Capital One 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

167

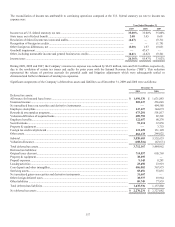

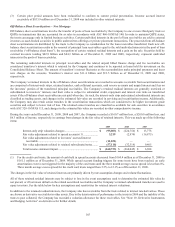

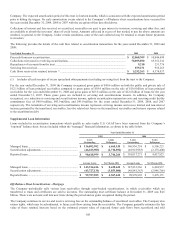

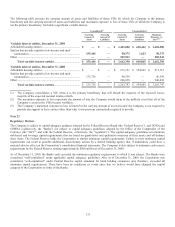

Key Assumptions and Sensitivities for Retained Interest Valuations

As of December 31

2009 2008(1)

Interest-only strip Retained Interests Interest-only

strip

Retained Interests

Interest-only strip/ Retained Interests ...................... $ 22,038 $ 3,696,942 $ 140,993 $ 1,329,392

Weighted average life for receivables (months) ...... 7 7 8 8

Principal repayment rate (weighted average rate) .... 16% 16% 16% 16%

Impact on fair value of 10% adverse change ........... $ 743 $ (5,335) $ (7,939) $ (28,014)

Impact on fair value of 20% adverse change ........... $ 1,516 $ (8,316) $ (12,917) $ (29,784)

Charge-off rate (weighted average rate) .................. 10% 10% 7% 7%

Impact on fair value of 10% adverse change ........... $ (9,403) $ (5,597) $ (77,577) $ (8,043)

Impact on fair value of 20% adverse change ........... $ (10,673) $ (11,777) $ (112,089) $ (16,086)

Discount rate (weighted average rate) ...................... 12% 8% 18% 15%

Impact on fair value of 10% adverse change ........... $ (1,179) $ (11,416) $ (668) $ (15,829)

Impact on fair value of 20% adverse change ........... $ (2,330) $ (23,019) $ (1,327) $ (31,564)

(1) Certain prior period amounts have been reclassified to conform to current period presentation.

Static pool credit losses are calculated by summing the actual and projected future credit losses and dividing them by the original

balance of each pool of assets. Due to the short-term revolving nature of the loan receivables, the weighted average percentage of

static pool credit losses is not considered materially different from the assumed charge-off rates used to determine the fair value of the

retained interests.

The Company acts as a servicing agent and receives contractual servicing fees of between 0.5% and 4% of the investor principal

outstanding, based upon the type of assets serviced. The Company generally does not record material servicing assets or liabilities for

these rights since the contractual servicing fee approximates market rates.

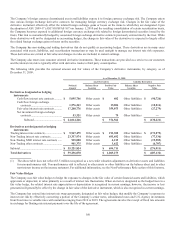

Cash Flows Related to the Off-Balance Sheet Securitizations

The Company receives proceeds from the trusts for off-balance sheet loans that are transferred and sold to external investors. The

sources of funds available to pay principal and interest on the asset-backed securities sold to investors include collections of both

principal receivables and finance charge and fee receivables, credit enhancements such as subordination, spread accounts or reserve

accounts and derivative agreements, including interest rate and currency swaps.

Collections of principal are generally returned to the Company as these collections are reinvested in the purchase of new principal loan

receivables (“revolving securitization”). However, the Company is required to remit principal collections to the trust when the

securitization transaction is scheduled to mature or earlier if an early amortization event has occurred. Securitization transactions may

amortize earlier than scheduled due to certain early amortization triggers, which could require the Company to fund spread accounts,

and reduce the value of its retained residual interests. In this event, the Company would also be funding spread accounts related to the

trust. In addition, the Company loses the securitization as a funding source as the securities are repaid ahead of their original schedule

and likely loses the ability to securitize similar receivables in the future at desirable rates. Additionally, early amortization of

securitization structures would require the Company to record higher allowance for loan losses and would also have a significant

impact on the ability of the Company to meet regulatory capital adequacy requirements. See “Note 1- Significant Accounting

Policies” and “Note 23-Regulatory Matters” for additional information regarding capital adequacy requirements.

The Company is currently involved in two amortizing installment loan securitization programs. One of these installment loan trusts

breached an additional amortization trigger within the first quarter of 2009, due to the performance of the loans within the trust. The

Company began securitizing unsecured installment loans beginning in 1997 and a final addition into the trust occurred in early 2007.

The trust has outstanding securities issued to external investors totaling $172.3 million and $441.9 million as of December 31, 2009

and 2008, respectively. The impact of breaching the amortization trigger resulted in the trust moving from a pro rata amortization to a

sequential amortization, which means that the Company is no longer receiving pro rata cash allocations on the retained subordinated

tranches that it holds. The Company has no requirements to provide the trust with additional funding or to transfer additional

receivables. As of December 31, 2009, the Company has funded $20.3 million in a cash reserve account and holds a retained

subordinated note with a face amount of $12.0 million, which together represent our maximum exposure to loss. The cash reserve

account is carried at a fair value of $17.9 million as of December 31, 2009 with fair value adjustments to date of $2.4 million recorded

in earnings. The retained subordinated note is carried at a fair value of $10.5 million as of December 31, 2009 with fair value

adjustments of $1.5 million recorded in other comprehensive income. The change in amortization will not significantly impact the