Capital One 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 35

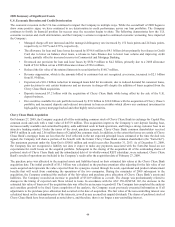

Valuation of Retained Interests in Securitization Transactions

The Company’s retained residual interests in off-balance sheet securitizations are recorded in accounts receivable from securitizations

and are comprised of interest-only strips, retained tranches, cash collateral accounts, cash reserve accounts and unpaid interest and

fees on the investors’ portion of the transferred principal receivables.

The Company removes loan receivables from its Consolidated Balance Sheet and records a gain on sale for securitization transactions

that qualify as sales (“off-balance sheet securitizations”). The gain is recorded net of transaction costs and is based on the estimated

present value of the net income stream of the assets sold and assets retained or liabilities incurred. The related receivable is the

interest-only strip, which is based on the present value of the estimated future cash flows from excess finance charges and past-due

fees over the sum of the return paid to security holders, estimated contractual servicing fees and credit losses. Retained assets are

recorded in accounts receivable from securitizations at estimated fair value. The Company’s retained residual interests are generally

restricted or subordinated to investors’ interests and their value is subject to substantial credit, repayment and interest rate risks on

transferred assets if the off-balance sheet receivables are not paid when due. As such, the interest-only strip and subordinated retained

interests are classified as trading, and changes in the estimated fair value are recorded in servicing and securitization income.

Additionally, the Company may retain senior tranches in the securitization transactions which are considered to be investment grade

securities and subject to a lower risk of loss. These senior tranches are also recorded in accounts receivable from securitizations at

estimated fair value. The Company classifies senior retained tranches as available for sale securities and related changes in the

estimated fair value are recorded in other comprehensive income.

The fair value of retained interest is highly sensitive to changes in certain assumptions. To the extent assumptions used by

management do not prevail, the estimated fair value of retained interests could be materially impacted.

As of December 31, 2009 and 2008, accounts receivable from securitization totaled $7.6 billion and $6.3 billion, respectively. This

balance consists of retained residual interests that are recorded at estimated fair value and totaled $4.0 billion and $2.3 billion at

December 31, 2009 and 2008, respectively. The remaining balance relates to cash collections held at financial institutions that are

expected to be returned to the Company on future distribution dates and principal collections accumulated for expected maturities of

securitization transactions with a subsequent return of loans receivables.

As described above, the Company has accounted for loan securitization transactions as sales and accordingly, the transferred loans

were removed from the consolidated financial statements as of and for the years ending December 31, 2009, 2008 and 2007. However,

beginning January 1, 2010, the Company will consolidate certain securitization trusts pursuant to ASU 2009-17 (ASC 810/SFAS 167)

and the securitization of loan receivables will be accounted for as a secured borrowing. The securitized loans and the corresponding

debt securities issued to third party investors will be consolidated at their respective carrying values. The retained interests in

securitized assets will be eliminated or reclassified, generally as loan receivables, accrued interest receivable or restricted cash, as

appropriate. See “Note 1 – Significant Accounting Policies” for expected financial statement impact and “Note 20 – Securitizations”

for further information about the accounting for securitized loans.

Recognition of Customer Rewards Liability

The Company offers products, primarily credit cards, that provide program members with various rewards such as airline tickets, free

or deeply discounted products or cash rebates, based on account activity. The Company establishes a rewards liability based on points

earned which are ultimately expected to be redeemed and the average cost per point redemption. As points are redeemed, the rewards

liability is relieved. The cost of reward programs is primarily reflected as a reduction to interchange income. The rewards liability will

be affected over time as a result of changes in the number of account holders in the reward programs, the actual amount of points

earned and redeemed, the actual costs of the rewards, changes made by reward partners and changes that the Company may make to

the reward programs in the future. To the extent assumptions used by management do not prevail, rewards costs could differ

significantly, resulting in either a higher or lower future rewards liability, as applicable.

As of December 31, 2009 and 2008, the rewards liability was $1.3 billion and $1.4 billion, respectively.

Derivative Instruments and Hedging Activities

The Company utilizes certain derivative instruments to minimize significant unplanned fluctuations in earnings caused by interest rate

and foreign exchange rate volatility. The Company’s goal is to manage sensitivity to changes in rates by offsetting the repricing or

maturity characteristics of certain assets and liabilities, thereby limiting the impact on earnings. The use of derivative instruments does

expose the Company to credit and market risk. The Company manages credit risk through strict counterparty credit risk limits and/or

collateralization agreements. See “Note 19—Derivative Instruments and Hedging Activities” for additional information on derivatives

and hedging.