Capital One 2009 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 173

billion to a purchaser that ultimately transferred most of these mortgage loans to a securitization trust. Some of the securities issued by

the trust were insured by two of the plaintiffs. Plaintiffs have alleged breaches of representations and warranties with respect to a

limited number of specific mortgage loans. Plaintiffs seek unspecified damages and an order compelling GreenPoint to repurchase the

entire portfolio of 30,000 mortgage loans based on alleged breaches of representations and warranties relating to a limited sampling of

loans in the portfolio, or, alternatively, the repurchase of specific mortgage loans to which the alleged breaches of representations and

warranties relate. GreenPoint has filed a motion to dismiss the complaint on the grounds that, among other things, the plaintiffs do not

have standing to bring the lawsuit and that a portfolio-wide repurchase remedy is not contractually available. The motion was argued

before the Court on September 21, 2009, but a ruling has not yet been issued.

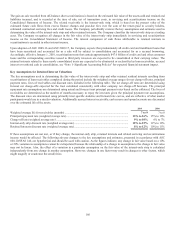

Given the complexity of the issues raised by these matters and the uncertainty regarding: (i) the outcome of these matters, (ii) the

likelihood and amount of any possible judgments, and (iii)with respect to the interchange lawsuits (a) the likelihood, amount and

validity of any claim against the member banks, including the Company and its subsidiary banks, (b) changes in industry structure that

may result from the suits and (c) the effects of these suits, in turn, on competition in the industry, member banks and interchange fees,

the Company cannot determine at this time the long-term effects of these matters.

In the first quarter of 2008, Visa completed an IPO of its stock. With IPO proceeds Visa established an escrow account for the benefit

of member banks to fund certain litigation settlements and claims. As a result, in the first quarter of 2008, the Company reduced its

Visa-related indemnification liabilities of $90.9 million recorded in other liabilities with a corresponding reduction of other non-

interest expense. The Company made an ASC 825-10/SFAS 159 election on the indemnification guarantee to Visa and the fair value

of the guarantee at December 31, 2009 and 2008 was zero, respectively.

Other Pending and Threatened Litigation

In addition, the Company is commonly subject to various pending and threatened legal actions relating to the conduct of its normal

business activities. In the opinion of management, the ultimate aggregate liability, if any, arising out of any such pending or threatened

legal actions will not be material to its consolidated financial position or its results of operations.

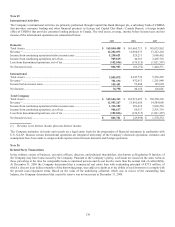

On September 21, 2009, the Tax Court issued a decision in the case Capital One Financial Corporation and Subsidiaries v.

Commissioner covering tax years 1995-1999, with both parties prevailing on certain issues. The time period for an appeal by each

party is pending. Although the final resolution of the case is uncertain and involves unsettled areas of law, the Company has accounted

for this matter applying the recognition and measurement criteria of FIN No. 48, Accounting for Uncertainty in Income Taxes, an

Interpretation of FASB Statement No. 109 (“ASC 740-10/FIN 48”). See “Note 18- Income Taxes” for further information regarding

the financial statement impact of the decision.

Note 22

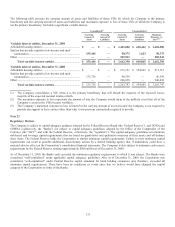

Other Variable Interest Entities

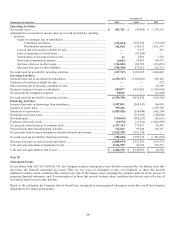

The Company has various types of off-balance sheet arrangements that we enter into in the ordinary course of business. Off-balance

sheet activities typically utilize SPEs that may be in the form of limited liability companies, partnerships or trusts. The SPEs raise

funds by issuing debt to third party investors. The SPEs hold various types of financial assets whose cash flows are the primary source

of repayment for the liabilities of the SPE. Investors only have recourse to the assets held by the SPE but may also benefit from other

credit enhancements.

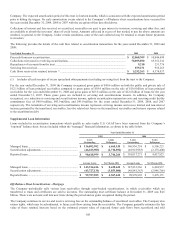

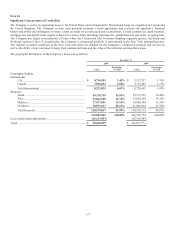

The Company is involved with various SPEs that are considered to be VIEs, as defined by ASC 810-10/FIN 46(R). With respect to its

investments, the Company is required to consolidate any VIE in which it is determined to be the primary beneficiary. The Company

reviews all significant interests in VIEs it is involved with such as amounts and types of financial and other support including

ownership interests, debt financing and guarantees. The Company also considers its rights and obligations as well as the rights and

obligations of other variable interest holders to determine whether it is required to consolidate the VIEs. To provide the necessary

disclosures, the Company aggregates similar VIEs based on the nature and purpose of the entities.

ASU 2009-17 (ASC 810/SFAS 167) eliminates the quantitative approach previously required for determining the primary beneficiary

of a variable interest entity, which was based on determining which enterprise absorbs the majority of the entity’s expected losses,

receives a majority of the entity’s expected residual returns, or both. Under ASU 2009-17 the primary beneficiary would be the entity

that has (i) the power to direct the activities of a VIE that most significantly impact the entity’s economic performance and (ii) the

obligation to absorb losses of the entity that could potentially be significant to the VIE or the right to receive benefits from the entity

that could potentially be significant to the VIE. ASU 2009-17 is effective for the Company’s annual reporting period beginning

January 1, 2010.

Upon adoption of ASU 2009-17 (ASC 810/SFAS 167), the Company will be required to consolidate certain VIE structures previously

accounted for as investments in an unconsolidated entity under the equity method of accounting. The Company does not expect the

financial statement impact to be material.