Capital One 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 84

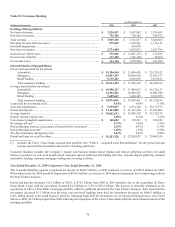

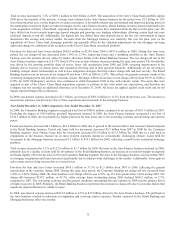

X. Capital

Capital Standards

The Company is subject to capital adequacy standards adopted by the Federal Reserve; and CONA and COBNA are subject to capital

adequacy guidelines adopted by the OCC. The capital adequacy guidelines set minimum risk-based and leverage capital requirements

that are based on quantitative and qualitative measures of their assets and off-balance sheet items. The Federal Reserve holds the

Company to similar minimum capital requirements. Failure to meet minimum capital requirements can result in possible additional,

mandatory or discretionary actions by the regulators that, if undertaken, could have a material adverse effect on the Company’s

consolidated financial statements.

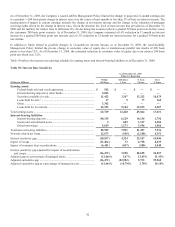

Under these guidelines, a bank’s or a holding company’s assets and certain specified off-balance sheet commitments and obligations

are assigned to various risk categories. A bank’s or holding company’s capital, in turn, is classified in one of three tiers. Tier 1 capital

includes, among other things, common equity, non-cumulative perpetual preferred stock, an eligible amount of cumulative perpetual

preferred stock at the holding company level, and minority interests in equity accounts of consolidated subsidiaries, less goodwill and

certain other deductions. Tier 2 capital includes, among other things, perpetual preferred stock not qualified as Tier 1 capital, a certain

amount of subordinated debt and the allowable portion of allowances for loan and lease losses, subject to certain limitations. Tier 3

capital includes qualifying unsecured subordinated debt.

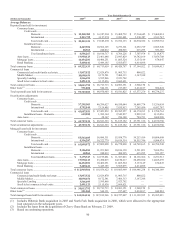

Banks and bank holding companies currently are required to maintain Tier 1 capital and the sum of Tier 1 and Tier 2 capital equal to

at least 4% and 8%, respectively, of their total risk-weighted assets (including certain off-balance sheet items, such as standby letters

of credit). The federal banking agencies, however, may set higher capital requirements for an individual bank or bank holding

company when a bank’s particular circumstances warrant.

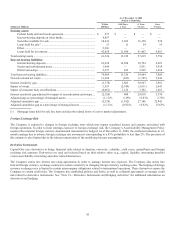

The federal banking agencies also require incorporation of market components into regulatory capital computations. Under the market

risk requirements, capital is allocated to support the amount of market risk related to a financial institution’s ongoing trading activities.

In addition, the federal banking agencies have established minimum leverage (Tier 1 capital to adjusted average total assets)

guidelines for banks within their regulatory jurisdiction. These guidelines provide for a minimum leverage ratio of 3% for banks that

meet certain specified criteria, including excellent asset quality, high liquidity, low interest rate exposure and the highest regulatory

rating. Banks not meeting these criteria are required to maintain a leverage ratio of 4%.

Capital One Financial Corporation requested temporary relief from the Federal Reserve Board’s risk based and leverage capital

guidelines in connection with the deferred tax assets related to Capital One’s acquisition of Chevy Chase Bank. This request was

granted by the Board on October 19, 2009. From time to time, the regulators propose changes and amendments to, and issue

interpretations of, risk-based capital guidelines and related reporting instructions. Such proposals or interpretations could, if

implemented in the future, affect the Company’s or each of the Bank’s reported capital ratios and net risk-adjusted assets.

On January 21, 2010, the OCC and the Federal Reserve announced a final rule regarding capital requirements related to the adoption

of ASU 2009-16 (ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167). Under the final rule, the Company and its subsidiary

banks will be required to hold additional capital in relation to the consolidated assets resulting from the application of ASU 2009-16

(ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167) and any associated creation of loan loss reserves. The rule provides for

a phase-in of the capital requirements in the form of an optional two-quarter delay in implementation for regulatory capital ratios,

followed by an optional two-quarter partial implementation for regulatory capital ratios. See “Note 1—Significant Accounting

Policies” for further details.

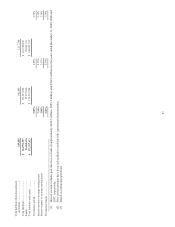

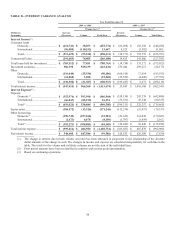

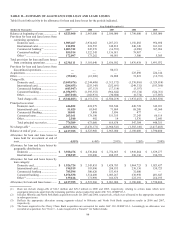

As of December 31, 2009, each of the Banks exceeded the minimum regulatory requirements and, therefore, each of the Banks was

considered “well-capitalized” under applicable capital adequacy guidelines. Also as of December 31, 2009, the Company exceeded all

minimum capital requirements and therefore, was considered “well-capitalized” under Federal Reserve capital standards for bank

holding companies.

Failure to meet applicable capital guidelines could subject the Company or the Banks to a variety of enforcement remedies available to

the regulators, including the issuance of a capital directive to increase capital and a limitation on the ability to pay dividends. In the

case of the Banks, failure to meet applicable capital guidelines could also lead to the termination of deposit insurance by the Federal

Deposit Insurance Corporation (the “FDIC”) and the appointment of a conservator or receiver (in severe cases). Failure to meet these

capital guidelines could also prevent the Company or the Banks from engaging in the expanded activities permitted for bank holding

companies and banks under the Gramm-Leach-Bliley Act.