Capital One 2009 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170

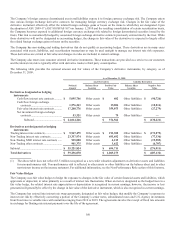

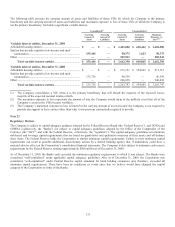

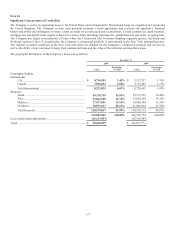

Supplemental Loan Information

Principal balances of off balance sheet single family residential loans, delinquent amounts and net credit losses being serviced by the

Company for the year ended December 31, 2009, were as follows:

As of December 31, 2009

Total Principal Amount of Loans ........................................................................................................................

.

$ 4,642,142

Principal Amount of Loans Past Due

90 Days or More or Non-Performing .............................................................................................................

.

$ 1,246,809

N

et Credit Losses

Year ended December 31, 2009 ................................................................................................................

.

$ 217,444

Information in the tables is included only for the year ended December 31, 2009 and no prior periods due to the fact that the Company

purchased Chevy Chase Bank on February 27, 2009.

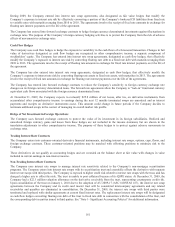

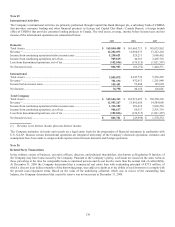

Secured Borrowings

In addition to issuing securitizations that qualify as sales, the Company also issues securitizations that are accounted for as secured

borrowings. Similar to off-balance sheet securitizations, the Company transfers a pool of loan receivables to a special purpose entity;

however, these SPEs do not qualify as QSPEs and thus, are considered VIEs that are consolidated by the Company. The transferred

loan receivables continue to be accounted for as loans, and the Company continues to carry an appropriate allowance for loan and

lease losses for these assets. The Company receives proceeds for the issuance of debt securities, and the Company records the

securitization debt in other borrowings. The investors and the trusts have no recourse to the Company’s assets if the loans associated

with these secured borrowings are not paid when due. The Company has not provided any financial or other support during the periods

presented that it was not previously contractually required to provide.

Principal payments on the borrowings are based on principal collections, net of losses, on the transferred auto loans. The secured

borrowings accrue interest predominantly at fixed rates and mature between January 2010 and August 2011, but may mature earlier or

later, depending upon the repayment of the underlying auto loans. At December 31, 2009 and 2008, $4.0 billion and $7.5 billion,

respectively, of the external secured borrowings were outstanding. At December 31, 2009 and 2008, the auto loans within the trust

totaled $4.2 billion and $7.8 billion. The difference primarily represents over collateralization of loans that are expected to be returned

to the Company as investors receive payment of principal and the over collateralization requirement is reduced.

The Company is required to remit principal collections to the trust when the securitization transaction is scheduled to mature or earlier

if an amortization event has occurred. No early amortization events related to the Company’s securitizations accounted for as secured

borrowings have occurred for the years ended December 31, 2009 and 2008, respectively.

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing and other fees, and

are available to absorb the investors’ share of credit losses. Under certain conditions, some of the cash collected may be retained to

ensure future payments to investors. Amounts collected in excess of the amount that is used to pay the above amounts are generally

remitted to the Company.

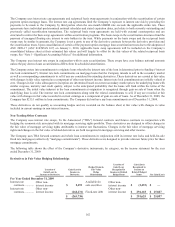

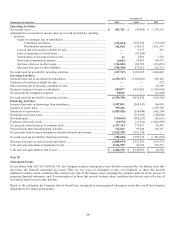

Guarantees and Other Obligations

Manufactured Housing

The Company retains the primary obligation for certain provisions of corporate guarantees, recourse sales and clean-up calls related to

the discontinued manufactured housing operations of GreenPoint Credit LLC (“GPC”) which was sold to a third party in 2004.

Although the Company is the primary obligor, recourse obligations related to former GPC whole loan sales, commitments to exercise

mandatory clean-up calls on certain GPC securitization transactions and servicing were transferred to a third party in the sale

transaction.

The Company was required to fund letters of credit in 2004 to cover losses, and is obligated to fund future amounts under swap

agreements for certain transactions. The Company also has the right to receive any funds remaining in the letters of credit after the

securities are released. The amount funded under the letters of credit was $204.5 million and $220.8 million at December 31, 2009 and

2008 respectively. The fair value of the expected residual balances on the funded letters of credit was $46.0 million and $11.1 million

at December 31, 2009 and 2008, respectively, and is included in other assets on the Consolidated Balance Sheet. The Company’s

maximum exposure under the swap agreements was $32.7 million and $37.5 million at December 31, 2009 and 2008, respectively.

The value of the Company’s obligations under these swaps was $18.3 million and $20.8 million at December 31, 2009 and 2008,

respectively, and is recorded in other liabilities on the Consolidated Balance Sheet.