Capital One 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

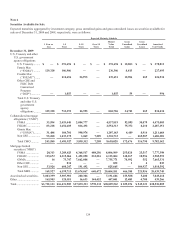

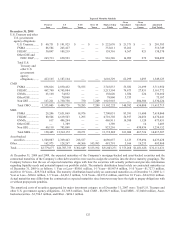

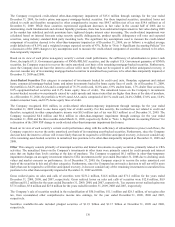

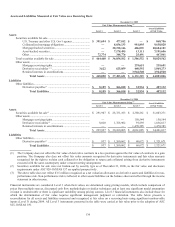

Expected Maturity Schedule

1 Year or

Less

1–5

Years

5–10

Years Over 10

Years Market Value

Totals

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Amortized

Cost Totals

December 31, 2008

U.S. Treasury and other

U.S. government

agency obligations

U.S. Treasury ........ $ 40,751 $ 181,925 $ — $ — $ 222,676 $ 21,371 $ — $ 201,305

FNMA .................. 86,584 245,427 — — 332,011 15,262 — 316,749

FHLMC ................ 30,097 109,219 — — 139,316 9,567 821 130,570

Other GSE and

FDIC DGP ....... 265,733 650,593 — — 916,326 16,099 272 900,499

Total U.S.

Treasury and

other U.S.

government

agency

obligations ....... 423,165 1,187,164 — — 1,610,329 62,299 1,093 1,549,123

CMO

FNMA .................. 836,826 2,830,452 78,555 — 3,745,833 55,582 21,699 3,711,950

FHLMC ................ 467,790 4,745,804 — — 5,213,594 79,673 27,851 5,161,772

GNMA .................. 63,168 74,852 — — 138,020 1,584 224 136,660

Other GSE ............ — 78,860 — — 78,860 3,753 — 75,107

Non GSE .............. 167,221 1,750,758 730 7,209 1,925,918 — 604,306 2,530,224

Total CMO ........... 1,535,005 9,480,726 79,285 7,209 11,102,225 140,592 654,080 11,615,713

MBS

FNMA .................. 29,206 7,651,869 18,976 — 7,700,051 93,591 11,600 7,618,060

FHLMC ................ 80,504 4,619,503 1,295 — 4,701,302 54,917 24,056 4,670,441

GNMA .................. 617 486,294 — — 486,911 14,580 1,120 473,451

Other GSE ............ — 1,389 — — 1,389 — 14 1,403

Non GSE .............. 40,118 783,098 — — 823,216 — 430,936 1,254,152

Total MBS ............ 150,445 13,542,153 20,271 — 13,712,869 163,088 467,726 14,017,507

Asset-backed

securities ................... 1,508,087 2,369,443 218,527 — 4,096,057 2,123 339,494 4,433,428

Other .............................. 162,975 128,267 44,566 145,983 481,791 5,166 19,235 495,860

Total ............................... $3,779,677 $26,707,753 $ 362,649 $ 153,192 $31,003,271 $ 373,268 $1,481,628 $ 32,111,631

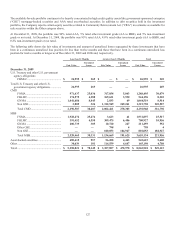

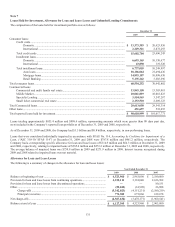

At December 31, 2009 and 2008, the expected maturities of the Company’s mortgage-backed and asset-backed securities and the

contractual maturities of the Company’s other debt securities were used to assign the securities into the above maturity groupings. The

Company believes that the use of expected maturities aligns with how the securities will actually perform and provides information

regarding liquidity needs and potential impacts on portfolio yields. The maturity distribution based solely on contractual maturities as

of December 31, 2009 is as follows: 1 Year or Less—$380.1 million, 1-5 Years—$6,967.4 million, 5-10 Years—$1,727.3 million,

and Over 10 Years—$29,754.8 million. The maturity distribution based solely on contractual maturities as of December 31, 2008 is: 1

Year or Less—$268.6 million, 1-5 Years—$4,263.5 million, 5-10 Years—$2,233.2 million, and Over 10 Years—$24,238.0 million.

Actual maturities may differ from the contractual or expected maturities since borrowers may have the right to prepay obligations with

or without prepayment penalties.

The amortized costs of securities aggregated by major investment category as of December 31, 2007 were: Total U.S. Treasury and

other U.S. government agency obligations - $1,369.8 million, Total CMO - $8,856.9 million, Total MBS - $7,040.0 million, Asset-

backed securities - $1,796.5 million, and Other - $696.1 million.