Capital One 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

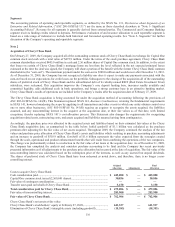

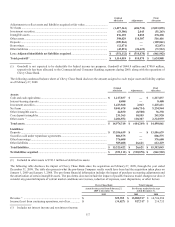

122

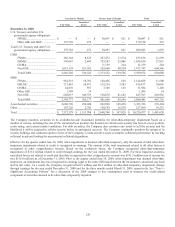

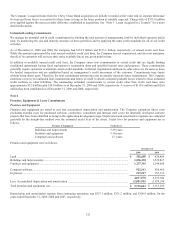

Year Ended December 31, 2007

Total Company

Credit

Card

Commercial

Banking

Consumer

Banking Other Total

Managed (1) Securitization

Adjustment(1)

Total

Reported

N

et interest income ....... $ 7,330,367 $ 931,227 $ 2,915,693 $ (157,537) $ 11,019,750 $ (4,489,905) $ 6,529,845

N

on-interest income ...... 4,758,466 127,029 924,872 (44,599) 5,765,768 2,288,455 8,054,223

Provision for loan and

lease losses ............... 3,635,567 (27,844) 1,116,143 114,086 4,837,952 (2,201,450) 2,636,502

Restructuring

expenses ................... — — — 138,237 138,237 — 138,237

Other non-interest

expenses ................... 4,801,636 384,733 2,567,794 185,610 7,939,773 — 7,939,773

Income tax provision

(benefit) .................... 1,254,899 244,028 54,699 (275,789) 1,277,837 — 1,277,837

N

et income (loss) from

continuing

operations net

of tax ........................ $ 2,396,731 $ 457,339 $ 101,929 $ (364,280) $ 2,591,719 $ — $ 2,591,719

Loans held for

investment ................ $ 81,380,091 $ 27,047,241 $ 42,349,296 $ 585,789 $151,362,417 $(49,557,390) $101,805,027

Total deposits ................ $ — $ 14,876,726 $ 57,692,006 $ 10,192,444 $ 82,761,176 $ — $ 82,761,176

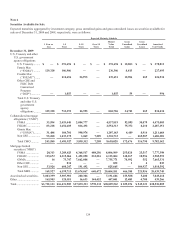

(1) Income statement adjustments for the year ended December 31, 2009 reclassify the finance charge of $4.9 billion, past due fees

of $0.8 billion, other interest income of $(0.2) billion and interest expense of $1.1 billion; from non –interest income to net

interest income. Net charge-offs of $3.9 billion are reclassified from non-interest income to provision for loan losses.

Income statement adjustments for the year ended December 31, 2008 reclassify the finance charge of $5.6 billion, past due fees

of $0.9 billion, other interest income of $(0.2) billion and interest expense of $2.1 billion; from non – interest income to net

interest income. Net charge-offs of $2.9 billion are reclassified from non-interest income to provision for loan losses.

Income statement adjustments for the year ended December 31, 2007 reclassify the finance charge of $6.3 billion, past due fees

of $1.0 billion, other interest income of $(0.2) billion and interest expense of $2.7 billion; from non –interest income to net

interest income. Net charge-offs of $2.2 billion are reclassified from non-interest income to provision for loan losses.

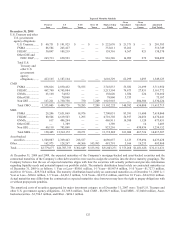

Significant Segment Adjustments That Affect Comparability

In 2009, the Company recorded an additional $80.5 million related to the Federal Deposit Insurance Corporation (“FDIC”) special

assessment. The amount was allocated to non-interest expense based on each segment’s share of FDIC insured deposits.

During 2009, the Company began a hedge program on brokered CDs, by entering into interest rate swap agreements, designated as

fair value hedges, converting a portion of the Company’s brokered CD liabilities from fixed rates to variable rates. As a result, the

Company recognized a reduction of $75.0 million in interest expense.

During 2009, the Company sold approximately $8.4B of FNMA, FHLMC, MBS, ABS and CMBS securities with generally shorter

expected maturities and purchased $8.3B billion of GNMA securities with generally longer expected maturities for overall asset

liability management purposes. In addition, GNMA securities also provide regulatory capital savings over FNMA and FHLMC

securities based on their risk weight of zero percent. As a result of these sales, gains of $218.4 million were recognized in non interest

income.

During 2008, the Company recognized a goodwill impairment charge of $810.9 million in the Consumer Banking segment.

During 2008, the Company repurchased approximately $1.0 billion of certain senior unsecured debt, recognizing a gain of $52.0

million in non-interest income and reported in the Other category. The Company initiated the repurchases to take advantage of the

current market environment and replaced the repurchased debt with lower-rate unsecured funding.

During 2007, the Company completed the sale of its interest in a relationship agreement to develop and market consumer credit

products in Spain and recorded a net gain related to this sale of $31.3 million consisting of a $41.6 million increase in non-interest

income partially offset by a $10.3 million increase in non-interest expense. This gain was recorded in the Credit Card segment.