Capital One 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

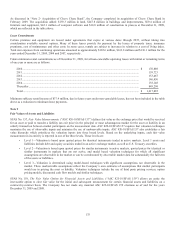

136

(3) An end of quarter convention is used to reflect activity in retained interests in securitizations, resulting in all transactions and

assumption changes being reflected as if they occurred on the last day of the quarter. Gains (losses) related to Level 3 retained

interests in securitizations are reported in servicing and securitizations income, which is a component of non-interest income.

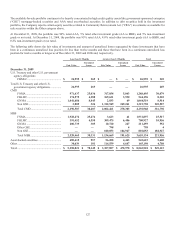

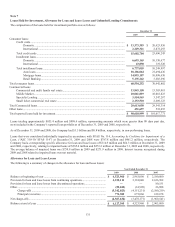

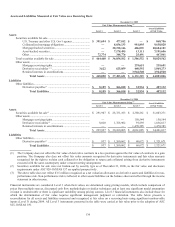

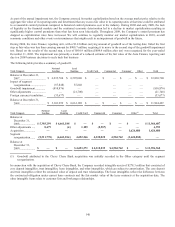

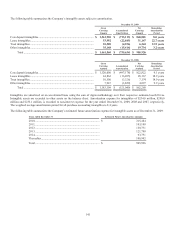

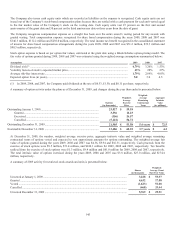

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The Company is also required to measure and recognize certain other financial assets at fair value on a nonrecurring basis in the

consolidated balance sheet. For assets measured at fair value on a nonrecurring basis and still held on the consolidated balance sheet at

December 31, 2009 and 2008, the following table provides the fair value measures by level of valuation assumptions used and the

amount of fair value adjustments recorded in earnings for those assets. Fair value adjustments for loans held for sale, foreclosed assets,

and other assets are recorded in other non-interest expense, and fair value adjustments for loans held for investment are recorded in

provision for loan and lease losses in the consolidated statement of income.

December 31, 2009

Fair Value Measurements Using Assets at

Fair Value Total

Losses

Level 1 Level 2 Level 3

Assets

Loans held for sale ..................................................................

.

$ — $ 266,240 $ — $ 266,240 $ 15,433

Loans held for investment .......................................................

.

— 39,367 231,375 270,742 114,869

Foreclosed assets(1) ..................................................................

.

— 197,386 — 197,386 26,211

Other ........................................................................................

.

— 31,310 — 31,310 (3,866)

Total .............................................................................

.

$ — $ 534,303 $ 231,375 $ 765,678 $ 152,647

December 31, 2008

Fair Value Measurements Using Assets at

Fair Value Total

Losses

Level 1 Level 2 Level 3

Assets

Loans held for sale ..................................................................... $ — $ 68,462 $ — $ 68, 462 $ 14,386

Loans held for investment .......................................................... — 64,737 142,768 207,505 62,747

Total ................................................................................ $ — $ 133,199 $ 142,768 $ 275,967 $ 77,133

(1) Represents the fair value and related losses of foreclosed properties that were written down subsequent to their initial

classification as foreclosed properties.

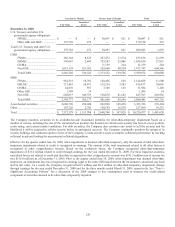

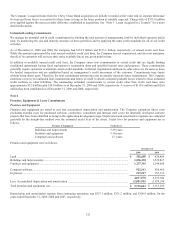

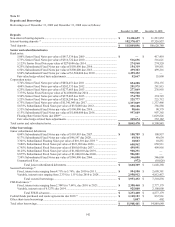

Fair Value of Financial Instruments

The following reflects the fair value of financial instruments whether or not recognized on the consolidated balance sheet at fair value.

December 31, 2009 December 31, 2008

Carrying

Amount Estimated

Fair Value Carrying

Amount

Estimated

Fair Value

Financial Assets

Cash and cash equivalents .......................................................... $ 8,684,624 $ 8,684,624 $ 7,491,343 $ 7,491,343

Securities available for sale ........................................................ 38,829,562 38,829,562 31,003,271 31,003,271

Securities held to maturity .......................................................... 80,577 80,577 — —

Loans held for sale ...................................................................... 268,307 268,307 68,462 68,462

N

et loans held for investmen

t

..................................................... 86,491,604 86,158,212 96,493,811 86,370,194

Interest receivable ....................................................................... 936,146 936,146 827,909 827,909

Accounts receivable from securitization ..................................... 7,629,597 7,629,597 6,342,754 6,342,754

Derivatives .................................................................................. 1,069,273 1,069,273 1,836,817 1,836,817

Mortgage servicing rights ........................................................... 239,651 239,651 150,544 150,544

Financial Liabilities

N

on-interest bearing deposits...................................................... $ 13,438,659 $ 13,438,659 $ 11,293,852 $ 11,293,852

Interest-bearing deposits ............................................................. 102,370,437 102,616,339 97,326,937 98,031,913

Senior and subordinated notes .................................................... 9,045,470 9,156,030 8,308,843 6,922,300

Other borrowings ........................................................................ 11,968,461 11,723,046 14,869,648 12,948,145

Interest payable ........................................................................... 509,105 509,105 676,398 676,398

Derivatives .................................................................................. 407,132 407,132 1,321,671 1,321,671