Capital One 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

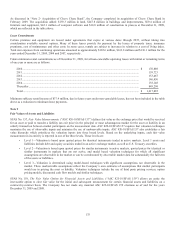

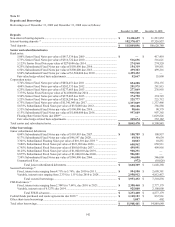

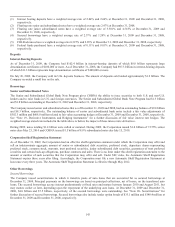

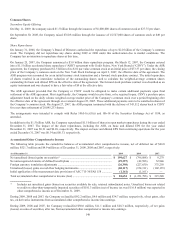

(1) Interest bearing deposits have a weighted average rate of 2.04% and 2.64% at December 31, 2009 and December 31, 2008,

respectively.

(2) Floating rate senior and subordinated notes have a weighted average rate 2.47% at December 31, 2008.

(3) Floating rate junior subordinated notes have a weighted average rate of 3.301% and 4.518% at December 31, 2009 and

December 31, 2008, respectively.

(4) Secured borrowings have a weighted average rate of 2.37% and 1.24% at December 31, 2009 and December 31, 2008,

respectively.

(5) FHLB advances have a weighted average rate 0.327% and 2.85% at December 31, 2009 and December 31, 2008, respectively.

(6) Federal funds purchased have a weighted average rate of 0.11% and 0.01% at December 31, 2009 and December 31, 2008,

respectively.

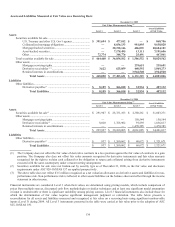

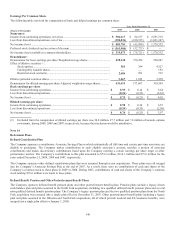

Deposits

Interest-Bearing Deposits

As of December 31, 2009, the Company had $102.4 billion in interest-bearing deposits of which $8.8 billion represents large

denomination certificates of $100,000 or more. As of December 31, 2008, the Company had $97.3 billion in interest-bearing deposits

of which $11.3 billion represents large denomination certificates of $100,000 or more.

On July 26, 2009, the Company sold its U.K. deposits business. The amount of deposits sold totaled approximately $1.2 billion. The

Company recorded a small loss on the sale.

Borrowings

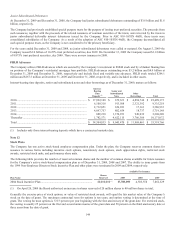

Senior and Subordinated Notes

The Senior and Subordinated Global Bank Note Program gives COBNA the ability to issue securities to both U.S. and non-U.S.

lenders and to raise funds in U.S. and foreign currencies. The Senior and Subordinated Global Bank Note Program had $1.3 billion

and $1.8 billion outstanding at December 31, 2009 and December 31, 2008, respectively.

The Company issued senior and subordinated notes that as of December 31, 2009 and 2008, had an outstanding balance of $9.0 billion

and $8.3 billion, respectively. The outstanding balance of senior and subordinated bank notes include a fair value adjustments of

$302.3 million and $608.0 million related to fair value accounting hedges at December 31, 2009 and December 31, 2008, respectively.

See “Note 19- Derivative Instruments and Hedging Instruments” for a further discussion of fair value interest rate hedges. The

weighted average stated rate included in the table above is before the impact of these interest rate derivatives.

During 2009, notes totaling $1.4 billion were called or matured. During 2009, the Corporation issued $1.0 billion of 7.375% senior

notes dues May 23, 2014 and COBNA issued $1.5 billion of 8.8% subordinated notes due July 15, 2019.

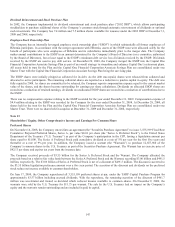

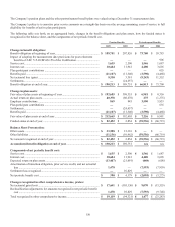

Corporation Shelf Registration Statement

As of December 31, 2009, the Corporation had an effective shelf registration statement under which the Corporation may offer and

sell an indeterminate aggregate amount of senior or subordinated debt securities, preferred stock, depositary shares representing

preferred stock, common stock, warrants, trust preferred securities, junior subordinated debt securities, guarantees of trust preferred

securities and certain back-up obligations, purchase contracts and units. There is no limit under this shelf registration statement to the

amount or number of such securities that the Corporation may offer and sell. Under SEC rules, the Automatic Shelf Registration

Statement expires three years after filing. Accordingly, the Corporation must file a new Automatic Shelf Registration Statement at

least once every three years. The Automatic Shelf Registration Statement is effective through May 2012.

Other Borrowings

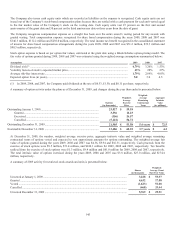

Secured Borrowings

The Company issued securitizations in which it transfers pools of auto loans that are accounted for as secured borrowings at

December 31, 2009. Principal payments on the borrowings are based on principal collections, net of losses, on the transferred auto

loans. The secured borrowings accrue interest predominantly at fixed rates and mature between January 2010 and August 2011, but

may mature earlier or later, depending upon the repayment of the underlying auto loans. At December 31, 2009 and December 31,

2008, $4.0 billion and $7.5 billion, respectively, of the secured borrowings were outstanding. See “Note 20- Securitizations” for

further discussion of secured borrowings. Secured borrowings also include tender option bonds of $33.1 million and $140.4 million at

December 31, 2009 and December 31, 2008, respectively.