Capital One 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 68

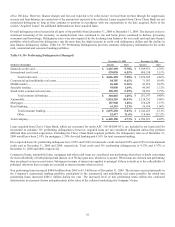

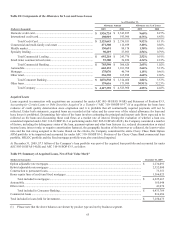

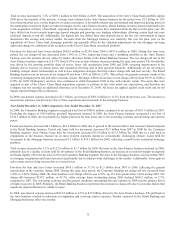

At December 31, 2009, the reserve was $210 million, compared to $122 million at December 31, 2008. The $88 million change in the

reserve from December 31, 2008 was the result of $74 million in repurchase claims settlements in the year that were applied against

the reserve and an expense of $162 million resulting primarily from an increase in the amount of open repurchase requests and an

increase in the estimated success rate of claimants pursuing repurchase requests. Due to the uncertainties discussed above, the

Company cannot reasonably estimate the total amount of losses that will actually be incurred as a result of GreenPoint’s repurchase

and indemnification obligations, and there can be no assurance that the Company’s current reserves will be adequate or that the total

amount of losses incurred will not have a material adverse effect upon the Company’s financial condition or results of operations. See

“Management’s Discussion and Analysis of Financial Results of Operations – Valuation of Representation and Warranty Reserve” for

further details.

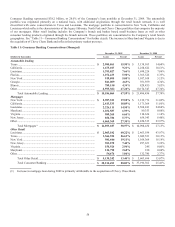

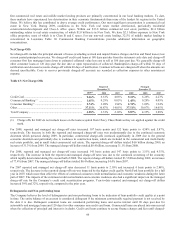

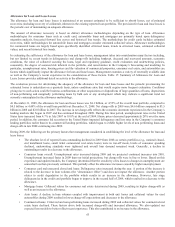

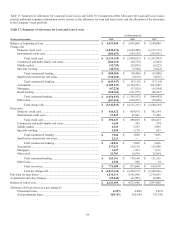

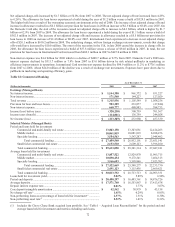

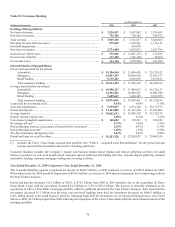

VII. Reportable Segment Summary for Continuing Operations

During the third quarter of 2009, the Company realigned its business segment reporting structure to better reflect the manner in which

the performance of the Company’s operations is evaluated. The Company now reports the results of its business through three

operating segments: Credit Card, Commercial Banking and Consumer Banking.

Segment results where presented have been recast for all periods presented. The three segments consist of the following:

• Credit Card includes the Company’s domestic consumer and small business card lending, domestic national small

business lending, national closed end installment lending and the international card lending businesses in Canada and the

United Kingdom.

• Commercial Banking includes the Company’s lending, deposit gathering and treasury management services to

commercial real estate and middle market customers. The Commercial segment also includes the financial results of a

national portfolio of small ticket commercial real estate loans that are in run-off mode.

• Consumer Banking includes the Company’s branch based lending and deposit gathering activities for small business

customers as well as its branch based consumer deposit gathering and lending activities, national deposit gathering,

consumer mortgage lending and servicing activities and national automobile lending.

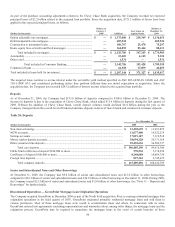

The segment reorganization includes the allocation of Chevy Chase Bank to the appropriate segments. Chevy Chase Bank’s operations

are included in the Commercial Banking and Consumer Banking segments beginning in the second quarter 2009. Chevy Chase Bank’s

operations for the first quarter of 2009 remain in the Other category due to the timing of acquisition. The Other category includes

GreenPoint originated consumer mortgages originated for sale but held for investment since originations were suspended in 2007, the

results of corporate treasury activities, including asset-liability management and the investment portfolio, the net impact of transfer

pricing, brokered deposits, certain unallocated expenses, gains/losses related to the securitization of assets, and restructuring charges

related to the Company’s cost initiative and Chevy Chase Bank acquisition.

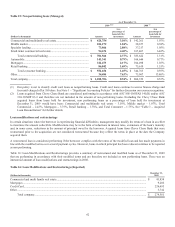

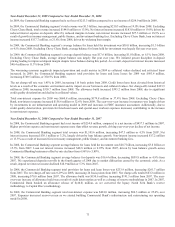

We maintain our books and records on a legal entity basis for the preparation of financial statements in conformity with U.S. GAAP.

The following table presents information prepared from our internal management information system, which includes securitized

loans in our managed loan portfolio, and is maintained on a line of business level through allocations from legal entities.