Capital One 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

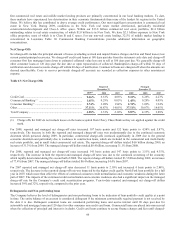

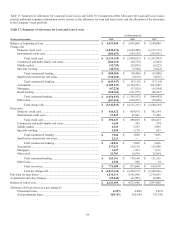

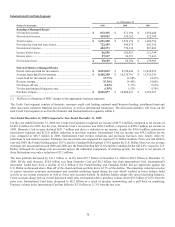

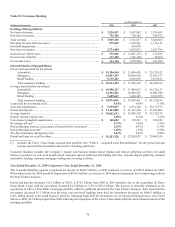

Table 21: Credit Card

As of December 31

(Dollars in thousands)

2009 2008

2007

Earnings (Managed Basis) (1)

N

et interest income .................................................................

.

$ 7,542,462 $ 7,463,480 $ 7,330,367

N

on-interest income ...............................................................

.

3,746,789 4,678,377 4,758,466

Total revenue ..........................................................................

.

$ 11,289,251 $ 12,141,857 $ 12,088,833

Provision for loan and lease losses .........................................

.

6,051,492 6,107,961 3,635,567

N

on-interest expense ..............................................................

.

3,738,230 4,392,968 4,801,636

Income before taxes................................................................

.

1,499,529 1,640,928 3,651,630

Income taxes ...........................................................................

.

521,909 573,908 1,254,899

N

et income .............................................................................

.

$ 977,620 $ 1,067,020 $ 2,396,731

Selected Metrics (Managed Basis) (1)

Period end loans held for investment .....................................

.

$ 68,523,662 $ 79,665,223 $ 81,380,091

Average loans held for investment .........................................

.

$ 73,075,519 $ 79,208,971 $ 78,085,153

Loans held for investment yield .............................................

.

12.90% 13.20% 14.14%

Revenue margin ......................................................................

.

15.45% 15.33% 15.51%

N

et charge-off rate .................................................................

.

9.15% 6.26% 4.23%

30+day performing delinquency rate ......................................

.

5.88% 4.86% 4.35%

Purchase Volume ....................................................................

.

$ 102,068,116 $ 113,835,373 $ 115,180,779

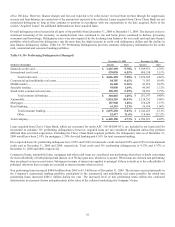

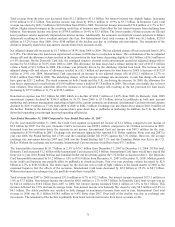

Domestic Card sub-segment

As of December 31,

(Dollars in thousands)

2009 2008

2007

Earnings (Managed Basis) (1)

N

et interest income .................................................................

.

$ 6,670,127 $ 6,492,086 $ 6,271,919

N

on-interest income ...............................................................

.

3,327,836 4,127,615 4,136,158

Total revenue ..........................................................................

.

$ 9,997,963 $ 10,619,701 $ 10,408,077

Provision for loan and lease losses .........................................

.

5,329,033 5,460,986 3,033,217

N

on-interest expense ..............................................................

.

3,255,957 3,622,838 3,934,574

Income before taxes ...............................................................

.

1,412,973 1,535,877 3,440,286

Income taxes ...........................................................................

.

494,542 537,557 1,183,458

N

et income (loss) ...................................................................

.

$ 918,431 $ 998,320 $ 2,256,828

Selected Metrics (Managed Basis)

Period end loans held for investment .....................................

.

$ 60,299,827 $ 70,944,581 $ 69,723,169

Average loans held for investment .........................................

.

$ 64,670,269 $ 68,638,180 $ 66,774,914

Loans held for investment yield .............................................

.

12.80% 13.09% 14.09%

Revenue margin ......................................................................

.

15.46% 15.47% 15.59%

N

et charge-off rate .................................................................

.

9.19% 6.33% 4.00%

30+day performing delinquency rate ......................................

.

5.78% 4.78% 4.28%

Purchase Volume ....................................................................

.

$ 93,566,239 $ 103,035,146 $ 105,875,472