Capital One 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

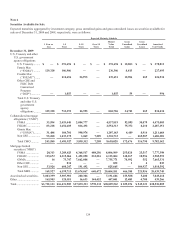

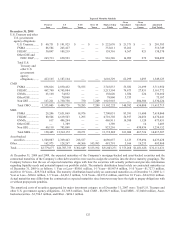

Segments

The accounting policies of operating and reportable segments, as defined by the SFAS No. 131, Disclosures about Segments of an

Enterprise and Related Information, (“ASC 280-10/SFAS 131”) are the same as those described elsewhere in “Note 1- Significant

Accounting Policies”. Revenue for all segments is generally derived from external parties. The Commercial and Consumer Banking

segment receives funding credits related to deposits. Performance evaluation of and resource allocation to each reportable segment is

based on a wide range of indicators to include both historical and forecasted operating results. See “Note 5- Segments” for further

discussion of the Company’s operating and reportable segments.

Note 2

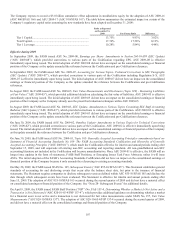

Acquisition of Chevy Chase Bank

On February 27, 2009, the Company acquired all of the outstanding common stock of Chevy Chase Bank in exchange for Capital One

common stock and cash with a total value of $475.9 million. Under the terms of the stock purchase agreement, Chevy Chase Bank

common shareholders received $445.0 million in cash and 2.56 million shares of Capital One common stock. In addition, to the extent

that losses on certain of Chevy Chase Bank’s mortgage loans are less than the level reflected in the net expected principal losses

estimated at the time the deal was signed, the Company will share a portion of the benefit with the former Chevy Chase Bank common

shareholders (the “earn-out”). The maximum payment under the earn-out is $300.0 million and would occur after December 31, 2013.

As of December 31, 2009, the Company has not recognized a liability nor does it expect to make any payments associated with the

earn-out based on our expectations for credit losses on the portfolio. Subsequent to the closing of the acquisition all of the outstanding

shares of preferred stock of Chevy Chase Bank and the subordinated debt of its wholly-owned REIT (Real Estate Investment Trust)

subsidiary, were redeemed. This acquisition improves the Company’s core deposit funding base, increases readily available and

committed liquidity, adds additional scale in bank operations, and brings a strong customer base in an attractive banking market.

Chevy Chase Bank’s results of operations are included in the Company’s results after the acquisition date of February 27, 2009.

The Chevy Chase Bank acquisition is being accounted for under the acquisition method of accounting following the provisions of

ASC 805-10/SFAS No. 141(R). This Statement replaced SFAS 141, Business Combinations, retaining the fundamental requirements

in SFAS 141, however broadening the scope by applying to all transactions and other events in which one entity obtains control over

one or more other businesses. ASC 805-10/SFAS No. 141(R) requires an acquirer to recognize the assets acquired, the liabilities

assumed, and any noncontrolling interest in the acquiree at the acquisition date, at their fair values as of that date, with limited

exceptions, thereby replacing SFAS 141’s cost-allocation process. This Statement also changes the requirements for recognizing

acquisition related costs, restructuring costs, and assets acquired and liabilities assumed arising from contingencies.

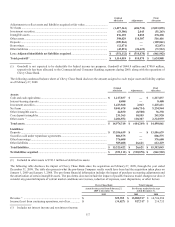

Accordingly, the purchase price was allocated to the acquired assets and liabilities based on their estimated fair values at the Chevy

Chase Bank acquisition date, as summarized in the table below. Initial goodwill of $1.1 billion was calculated as the purchase

premium after adjusting for the fair value of net assets acquired. Throughout 2009, the Company continued the analysis of the fair

values and purchase price allocation of Chevy Chase Bank’s assets and liabilities which resulting in purchase accounting adjustments

and an increase to goodwill of $510.9 million. Goodwill of $1.6 billion represents the value expected from the synergies created

through the scale, operational and product enhancement benefits that will result from combining the operations of the two companies.

The change was predominantly related to a reduction in the fair value of net loans at the acquisition date. As of December 31, 2009,

the Company has completed the analysis and considers purchase accounting to be final and the Company has recast previously

presented information as if all adjustments to the purchase price allocation had occurred at the date of acquisition. The fair value of the

non-controlling interest was calculated based on the redemption price of the interests, as well as any accrued but unpaid dividends.

The shares of preferred stock of Chevy Chase Bank have been redeemed as noted above, and therefore, there is no longer a non-

controlling interest.

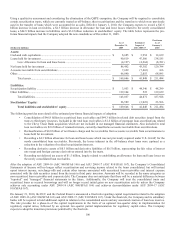

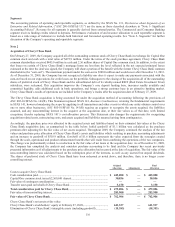

Original

Allocation Adjustments

Final

Allocation

Costs to acquire Chevy Chase Bank:

Cash consideration paid ................................................................................................

.

$ 445,000 $ — $ 445,000

Capital One common stock issued (2,560,601 shares) ..................................................

.

30,856 — 30,856

Fair value of contingent consideration ..........................................................................

.

— — —

Transfer taxes paid on behalf of Chevy Chase Bank ....................................................

.

3,150 — 3,150

Total consideration paid for Chevy Chase Bank ......................................................

.

$ 479,006 $ — $ 479,006

Fair value of noncontrolling interest .............................................................................

.

283,900 — 283,900

Fair value of Chevy Chase Bank ...............................................................................

.

$ 762,906 — $ 762,906

Chevy Chase Bank’s net assets at fair value:

Chevy Chase Bank’s stockholders’ equity at February 27, 2009 ..................................

.

641,537 — 641,537

Elimination of Chevy Chase Bank’s intangible assets (including goodwill) ................

.

(18,383) — (18,383)