Capital One 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 36

At inception, the Company determines if a derivative instrument meets the criteria for hedge accounting. Ongoing effectiveness

evaluations are made for instruments that are designated and qualify as hedges. If the derivative does not qualify for hedge accounting,

no assessment of effectiveness is needed by management.

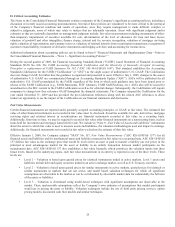

Accounting for Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes (“ASC 740-10/SFAS

109”), recognizing the current and deferred tax consequences of all transactions that have been recognized in the financial statements

using the provisions of the enacted tax laws. Deferred tax assets and liabilities are determined based on differences between the

financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect

when the differences are expected to reverse. The Company adopted the provisions of FASB Interpretation No. 48, Accounting for

Uncertainty in Income Taxes, an Interpretation of FASB Statement No. 109, (“ASC 740-10/FIN 48”) effective January 1, 2007.

The calculation of the Company’s income tax provision is complex and requires the use of estimates and judgments. When analyzing

business strategies, the Company considers the tax laws and regulations that apply to the specific facts and circumstances for any

transaction under evaluation. This analysis includes the amount and timing of the realization of income tax provisions or benefits.

Management closely monitors tax developments in order to evaluate the effect they may have on its overall tax position and the

estimates and judgments utilized in determining the income tax provision and records adjustments as necessary.

The Company records valuation allowances to reduce deferred tax assets to the amount that is more likely than not to be realized. In

making this assessment, management analyzes future taxable income, reversing temporary differences and ongoing tax planning

strategies. Should a change in circumstances lead to a change in judgment about the ability to realize deferred tax assets in future

years, the Company would adjust related valuation allowances in the period that the change in circumstances occurs, along with a

corresponding increase or charge to income.

For the years ended December 31, 2009 and 2008, the provision for income taxes on continuing operations was $349.5 million and

$497.1 million, respectively, and as of December 31, 2009 and 2008, the valuation allowance was $108.5 million and $67.7 million,

respectively.

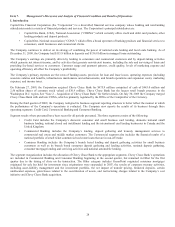

III. Off-Balance Sheet Arrangements

The Company is involved in various types of off-balance sheet arrangements in the ordinary course of business. Off-balance sheet

activities typically utilize special purpose entities (“SPEs”) that may be in the form of limited liability companies, partnerships or

trusts. The SPEs raise funds by issuing debt to third party investors. The SPEs hold various types of financial assets whose cash flows

are the primary source of repayment for the liabilities of the SPE. Investors only have recourse to the assets held by the SPE but may

also benefit from other credit enhancements. The Company’s involvement in these arrangements can take many different forms,

including securitization activities, servicing activities, the purchase or sale of mortgage-backed and other asset backed securities in

connection with our investment portfolio, and loans to variable interest entities (“VIEs”) that hold debt, equity, real estate or other

assets. In certain instances, the Company also provides guarantees to VIEs or holders of variable interests in VIEs. See “Note 15 –

Mortgage Servicing Rights”; “Note 20 – Securitizations”; “Note 21 – Commitments, Contingencies and Guarantees”; and “Note 22 –

Other Variable Interest Entities” for further detail on the Company’s involvement and exposure related to off-balance sheet

arrangements.

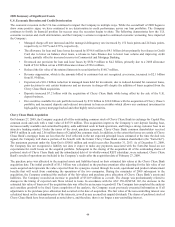

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 166, An Amendment of FASB Statement No. 140

(“SFAS 166”) and Statement of Financial Accounting Standards No. 167, Amendments to FASB Interpretation No. 46(R) (“SFAS

167”). In December 2009, the FASB issued ASU No. 2009-16, Transfers and Servicing (Topic 860): Accounting for Transfers of

Financial Assets (“ASU 2009-16”) and ASU No. 2009-17, Consolidations (Topic 810): Improvements to Financial Reporting by

Enterprises Involved with Variable Interest Entities (“ASU 2009-17”), which provided amendments to various parts of SFAS 166 and

SFAS 167.

ASU 2009-16 (Topic 860/SFAS 166) removes the concept of a qualifying special-purpose entity (“QSPE”) from SFAS 140,

Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities (“ASC 860-10/SFAS 140”) and removes

the exception from applying FASB Interpretation No. 46, Consolidation of Variable Interest Entities (“ASC 810-10/FIN 46(R)”), to

qualifying special-purpose entities. ASU 2009-17 (ASC 810/SFAS 167) eliminates the quantitative approach previously required for

determining the primary beneficiary of a variable interest entity, which was based on determining which enterprise absorbs the

majority of the entity’s expected losses, receives a majority of the entity’s expected residual returns, or both. Under ASU 2009-17 the

primary beneficiary would be the entity that has (i) the power to direct the activities of a variable interest entity that most significantly

impact the entity’s economic performance and (ii) the obligation to absorb losses of the entity that could potentially be significant to

the VIE or the right to receive benefits from the entity that could potentially be significant to the VIE. ASU 2009-16 and ASU 2009-

17 are effective for the Company’s annual reporting period beginning January 1, 2010.