Capital One 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

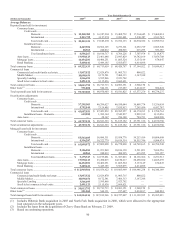

As of December 31, 2009, the Company’s Asset/Liability Management Policy limited the change in projected 12-month earnings due

to a gradual +/-200 basis points change in interest rates over the course of nine months to less than 5% of base net interest income. The

measurement of impact to current earnings includes the change in net interest income and the change in the valuation of mortgage

servicing rights driven by the change in interest rates. Given the absolute low level of interest rates that prevailed as of December 31,

2009 and the inability for market rates to fall below 0%, the declining rate scenario reflects a gradual 50 basis point rate decline versus

the customary 200 basis point scenario. As of December 31, 2009, the Company estimated a 0.4% reduction in 12-month net interest

income for a gradual 200 basis point rate increase and a 0.1% reduction in 12-month net interest income for a gradual 50 basis point

rate decline.

In addition to limits related to possible changes in 12-month net interest income, as of December 31, 2009, the Asset/Liability

Management Policy limited the pre-tax change in economic value of equity due to instantaneous parallel rate shocks of 200 basis

points to less than 12%. As of December 31, 2009, the estimated reduction in economic value of equity due to an adverse 200 basis

point rate shock was 3.2%.

Table 30 reflects the interest rate repricing schedule for earning assets and interest-bearing liabilities as of December 31, 2009.

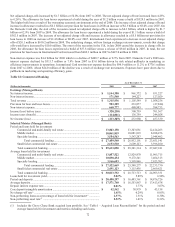

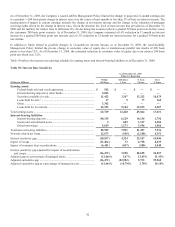

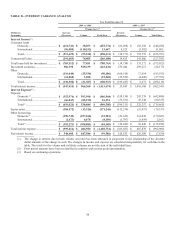

Table 30: Interest Rate Sensitivity

As of December 31, 2009

Subject to Repricing

(Dollars in Millions)

Within

180 Days >180 Days-

1 Year

>1 Year-

5 Years Over

5 Years

Earning assets:

Federal funds sold and resale agreement ........................................... $ 542 $ — $ — $ —

Interest-bearing deposits at other banks ............................................ 5,043 — — —

Securities available for sale ............................................................... 11,432 3,307 13,212 10,879

Loans held for sale(1) ......................................................................... 17 9 77 165

Other ................................................................................................. 3,302 — — —

Loans held for investment ................................................................. 42,393 9,104 32,535 6,587

Total earning assets .................................................................................... 62,729 12,420 45,824 17,631

Interest-bearing liabilities:

Interest-bearing deposits ................................................................... 80,315 6,129 14,134 1,792

Senior and subordinated notes........................................................... 5 689 3,767 4,584

Other borrowings .............................................................................. 5,639 1,173 3,596 1,560

Total interest-bearing liabilities .................................................................. 85,959 7,991 21,497 7,936

N

on-rate related net items ........................................................................... 12,673 (105 ) (2,180) 4,351

Interest sensitivity gap ................................................................................ (10,557 ) 4,324 22,147 14,046

Impact of swaps .......................................................................................... (11,464 ) 73 6,758 4,633

Impact of consumer loan securitizations ..................................................... (4,451 ) (847 ) (250) 5,548

Interest sensitivity gap adjusted for impact of securitizations

and swaps ............................................................................................... (26,472 ) 3,550 28,655 24,227

Adjusted gap as a percentage of managed assets ........................................ (12.46)% 1.67% 13.49% 11.41%

Adjusted cumulative gap ............................................................................ (26,472 ) (22,922 ) 5,733 29,960

Adjusted cumulative gap as a percentage of managed assets ..................... (12.46)% (10.79)% 2.70% 14.10%