent acquisitions. These plans were all merged

into the Company’s Associate Savings Plan at the end of 2007. As a result, there were no contributions of cash and shares of the

Company’s common stock to these plans in 2009 or 2008. During 2007, contributions of cash and shares of the Company’s common

stock totaling $35.6 million were made to these plans.

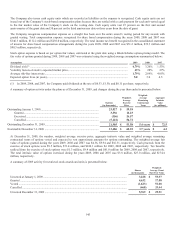

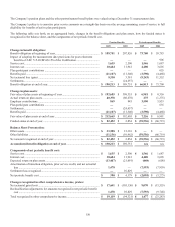

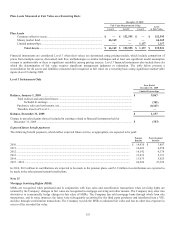

Defined Benefit Pension and Other Postretirement Benefit Plans

The Company sponsors defined benefit pension plans and other postretirement benefit plans. Pension plans include a legacy frozen

cash balance plan and plans assumed in the North Fork acquisition, including two qualified defined benefit pension plans and several

non-qualified defined benefit pension plans. The Company’s legacy pension plan and the two qualified pension plans from the North

Fork acquisition were merged into a single plan effective December 31, 2007. Other postretirement benefit plans including a legacy

plan and plans assumed in the Hibernia and North Fork acquisitions, all of which provide medical and life insurance benefits, were

merged into a single plan effective January 1, 2008.