Capital One 2009 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

169

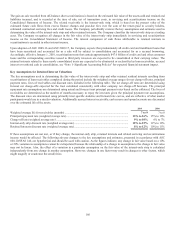

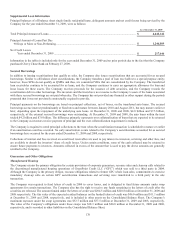

receivables, using management’s best estimates of the key assumptions – credit losses, prepayment speeds and discount rates

commensurate with the risks involved. As of December 31, 2009, six of the twenty one securitization deals hit the cumulative loss

triggers. As a result of hitting the cumulative loss trigger, the insurer has the right to replace the Company as servicer. The Company

has been notified by the insurer of certain Chevy Chase Bank mortgage securitization transactions that it will be removed as servicer

of mortgage loans with an aggregate unpaid principal balance as of December 31, 2009 of $3.1 billion. The fair value of mortgage

servicing rights at December 31, 2009 reflects this expected loss of servicing.

In connection with the securitization of certain payment option arm mortgage loans, the Company is obligated to fund a portion of any

“negative amortization” resulting from monthly payments that are not sufficient to cover the interest accrued for that payment period.

For each dollar of negative amortization funded by the Company, the balance of certain mortgage-backed securities received by the

Company as part of the securitization transaction increase accordingly. As the borrowers make principal payments, these securities

receive their pro rata portion of those payments in cash, and the balances of those securities held by the Company are reduced

accordingly. As funds are drawn, the Company records an asset in the form of negative amortization bonds, which are classified as

securities held to maturity. The Company has also entered into certain derivative contracts related to the securitization activities. These

are classified as free standing derivatives, with fair value adjustments recorded in non-interest income. See “Note 19- Derivative

Instruments and Hedging Activities” for further details on these derivatives.

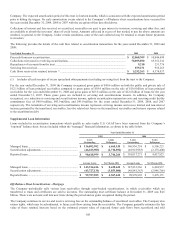

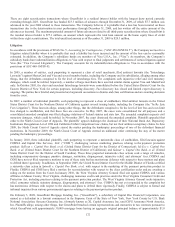

Upon adoption of ASU 2009-16 and ASU 2009-17, certain mortgage loans that have been securitized and accounted for as a sale will

be subject to consolidation and accounted for as a secured borrowing. Accordingly, effective January 1, 2010, mortgage securitization

trusts that contain approximately $1.6 billion of mortgage loans will be consolidated and the retained interests and mortgage servicing

rights related to these newly consolidated trusts will be eliminated in consolidation. See “Note 1- Significant Accounting Policies” for

expected financial statement impact and see “Note 15- Mortgage Servicing Rights” for further information about the accounting for

mortgage servicing rights.

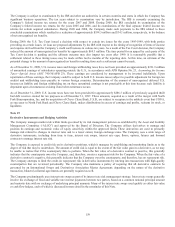

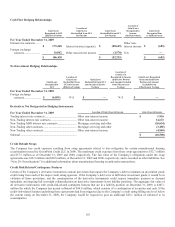

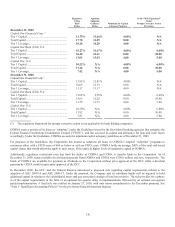

Key Assumptions and Sensitivities for Retained Interest Valuations

Servicing, securitization and mortgage servicing and other includes the initial gains on current securitization and sale transactions and

income from interest-only strips receivable recognized in connection with current and prior period securitization and sale transactions.

For the year ended December 31, 2009, key assumptions and the sensitivity of the current fair value of the retained interests to an

immediate 10 percent and 20 percent adverse change in those assumptions are as follows:

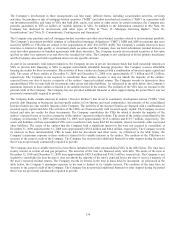

As of December 31, 2009 (1)

Interest-only strip/Retained Interests ........................................................................................................... $ 225,561

Weighted average life (in years) ................................................................................................................... 3.4

Prepayment speed assumption ...................................................................................................................... 27.8%

Impact on fair value at 10% adverse change ................................................................................................. $ (4,502)

Impact on fair value at 20% adverse change ................................................................................................. $ (8,738)

Residual cash flow discount rate (annual) .................................................................................................... 11.5%

Impact on fair value at 10% adverse change ................................................................................................. $ (5,948)

Impact on fair value at 20% adverse change ................................................................................................. $ (11,570)

(1) Mortgage related retained interests were acquired in connection with the Chevy Chase Bank acquisition during 2009.

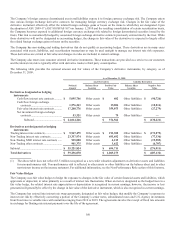

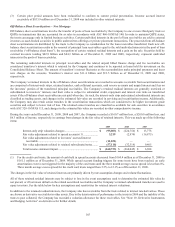

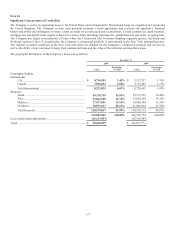

Cash Flows Related to the Off Balance Sheet Mortgage Securitizations

The following table summarizes certain cash flows received from securitization trusts for the year ended December 31, 2009:

Year Ended

December 31, 2009

Proceeds from new securitizations .................................................................................................................. $ —

Servicing fees received ................................................................................................................................... $ 15,926

Other cash flows received on retained interests .............................................................................................. $ 79,279