Capital One 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 38

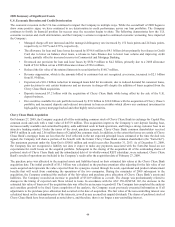

Recourse Exposure

The Company retains residual interests in the trusts as credit enhancements to support the credit quality of the receivables

transferred to the trust. The Company’s retained residual interests are generally restricted or subordinated to investors’ interests

and their value is subject to substantial credit, repayment and interest rate risks on the transferred financial assets. The value of

the retained residual interests represents the Company’s only exposure to loss resulting from its continuing involvement in the

trusts. The investors and the trusts have no recourse to the Company’s assets if the off-balance sheet loans are not paid when

due. The Company has not provided any financial or other support during the periods presented that it was not previously

contractually required to provide. The Company’s retained residual interests in the off-balance sheet securitizations are recorded

in accounts receivable from securitizations and are comprised of interest-only strips, retained senior tranches, retained

subordinated interests, cash collateral accounts, cash reserve accounts and unpaid interest and fees on the investors’ portion of

the transferred principal receivables. See “Note 20—Securitizations” for quantitative information regarding retained interests.

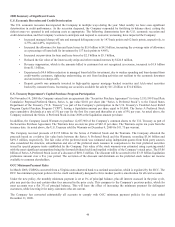

Collections and Amortization

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing and other fees,

and are available to absorb the investors’ share of credit losses. Amounts collected in excess of that needed to pay the above

amounts are remitted, in general, to the Company. Under certain conditions, some of the cash collected may be retained in

spread accounts to ensure future payments to investors. See “Note 20—Securitizations” for quantitative information regarding

revenues, expenses and cash flows that arise from securitization transactions.

Maturity terms of the existing securitizations vary from 2010 to 2025 and, for revolving securitizations, have accumulation

periods during which principal payments are aggregated to make payments to investors. As payments on the loans are

accumulated and are no longer reinvested in new loans, the Company’s funding requirements for loans increase accordingly.

The Company believes that it has the ability to continue to utilize securitization arrangements as a source of liquidity; however,

a significant reduction, termination or change in sale accounting for the Company’s off-balance sheet securitizations could

require the Company to draw down existing liquidity and/or to obtain additional funding through the issuance or recognition of

secured borrowings or unsecured debt, the raising of additional deposits or the slowing of asset growth to offset or to satisfy

liquidity needs.

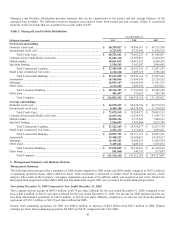

The amounts of investor principal from off-balance sheet loans as of December 31, 2009 that are expected to amortize into the

Company’s loans, or be otherwise paid over the periods indicated, are summarized in “Table 28 – Contractual Funding

Obligations”. Of the Company’s total managed loans, 34% and 31% were included in off-balance sheet securitizations for the

years ended December 31, 2009 and 2008, respectively.

Servicing Activities

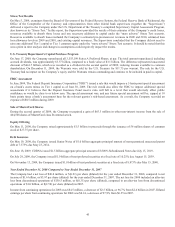

The Company services mortgage loans that have been sold through either whole loans sales or securitizations with servicing retained.

MSRs, are recognized when mortgage loans are sold in the secondary market and the right to service these loans are retained for a fee,

and are carried at fair value; changes in fair value are recognized in mortgage servicing and other. The Company enters into

derivatives to economically hedge changes in fair value of MSRs. The Company typically does not have any continuing involvement

other than its right to service the loans and the Company generally does not hold subordinate residual interests or enter into other

guarantees or liquidity agreements with these structures. The Company did, however, obtain certain retained interest-only bonds,

negative amortization bonds and other retained interests related to certain mortgage loan securitizations performed by Chevy Chase

Bank as a result of the Chevy Chase Bank acquisition during 2009. The Company records the MSR at estimated fair value and has no

other loss exposure over and above the recorded fair value. See “Note 15 – Mortgage Servicing Rights” for quantitative information

regarding MSRs.

Community Development Activities

As part of its community reinvestment initiatives, the Company invests in private investment funds that make investments in common

stock of VIEs or provide debt financing to VIEs to support multi-family affordable housing properties. The Company receives

affordable housing tax credits for these investments. The activities of these entities are financed with a combination of invested equity

capital and debt. The Company is not required to consolidate these entities because it does not absorb the majority of the entities’

expected losses nor does it receive a majority of the entities’ expected residual returns. The Company records its interests in these

unconsolidated VIEs in loans held for investment, other assets and other liabilities. The Company’s maximum exposure to these

entities is limited to its variable interests in the entities and the creditors of the VIEs have no recourse to the general credit of the

Company. The Company has not provided additional financial or other support during the period that it was not previously

contractually required to provide. See “Note 22—Other Variable Interest Entities” for quantitative information regarding Other

Variable Interest Entities.