Capital One 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

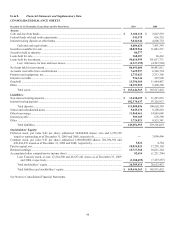

102

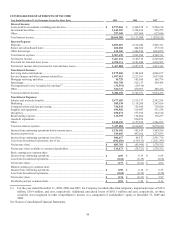

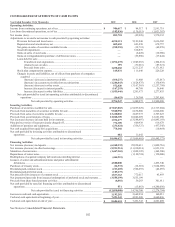

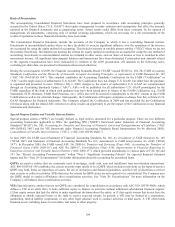

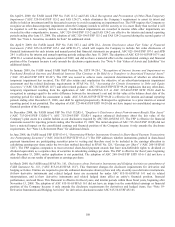

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31 (In Thousands)

2009 2008

2007

Operating Activities:

Income from continuing operations, net of tax ................................................................... $ 986,617 $ 84,517 $ 2,591,719

Loss from discontinued operations, net of tax .................................................................... (102,836) (130,515) (1,021,387)

N

et income (loss) ................................................................................................................ 883,781 (45,998) 1,570,332

Adjustments to reconcile net income to cash provided by operating activities:

Provision for loan and lease losses ........................................................................... 4,230,111 5,101,040 2,636,502

Depreciation and amortization, net .......................................................................... 682,603 691,430 678,757

Net gains on sales of securities available for sale .................................................... (218,355) (12,791) (69,976)

Goodwill impairment ............................................................................................... — 810,876 —

Gains on sales of auto loans ..................................................................................... — (2,428) (10,960)

Gains on extinguishment/repurchase of debt/senior notes ....................................... — (53,860) (17,444)

Loans held for sale: ..................................................................................................

Transfers in and originations ......................................................................... (1,194,239) (1,949,263) (404,831)

(Gains) losses on sales ................................................................................... 399 (31,016) (87,521)

Proceeds from sales ....................................................................................... 1,228,468 2,211,225 6,171,912

Stock plan compensation expense ............................................................................ 145,831 111,646 229,228

Changes in assets and liabilities, net of effects from purchase of companies

acquired: .............................................................................................................

(Increase) decrease in interest receivable ...................................................... (108,237) 11,408 (35,017)

(Increase) in accounts receivable from securitizations .................................. (1,286,843) (1,624,875) (130,439)

(Increase) decrease in other assets ................................................................. 572,820 (3,107,565) (2,257,798)

Increase (decrease) in interest payable .......................................................... (167,293) 44,789 56,846

Increase (decrease) in other liabilities ........................................................... (1,955,446) 1,201,973 1,277,833

Net cash provided by (used in) operating activities attributable to discontinued

operations ........................................................................................................... (16,653) 126,384 3,293,456

Net cash provided by operating activities ........................................... 2,796,947 3,482,975 12,900,880

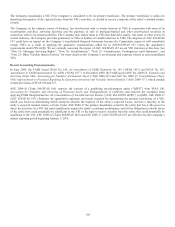

Investing Activities:

Purchases of securities available for sale ............................................................................ (27,827,065) (21,697,629) (12,717,204)

Proceeds from maturities of securities available for sale .................................................... 9,540,958 6,676,800 6,026,680

Proceeds from sales of securities available for sale ............................................................ 13,410,010 2,627,973 2,307,825

Proceeds from securitizations of loans ............................................................................... 12,068,309 10,046,699 12,641,050

N

et (increase) decrease in loans held for investment .......................................................... 1,932,677 (13,588,497) (18,895,193)

Principal recoveries of loans previously charged off .......................................................... 774,389 669,938 619,678

Additions of premises and equipment ................................................................................. (231,624) (356,327) (437,545)

N

et cash acquired from (paid for) acquisitions ................................................................... 778,166 — (10,464)

N

et cash provided by investing activities attributable to discontinued

operations ...................................................................................................................... 602 11,642 —

Net cash provided by (used in) investing activities ............................. 10,446,422 (15,609,401) (10,465,173)

Financing Activities:

N

et increase (decrease) in deposits ..................................................................................... (6,368,332) 25,859,613 (3,009,716)

N

et increase (decrease) in other borrowings ....................................................................... (5,911,914) (11,930,014) 6,853,338

Maturities of senior notes ................................................................................................... (1,447,365) (1,802,395) (462,500)

Repurchases of senior notes ................................................................................................ — (1,120,724) (150,000)

Redemptions of acquired company debt and noncontrolling interest ................................. (464,915) — —

Issuance of senior and subordinated notes and junior subordinated

debentures ..................................................................................................................... 4,500,000 — 1,495,740

Purchases of treasury stock ................................................................................................. (14,572) (12,501) (3,024,969)

Dividends paid-common stock ........................................................................................... (213,669) (568,255) (42,055)

Dividends paid-preferred stock ........................................................................................... (105,175) — —

N

et proceeds from issuances of common stoc

k

.................................................................. 1,537,363 772,017 43,493

N

et (payments)/proceeds from issuance/(redemption) of preferred stock and warrants ..... (3,555,199) 3,555,199 —

Proceeds from share based payment activities .................................................................... (6,881) 59,283 301,911

N

et cash provided by (used in) financing activities attributable to discontinued

operations ...................................................................................................................... 571 (15,863) (4,280,036)

Net cash provided by (used in) financing activities ............................ (12,050,088) 14,796,360 (2,274,794)

Increase in cash and cash equivalents ................................................................................. 1,193,281 2,669,934 160,913

Cash and cash equivalents at beginning of year .................................................................. 7,491,343 4,821,409 4,660,496

Cash and cash equivalents at end of year ............................................................................ $ 8,684,624 $ 7,491,343 $ 4,821,409

See Notes to Consolidated Financial Statements.