Capital One 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 67

representations and warranties. In the event of a repurchase, GreenPoint is typically required to pay the then unpaid principal balance

of the loan together with interest and certain expenses (including, in certain cases, legal costs incurred by the purchaser and/or others),

and GreenPoint recovers the underlying collateral. GreenPoint is exposed to any losses on the repurchased loans after giving effect to

recoveries on the collateral. GreenPoint may also be required to indemnify certain purchasers and others against losses they incur in

the event of breaches of representations and warranties and in various other circumstances, and the amount of such losses could

exceed the repurchase amount of the related loans.

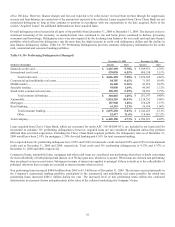

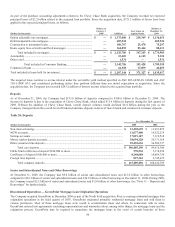

Most of the recent repurchase and indemnification requests received by GreenPoint and the lawsuit against it (see below) relate to

mortgage loans sold between 2005 and 2007. During this period, GreenPoint sold an aggregate of approximately $97.8 billion original

principal balance of mortgage loans, some of which have been repaid, but a significant amount of which remains outstanding. CONA

guaranteed certain of GreenPoint’s obligations with respect to certain mortgage loans sold beginning in December 2006 having an

original principal balance of approximately $3.9 billion.

At December 31, 2009, GreenPoint had open repurchase requests relating to approximately $943 million original principal balance of

mortgage loans (up from $639 million at December 31, 2008). The Company considers open requests to be requests with respect to

specific mortgage loans received within the past 24 months that are in the process of being paid, are under review or have been denied

by GreenPoint but not rescinded by the party requesting repurchase. Most of the open requests fall in this last category. In addition to

the foregoing open repurchase requests, GreenPoint is also a defendant in a lawsuit seeking, among other things, to require it to

repurchase an entire portfolio of approximately 30,000 mortgage loans within a certain securitization trust based on alleged breaches

of representations and warranties relating to a limited sampling of loans in the portfolio. See “Note 21—Commitments Contingencies

and Guarantees” for a discussion of the U.S. Bank litigation. GreenPoint has also received requests for indemnification in connection

with a number of lawsuits in which GreenPoint is not a party, including both representation and warranty litigation and securities class

actions brought on behalf of investors in securitization trusts that in the aggregate hold a significant principal balance of mortgage

loans for which GreenPoint was identified as the originator. The Company believes that a significant number of mortgage loans at

issue in the litigations referred to above as well as a significant number of mortgage loans sold by GreenPoint as to which no

repurchase or indemnification requests have been received are currently delinquent or already foreclosed on.

The Company has established a reserve in its consolidated financial statements for potential losses that are considered to be both

probable and reasonably estimable related to the mortgage loans sold by GreenPoint. The adequacy of the reserve is evaluated on a

quarterly basis and changes in the reserve are reported in discontinued operations. Factors considered in the evaluation process include

the amount of open repurchase requests, including any repurchase requests for specifically identified loans subject to representation

and warranty litigation against GreenPoint or against others demanding indemnification, the estimated amount of additional

repurchase requests to be received over the next 12 months (beyond which the Company does not believe that a reasonable assessment

can be made) based on the historical relationship between mortgage loan performance and repurchase requests and the estimated level

of future mortgage loan performance, the estimated success rate of claimants in pursuing requests, and the estimated recoveries by

GreenPoint on the underlying collateral. The Company expects that over the next 12 months both the delinquency rates on

GreenPoint-originated mortgage loans and the severity of losses on collateral recoveries will continue to be high. The reserve does not

include amounts for the portfolio-wide repurchase claim relating to 30,000 loans with an aggregate original principal balance of $1.8

billion at issue in the U.S. Bank litigation (see “Note 21—Commitments Contingencies and Guarantees” for a discussion of the U.S.

Bank litigation) or for the indemnification requests with respect to securities class actions, in each case as referred to above because

neither is sufficiently probable and estimable. As noted, the reserve does include amounts for repurchase requests for specifically

identified loans(other than the portfolio-wide repurchase claim) at issue in the U.S. Bank litigation and for repurchase requests for

specifically identified loans at issue in other representation and warranty litigation for which GreenPoint indemnification is sought.

The adequacy of the reserve and the ultimate amount of losses incurred will depend on, among other things, the actual future mortgage

loan performance, the actual level of future repurchase and indemnification requests, the actual success rates of claimants,

developments in litigation against GreenPoint and others, GreenPoint’s actual recoveries on the collateral, and macroeconomic

conditions (including unemployment levels and housing prices).