Capital One 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 130

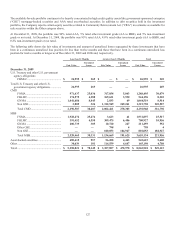

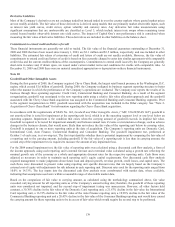

The Company recognized credit-related other-than-temporary impairment of $15.6 million through earnings for the year ended

December 31, 2009, for twelve prime non-agency mortgage-backed securities. For these impaired securities, unrealized losses not

related to credit and therefore recognized in other comprehensive income was $84.7 million (net of tax was $54.6 million) as of

December 31, 2009. While these securities experienced significant decreases in fair value in the second half of 2008 due to

deteriorating credit fundamentals and elevated liquidity premiums, there has been substantial improvement in fair value during 2009

as the market has stabilized and risk premiums have tightened despite interest rates increasing. The credit-related impairment was

calculated based on internal forecasts using security specific delinquencies, product specific delinquency roll rates and expected

severities, using industry standard third party modeling tools. The significant key assumptions used to measure the credit-related

component of securities deemed to be other-than-temporary impaired as of December 31, 2009, are as follows: a weighted average

credit default rate of 8.19% and a weighted average expected severity of 47%. Refer to “Note 1- Significant Accounting Policies” for

a discussion of the 2009 changes to key assumptions used to measure the credit-related component of securities deemed to be other-

than-temporarily impaired.

Based on its view of each prime non-agency security’s current credit performance, the sufficiency of subordination to protect cash

flows, the implicit U.S. Government guarantee of FNMA/FHLMC securities, and the explicit U.S. Government guarantee of GNMA

securities, the Company expects to recover the entire amortized cost basis of its remaining mortgage-backed securities. Furthermore,

since the Company does not have the intent to sell nor will it more likely than not be required to sell before anticipated recovery, it

does not consider any of its remaining mortgage-backed securities in unrealized loss positions to be other-than-temporarily impaired at

December 31, 2009 and 2008.

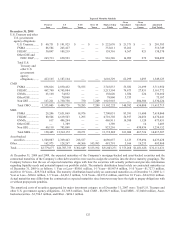

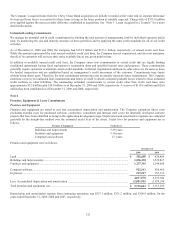

Asset-Backed Securities This category is comprised of investments backed by credit card, auto, floorplan, equipment and student

loans; commercial mortgage-backed loans; and minor investments backed by home equity lines of credit. As of December 31, 2009,

the portfolio is 84.2% rated AAA and is comprised of 76.3% credit card, 14.0% auto, 6.9% student loans, 1.7% dealer floor securities,

0.8% equipment-backed securities and 0.3% home equity lines of credit,. The unrealized losses on the Company’s investments

in asset-backed securities were primarily caused by credit spreads and interest rates that are higher than those at the date of purchase.

As of December 31, 2008, the portfolio is 96.0% rated AAA and is comprised of 40.1% credit card, 24.4% CMBS, 23.0% auto, 12.0%

student consumer loans, and 0.5% home equity lines of credit.

The Company recognized $0.8 million, in credit-related other-than-temporary impairment through earnings for the year ended

December 31, 2009 related to one home equity line of credit security. For this security, the realized loss not related to credit and

therefore recognized in other comprehensive income was $0.5 million (net of tax was $0.3 million) as of December 31, 2009. The

Company recognized $4.8 million and $0.4 million in other-than-temporary impairment through earnings for the year ended

December 31, 2008 and the three months ended March 31, 2009, respectively. Refer to “Note 1- Significant Accounting Policies” for

a discussion of the 2009 FSP change to credit-related other-than-temporary impairment disclosures.

Based on its view of each security’s current credit performance along with the sufficiency of subordination to protect cash flows, the

Company expects to recover the entire amortized cost basis of its remaining asset-backed securities. Furthermore, since the Company

does not have the intent to sell nor will it more likely than not be required to sell before anticipated recovery, it does not consider any

of its remaining asset-backed securities in unrealized loss positions to be other-than-temporarily impaired at December 31, 2009 and

2008.

Other This category consists primarily of municipal securities and limited investments in equity securities, primarily related to CRA

activities. The unrealized losses on the Company’s investments in other items were primarily caused by credit spreads and interest

rates that are higher than levels existing at the date of purchase. The Company recognized $6.1 million in other-than-temporary

impairment changes on an equity investment related to CRA investments in the year ended December 31, 2008 due to declining stock

values and market concerns on performance. As of December 31, 2009, the Company expects to recover the entire amortized cost

basis of the securities in this and all other categories. Furthermore, since the Company has not made a decision to sell nor will it more

likely than not be required to sell before anticipated recovery, it does not consider any of the remaining investments in unrealized loss

positions to be other-than-temporarily impaired at December 31, 2009 and 2008.

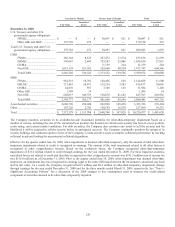

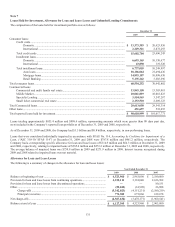

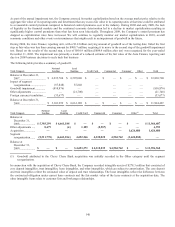

Gross realized gains on sales and calls of securities were $231.2 million, $14.6 million and $71.2 million for the years ended

December 31, 2009, 2008, and 2007, respectively. Gross realized losses on sales and calls of securities were $12.8 million, $0.9

million and $1.2 million for the years ended December 31, 2009, 2008, and 2007, respectively. Tax expense on net realized gains was

$77.6 million, $5.0 million and $25.0 million for the years ended December 31, 2009, 2008 and 2007, respectively.

The Company’s sale of securities resulted in the reclassification of $50.0 million, $11.1 million and $28.3 million, of net gains after

tax, from accumulated other comprehensive income into earnings, for the year ended December 31, 2009, 2008 and 2007,

respectively.

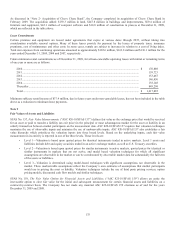

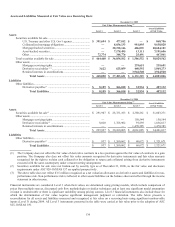

Securities available-for-sale included pledged securities of $11.9 billion and $13.7 billion at December 31, 2009 and 2008,

respectively.