Capital One 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

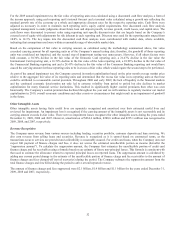

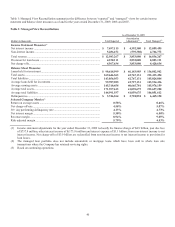

42

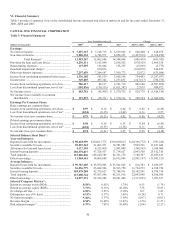

As of December 31, 2007

(Dollars in thousands)

Total Reported Securitization

Adjustments(1)

Total Managed(2)

Income Statement Measures(3)

N

et interest income .................................................................................

.

$ 6,529,845 $ 4,489,905 $ 11,019,750

N

on-interest income ................................................................................

.

8,054,223 (2,288,455) 5,765,768

Total revenue ..........................................................................................

.

$ 14,584,068 $ 2,201,450 $ 16,785,518

Provision for loan losses .........................................................................

.

2,636,502 2,201,450 4,837,952

N

et charge-offs .......................................................................................

.

1,960,545 2,201,450 4,161,995

Balance Sheet Measures

Loans held for investment .......................................................................

.

$ 101,805,027 $ 49,557,390 $ 151,362,417

Total assets ..............................................................................................

.

150,590,369 48,706,677 199,297,046

Total liabilities ........................................................................................

.

126,296,257 48,706,677 175,002,934

Average loans held for investment ..........................................................

.

93,836,760 51,185,182 145,021,942

Average earning assets ............................................................................

.

124,426,473 49,075,710 173,502,183

Average total assets ................................................................................

.

148,983,192 50,410,103 199,393,295

Average total liabilities ...........................................................................

.

123,780,056 50,411,179 174,191,235

Delinquencies ..........................................................................................

.

$ 3,721,444 $ 2,142,353 $ 5,863,797

Selected Company Metrics(3)

Return on average assets .........................................................................

.

1.79% 1.33%

N

et charge-off rate ..................................................................................

.

2.10% 2.88%

30+ day performing delinquency rate .....................................................

.

3.66% 3.87%

N

et interest margin ..................................................................................

.

5.38% 6.46%

Revenue margin ......................................................................................

.

12.01% 9.85%

Risk adjusted margin...............................................................................

.

10.40% 7.40%

(1) Income statement adjustments for the year ended December 31, 2007 reclassify the finance charge of $6.3 billion, past due fees

of $1.0 billion, other interest income of $(167.3) million and interest expense of $2.7 billion; from non –interest income to net

interest income. Net charge-offs of $2.2 billion are reclassified from non-interest income to net interest income to provision for

loan losses.

(2) The managed loan portfolio does not include automobile or mortgage loans which have been sold in whole loan sale

transactions where the Company has retained servicing rights.

(3) Based on continuing operations.