Capital One 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 44

2009 Summary of Significant Events

U.S. Economic Recession and Credit Deterioration

The economic recession in the U.S. has continued to impact the Company in multiple ways. While the second half of 2009 began to

show some positive signs, we have continued to see deterioration in credit performance across our loan portfolios. The Company

continues to fortify its financial position for success once the recession begins to abate. The following demonstrates how the U.S.

economic recession and credit deterioration, and the Company’s actions to respond to continued economic worsening, have impacted

the Company:

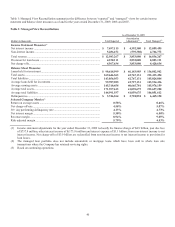

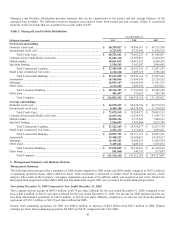

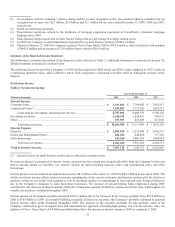

• Managed charge-off rate increased and the managed delinquency rate increased by 152 basis points and 24 basis points,

respectively, to 5.87% and 4.73%, respectively,

• The allowance for loan and lease losses decreased by $396.6 million to $4.1 billion driven primarily by releases in Credit

Card due to lower on balance sheet loans, a release in Auto Finance due to lower loan volume and improving credit

trends, partially offset by increased reserves in Commercial and Mortgage Banking,

• Decreased our provision for loan and lease losses by $870.9 million to $4.2 billion, primarily due to a 2008 allowance

build of $1.6 billion versus a 2009 allowance release of 396.6 million,

• Reduced the fair value of the retained interests in securitization by $160.7 million,

• Revenue suppression, which is the amounts billed to customers but not recognized as revenue, increased to $2.1 billion

from $1.9 billion,

• Experienced a $10.1 billion reduction in managed loans held for investment, due to reduced demand for consumer loans,

prior decisions to exit certain businesses and an increase in charge-offs despite the addition of loans acquired from the

Chevy Chase Bank acquisition,

• Deposits increased $7.2 billion with the acquisition of Chevy Chase Bank while being offset by the sale of the U.K.

deposit business,

• Our securities available for sale portfolio increased by $7.8 billion to $38.8 billion with the acquisition of Chevy Chase’s

portfolio, and increased deposits and reduced investment in loan receivables which allows our continued investment in

high-quality agency mortgage-backed and other highly rated securities.

Chevy Chase Bank Acquisition

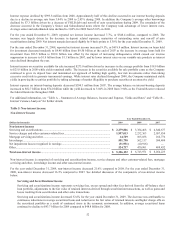

On February 27, 2009, the Company acquired all of the outstanding common stock of Chevy Chase Bank in exchange for Capital One

common stock and cash with a total value of $475.9 million. This acquisition improves the Company’s core deposit funding base,

increases readily available and committed liquidity, adds additional scale in bank operations, and brings a strong customer base in an

attractive banking market. Under the terms of the stock purchase agreement, Chevy Chase Bank common shareholders received

$445.0 million in cash and 2.56 million shares of Capital One common stock. In addition, to the extent that losses on certain of Chevy

Chase Bank’s mortgage loans are less than the level reflected in the net expected principal losses estimated at the time the deal was

signed, the Company will share a portion of the benefit with the former Chevy Chase Bank common shareholders (the “Earn-Out”).

The maximum payment under the Earn-Out is $300.0 million and would occur after December 31, 2013. As of December 31, 2009,

the Company has not recognized a liability nor does it expect to make any payments associated with the Earn-Out based on our

expectations for credit losses on the acquired portfolio. Subsequent to the closing of the acquisition all of the outstanding shares of

preferred stock of Chevy Chase Bank and the subordinated debt of its wholly-owned REIT subsidiary, were redeemed. Chevy Chase

Bank’s results of operations are included in the Company’s results after the acquisition date of February 27, 2009.

The purchase price was allocated to the acquired assets and liabilities based on their estimated fair values at the Chevy Chase Bank

acquisition date. The initial goodwill of $1.1 billion was calculated as the purchase premium after adjusting for the fair value of net

assets acquired and represents the value expected from the synergies created through the scale, operational and product enhancement

benefits that will result from combining the operations of the two companies. During the remainder of 2009 subsequent to the

acquisition, the Company continued the analysis of the fair values and purchase price allocation of Chevy Chase Bank’s assets and

liabilities. The Company recorded an increase to goodwill of $510.9 million as a result. The change was predominantly related to

changes in the timing of expected cash flows related to loans. In accordance with the ASC 350-20/SFAS 142, the decrease in the

estimated fair value of loans as of the acquisition date was offset by an increase in goodwill. The Company has completed the analysis

and considers goodwill to be final. Upon completion of the analysis, the Company recast previously presented information as if all

adjustments to the purchase price allocation had occurred at the date of acquisition. The fair value of the non-controlling interest was

calculated based on the redemption price of the interests, as well as any accrued but unpaid dividends. The shares of preferred stock of

Chevy Chase Bank have been redeemed as noted above, and therefore, there is no longer a non-controlling interest.