Capital One 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Capital Markets Funding The Company also meets its liquidity needs by accessing the capital markets for funding by issuing asset

backed securities and senior and subordinated debt. Access to the capital markets and the cost of borrowing are heavily influenced by

the Company’s credit ratings. Rating agencies base their ratings on numerous factors, including liquidity, capital adequacy, asset

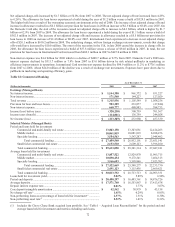

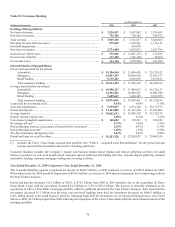

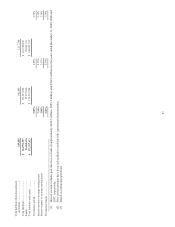

quality and quality of earnings. Significant changes in these factors could result in different ratings. Table 26: Senior Unsecured Debt

Credit Ratings provides a summary of the ratings for the senior unsecured debt of the Corporation, COBNA and CONA as of

December 31, 2009.

Table 26: Senior Unsecured Debt Credit Ratings

Capital One Financial

Corporation Capital One

Bank (USA), N.A.

Capital One, N.A.

Moody’s (1) .......................................................................................................... Baa1 A2 A2

S&P (1) ................................................................................................................. BBB BBB+ BBB+

Fitch, Inc(1) ......................................................................................................... A- A- A-

Dominion Bond Rating Service(1) ...................................................................... BBB*** A* A*

(1) As of the date of this report, Moody’s, S&P, Fitch, Inc and Dominion Bond Rating Service have the Company on a negative

outlook.

* low *** high

Loan Securitizations The Company engages in securitization transactions of loans for funding purposes. The Company receives the

proceeds from third party investors for securities issued from the Company’s securitization vehicles, which are collateralized by

receivables transferred from the Company’s portfolio. The Company removes the loans from the reported financial statements for

securitizations that qualify as sales in accordance with ASU 2009-16 (ASC 860/SFAS 166). Alternatively, when the transfer would

not be considered a sale but rather a financing, the assets will remain on the Company’s reported financial statements with an

offsetting liability recognized approximating the amount of proceeds received. The Company has committed securitization conduit

lines of $10.1 billion, of which $7.2 billion was outstanding as of December 31, 2009.

The Company can continue to obtain additional funding through the issuance or recognition of secured borrowings and the raising of

additional deposits to satisfy our liquidity needs as securitization does not depend on sales accounting treatment.

Senior and Subordinated Notes Other funding programs established by the Company include senior and subordinated notes,

including notes issued under COBNA’s Senior and Subordinated Global Bank Note Program (“The Program”). The Program gives

COBNA the ability to issue securities to both U.S. and non-U.S. lenders and to raise funds in the U.S. and foreign currencies, subject

to conditions customary for transactions of this nature. Notes may be issued under the Program with maturities of thirty days or more

from the date of issue. The Program was last updated in June 2005.

Federal Home Loan Bank Advances The Banks are members of the Federal Home Loan Banks (“FHLB”). The FHLB provides

additional sources of funding through advances to the Banks. The FHLB advances are secured by the Company’s securities,

residential mortgage loans portfolio, multifamily loans, commercial real estate loans and home equity lines of credit. The Company’s

FHLB membership is secured by the Company’s investment in FHLB stock, which totaled $264.1 million at December 31, 2009.

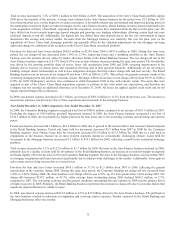

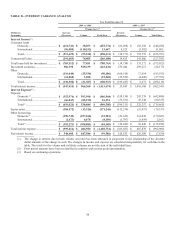

Short Term Borrowings The Company also has access to and utilizes various other short term borrowings to support its operations.

These borrowings are generally in the form of Federal Funds Purchased and Resale Agreements, most of which are overnight

borrowings. Other short term borrowings are not a significant portion of the Company’s overall funding. Table 27: Other Short Term

Borrowings provides summary information about the amounts borrowed and rates paid on other short term borrowings.