Capital One 2009 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

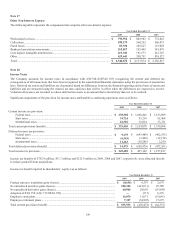

164

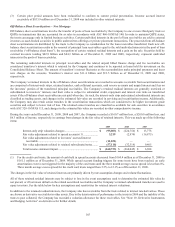

Non-Performance Risk

Non-performance risk refers to the risk that an obligation will not be fulfilled. It affects the calculation of the estimated fair value of

derivative liabilities and includes the Company’s own credit risk. The Company calculates nonperformance risk by comparing its own

CDS spreads to the discount benchmark curve and applying the difference to the netted uncollateralized obligation. During 2009, the

Company recorded a $1.2 million reduction to the fair value of derivative liabilities with a corresponding increase to other non-interest

income to reflect nonperformance risk. The Company also includes counterparty credit risk in the calculation of the estimated fair

value of derivative assets by comparing counterparty credit default swap spreads to the discount benchmark curve and applying the

difference to the netted uncollateralized exposure. During 2009, the Company recorded a $4.7 million credit valuation allowance to

reduce the fair value of derivative assets with a corresponding reduction to other non-interest income.

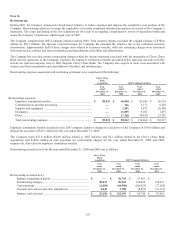

Note 20

Securitizations

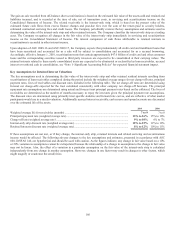

The Company engages in securitization transactions for funding purposes. The Company receives the proceeds from third party

investors for securities issued from the Company’s securitization trusts which are collateralized by transferred receivables from the

Company’s portfolio. The Company removes loans from the reported financial statements when securitizations qualify as sales in

accordance with ASC 860-10/SFAS 140. Alternatively, when the transfer is not considered a sale but is rather considered a secured

borrowing, the assets will remain on the Company’s reported financial statements with an offsetting liability recognized for the

amount of proceeds received.

The Company uses QSPEs to conduct off-balance sheet securitization activities and SPEs that are considered VIEs to conduct other

securitization activities. Interests in the securitized and sold loans may be retained in the form of interest-only strips, retained tranches,

cash collateral accounts, cash reserve accounts and unpaid interest and fees on the investors’ portion of the transferred principal

receivables. The Company also retains a transferor’s interest in certain of the securitized non-mortgage loan receivables transferred to

the trusts which is carried on a historical cost basis and reported as loans held for investment on the Consolidated Balance Sheet.

The Company primarily accounted for loan securitization transactions as sales and accordingly, the transferred loans were removed

from the consolidated financial statements as of and for the years ending December 31, 2009, 2008 and 2007. However, beginning

January 1, 2010, the Company will consolidate certain securitization trusts pursuant to the adoption of ASU 2009-17 (ASC 810/SFAS

167) and the securitization of loan receivables related to these newly consolidated trusts will be accounted for as a secured borrowing

rather than as a sale. The retained interests in securitized assets will be eliminated or reclassified, generally as loan receivables,

accrued interest receivable or restricted cash, as appropriate. See “Note 1- Significant Accounting Policies” for expected financial

statement impact.

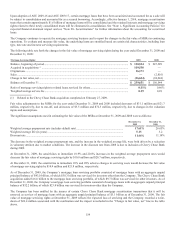

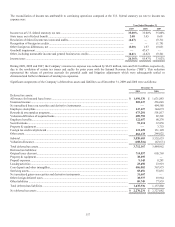

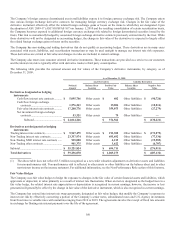

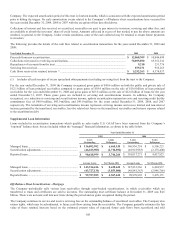

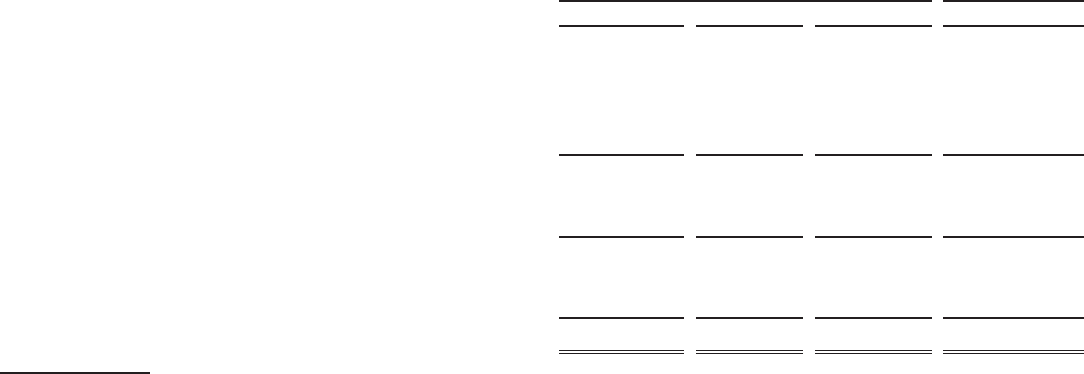

Accounts Receivable from Securitizations

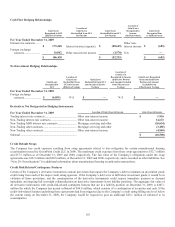

The following provides details of accounts receivable from securitizations as of December 31, 2009 and 2008:

2009 2008

As of December 31 Non Mortgage Mortgage(2) Total

Non Mortgage (3)

Interest-only strip classified as trading ...............................................

.

$ 22,038 $ 222,568 $ 244,606 $ 140,993

Retained interests classified as trading:

Retained notes ..........................................................................

.

572,474 — 572,474 407,113

Cash collateral ..........................................................................

.

138,336 2,993 141,329 169,126

Investor accrued interest receivable ..........................................

.

898,267 — 898,267 —

Total retained interests classified as trading .............................

.

1,609,077 2,993 1,612,070 576,239

Retained notes classified as available for sale ....................................

.

2,087,864 — 2,087,864 753,153

Other retained interests ......................................................................

.

— 12,124 12,124 831,275

Total retained residual interests..........................................................

.

3,718,979 237,685 3,956,664 2,301,660

Collections on deposit for off balance sheet securitizations (1) ...........

.

3,172,231 (411) 3,171,820 3,313,493

Collections on deposit for secured borrowings ..................................

.

501,113 — 501,113 727,601

Total Accounts Receivable from Securitizations ...............................

.

$ 7,392,323 $ 237,274 $ 7,629,597 $ 6,342,754

(1) Collections on deposit for off-balance sheet securitizations include $2.2 billion and $1.8 billion of principal collections

accumulated for expected maturities of securitization transactions as of December 31, 2009 and 2008, respectively. Collections

on deposit for off-balance sheet securitizations are shown net of payments due to investors for interest on the notes.

(2) The mortgage securitization transactions relate to Chevy Chase Bank acquisition which occurred on February 27, 2009.