Capital One 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

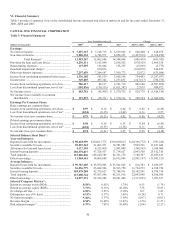

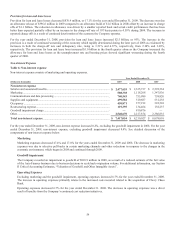

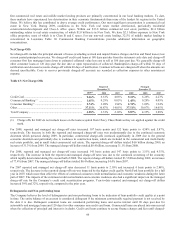

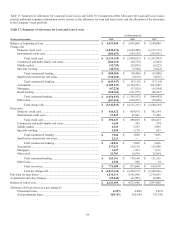

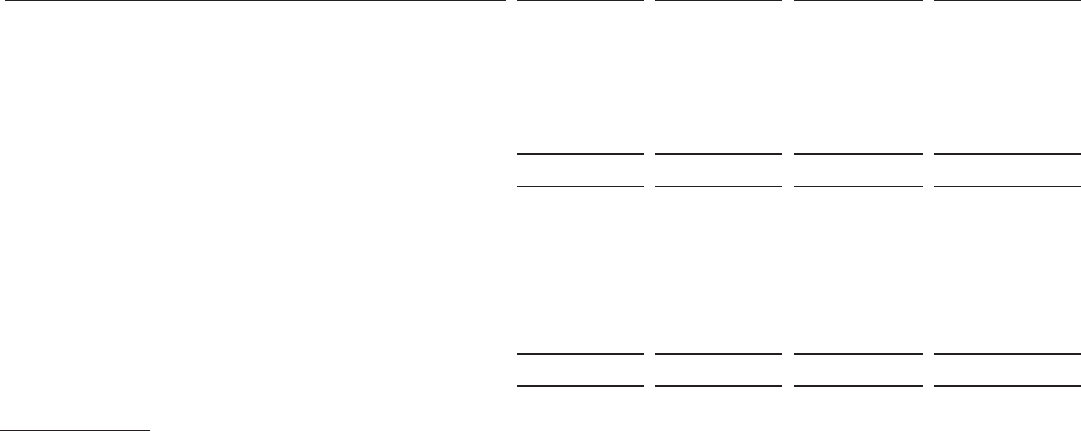

Table 12: Reported Loan Maturity Schedule(1 )

(in thousands)

Amounts due

in one year or

less

Amounts due

after one year

through five

years Amounts due

after five years

Total

Fixed Rate

Total Credit Card ....................................................................... $ 12,510,870 $ 3,377,017 $ — $ 15,887,887

Total Commercial Banking ....................................................... 2,793,762 10,414,144 2,968,980 16,176,886

Automobile ................................................................................ 457,007 14,686,310 3,288,796 18,432,113

Mortgage ................................................................................... 943,078 2,243,638 2,848,239 6,034,955

All other loans ........................................................................... 476,026 2,422,116 4,421,676 7,319,818

Total fixed rate loans........................................................ $ 17,180,743 $ 33,143,225 $ 13,527,691 $ 63,851,659

Variable Rate

Total Credit Card ....................................................................... $ — $ — $ — $ —

Total Commercial Banking ....................................................... 7,464,024 5,068,349 1,037,288 13,569,661

Automobile ................................................................................ — — — —

Mortgage ................................................................................... 1,175,149 233,489 6,375,635 7,784,273

All other loans ........................................................................... 3,380,507 1,761,629 271,270 5,413,406

Total variable loans .......................................................... $ 12,019,680 $ 7,063,467 $ 7,684,193 $ 26,767,340

Total Company loans ................................................................. $ 29,200,423 $ 40,206,692 $ 21,211,884 $ 90,618,999

(1) Please note that the above balances are shown by product type and not by segment.

Credit Risk

Credit Risk is the risk of loss from a borrower’s failure to meet the terms of any contract or failure to otherwise perform as agreed.

There are four primary sources of credit risk: (1) changing economic conditions, which affect borrowers’ ability to pay and the value

of any collateral; (2) a changing competitive environment, which affects customer debt loads, borrowing patterns and loan terms;

(3) our underwriting strategies and standards, which determine to whom we offer credit and on what terms; and (4) the quality of our

internal controls, which establish a process to test that underwriting conforms to our standards and identifies credit quality issues so

we can act upon them in a timely manner.

We have quantitative credit risk guidelines for each of our lines of business. We conduct portfolio and decision level monitoring and

stress tests using economic and legislative stress scenarios. Credit risk objectives are achieved by establishing a credit governance

framework and by establishing policies, procedures, and controls for each step in the credit process. The Board of Directors, Chief

Executive Officer, Chief Risk Officer, Chief Consumer and Commercial Credit Officers, and Division Presidents have specific

accountable roles in the management of credit risk. These include policy approval, creation of credit strategy, review of credit

position, and delegation of authority. Our evolving credit risk position and recommendations to address issues are reviewed by the

Credit Policy Committee and the Board of Directors.

Economic Factors

In evaluating credit risk, the Company considers changing economic conditions and their effects on borrowers’ ability to pay and the

value of any collateral securing the loan. Beginning in mid-2007, economic conditions in the Company’s markets have deteriorated,

with unemployment in the United States reaching 10% at the end of 2009. In addition, asset values, particularly home prices and, more

recently, commercial real estate, have declined substantially. The deterioration in economic conditions during this time period has

created pressure on consumers and businesses to service their debts, resulting in higher levels of delinquencies, charge-offs and

additions to the Company’s allowance for loan and lease losses.

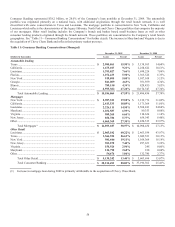

Credit Concentration

The Company believes that diversification of credit is another important element of evaluating credit risk. The Company maintains a

diverse portfolio, offering a broad array of credit products to consumers, small businesses and commercial customers. We think our

consumer portfolios are well diversified nationally and have limited exposure to regional weaknesses. Table 9: Credit Card

Concentrations and Table 11: Consumer Banking Concentrations provide additional information on geographic concentrations of

credit.