Capital One 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 31

The evaluation process for determining the adequacy of the allowance for loan and lease losses and the periodic provisioning for

estimated losses is undertaken on a quarterly basis, unless conditions arise that would require more frequent evaluation. Conditions

giving rise to such action could be business combinations or other acquisitions or dispositions of large quantities of loans, dispositions

of non-performing and marginally performing loans by bulk sale or any development which may indicate a significant trend not

currently contemplated in the allowance methodology.

Commercial and small business loans are considered to be impaired in accordance with the provisions of SFAS No. 114, Accounting

by Creditors for Impairment of a Loan, (“ASC 310-10/SFAS 114”) when it is probable that all amounts due in accordance with the

contractual terms will not be collected. Specific allowances are determined in accordance with ASC 310-10/SFAS 114. Impairment is

measured based on the present value of the loan’s expected cash flows, the loan’s observable market price or the fair value of the

loan’s collateral.

For purposes of determining impairment, consumer loans are collectively evaluated as they are considered to be comprised of large

groups of smaller-balance homogeneous loans and therefore are not individually evaluated for impairment under the provisions of

ASC 310-10/SFAS 114.

Troubled debt restructurings (“TDR”) occur when the Company agrees to significantly modify the original terms of a loan due to the

deterioration in the financial condition of the borrower. During 2009, the Company modified $279.6 million of loans that meet the

requirements of a TDR. See “Table 16 – Loan Modifications and Restructurings” for additional details.

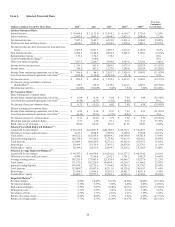

As of December 31, 2009 and 2008, the balance in the allowance for loan and lease losses was $4.1 billion and $4.5 billion,

respectively. The loans acquired from Chevy Chase Bank were initially recorded at fair value with no separate valuation allowance

recorded at the date of acquisition. Instead, the Company recorded net expected principal losses of approximately $2.2 billion as a

component of the fair value adjustment for which actual losses will be applied. As long as expected cash flows and credit losses are

consistent with the original net expected principal losses, an additional allowance will not be recorded and these assets will be

considered performing. See “Table 19—Summary of Acquired Loans” for further details.

Valuation of Goodwill and Other Intangible Assets

As of December 31, 2009 and 2008, goodwill of $13.6 billion and $12.0 billion and net intangibles of $905.9 million and $862.3

million, respectively, were included in the Consolidated Balance Sheet. In connection with the acquisition of Chevy Chase Bank, an

additional $1.6 billion of goodwill and $278.3 million of intangible assets were recorded. The goodwill related to Chevy Chase Bank

was initially recorded in “Other” and then assigned to Commercial and Consumer Banking segments along with the operations of

Chevy Chase Bank. See “Note 2 – Acquisition of Chevy Chase Bank” and “Note 10—Goodwill and Other Intangible Assets” for

further details.

Goodwill and other intangible assets, primarily core deposit intangibles, reflected on the Consolidated Balance Sheet arose from

acquisitions accounted for under the purchase method. At the date of acquisition, the Company recorded the assets acquired and

liabilities assumed at fair value. The excess of the cost of the acquired business over the fair value of the net assets acquired is

recorded on the balance sheet as goodwill. The cost includes the consideration paid and all direct costs associated with the acquisition.

Indirect costs relating to the acquisition were expensed when incurred.

Goodwill

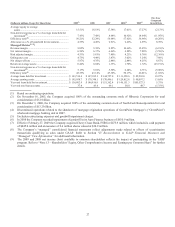

During the third quarter of 2009, the Company realigned its business segment reporting structure to better reflect the manner in which

the performance of the Company’s operations is evaluated. The Company now reports the results of its business through three

operating segments: Credit Card, Commercial Banking and Consumer Banking. As a result, goodwill was reassigned to the new

reporting units using a relative fair value allocation approach and an interim impairment test was performed at that time. All segment

data, including goodwill allocation was restated into new segment presentation for all periods presented. As part of the segment

reorganization, the goodwill associated with the Chevy Chase Bank acquisition was assigned to the Commercial Banking and

Consumer Banking segments. See “Note 10—Goodwill and Other Intangible Assets” for additional information regarding the

reallocation of goodwill.

In accordance with the requirements of SFAS No. 142, Goodwill and Other Intangible Assets, (“ASC 350-10/SFAS 142”), goodwill is

not amortized but is tested for impairment at the reporting unit level, which is at the operating segment level or one level below an

operating segment. Impairment is the condition that exists when the carrying amount of goodwill exceeds its implied fair value.

Goodwill is required to be tested for impairment annually and between annual tests if events or circumstances change, such as adverse

changes in the business climate, that would more likely than not reduce the fair value of the reporting unit below its carrying value.

Goodwill is assigned to one or more reporting units at the date of acquisition. The Company’s reporting units are Domestic Card,

International Card, Commercial Banking, Consumer Banking and Auto Finance, which is included in the consumer banking segment.

The goodwill impairment test, performed at October 1 of each year, is a two-step test. The first step identifies whether there is

potential impairment by comparing the fair value of a reporting unit to the carrying amount, including goodwill. If the fair value of a

reporting unit is less than its carrying amount, the second step of the impairment test is required to measure the amount of any

impairment loss.