Capital One 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

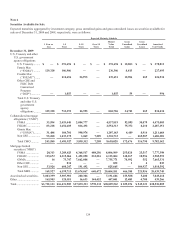

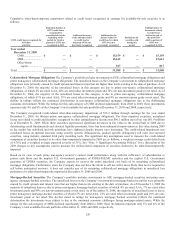

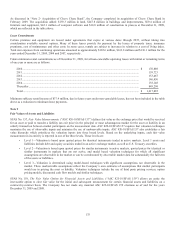

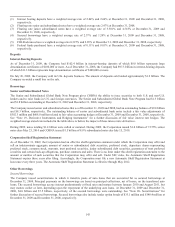

Assets and Liabilities Measured at Fair Value on a Recurring Basis

December 31, 2009

Fair Value Measurements Using (3)

Level 1 Level 2 Level 3

Assets/Liabilities

at Fair Value

Assets

Securities available for sale ...........................................................

U.S. Treasury and other U.S. Gov’t agency ......................... $ 391,694 $ 477,012 $ — $ 868,706

Collateralized mortgage obligations .................................... — 8,656,133 981,895 9,638,028

Mortgage-backed securities ................................................. — 20,198,146 486,035 20,684,181

Asset-backed securities ........................................................ — 7,178,495 13,111 7,191,606

Other .................................................................................... 72,774 348,776 25,491 447,041

Total securities available for sale .................................................. $ 464,468 $ 36,858,562 $ 1,506,532 $ 38,829,562

Other assets ...................................................................................

Mortgage servicing rights .................................................... — — 239,651 239,651

Derivative receivables(1) (3) ..................................................... 3,622 625,059 440,592 1,069,273

Retained interests in securitizations ..................................... — — 3,944,540 3,944,540

Total Assets ............................................................... $ 468,090 $ 37,483,621 $ 6,131,315 $ 44,083,026

Liabilities

Other liabilities ..............................................................................

Derivative payables(1) .......................................................... $ 8,189 $ 366,010 $ 32,934 $ 407,132

Total Liabilities ......................................................... $ 8,189 $ 366,010 $ 32,934 $ 407,132

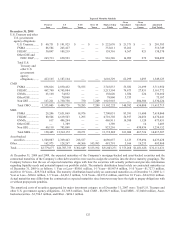

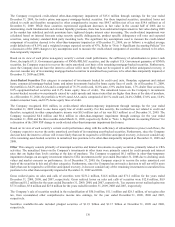

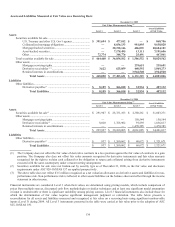

December 31, 2008

Fair Value Measurements Using (3) Assets/Liabilities

at Fair Value

Level 1 Level 2 Level 3

Assets

Securities available for sale(2) ........................................................ $ 291,907 $ 28,331,103 $ 2,380,261 $ 31,003,271

Other assets ...................................................................................

Mortgage servicing rights .................................................... — — 150,544 150,544

Derivative receivables(1) ...................................................... 8,020 1,768,902 59,895 1,836,817

Retained interests in securitizations ..................................... — — 1,470,385 1,470,385

Total Assets ............................................................... $ 299,927 $ 30,100,005 $ 4,061,085 $ 34,461,017

Liabilities

Other liabilities ..............................................................................

Derivative payables(1) .......................................................... $ 937 $ 1,260,062 $ 60,672 $ 1,321,671

Total Liabilities ......................................................... $ 937 $ 1,260,062 $ 60,672 $ 1,321,671

(1) The Company does not offset the fair value of derivative contracts in a loss position against the fair value of contracts in a gain

position. The Company also does not offset fair value amounts recognized for derivative instruments and fair value amounts

recognized for the right to reclaim cash collateral or the obligation to return cash collateral arising from derivative instruments

executed with the same counterparty under a master netting arrangement.

(2) Securities available for sale were not broken-out by security type as of December 31, 2008, as the fair value and disclosure

requirements under ASC 820-10/SFAS 157 are applied prospectively.

(3) The above table does not reflect $3.5 million recognized as a net valuation allowance on derivative assets and liabilities for non-

performance risk. Non-performance risk is reflected in other assets/liabilities on the balance sheet and offset through the income

statement in other income.

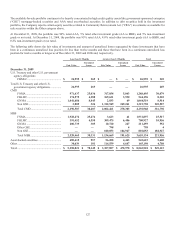

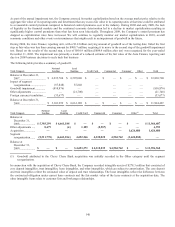

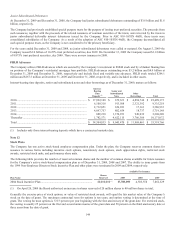

Financial instruments are considered Level 3 when their values are determined using pricing models, which include comparison of

prices from multiple sources, discounted cash flow methodologies or similar techniques and at least one significant model assumption

or input is unobservable or there is significant variability among pricing sources. Level 3 financial instruments also include those for

which the determination of fair value requires significant management judgment or estimation. The table below presents a

reconciliation for all assets and liabilities measured and recognized at fair value on a recurring basis using significant unobservable

inputs (Level 3) during 2009. All Level 3 instruments presented in the table were carried at fair value prior to the adoption of ASC

825-10/SFAS 159.