Capital One 2009 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 172

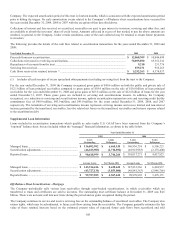

There are eight securitization transactions where GreenPoint is a residual interest holder with the longest draw period currently

extending through 2023. GreenPoint has funded $23.3 million of advances through December 31, 2009, of which $7.7 million was

advanced in the year 2009 related to these transactions. The Company believes it is probable that a loss has been incurred on these

transactions due to the deterioration in asset performance through December 31, 2009, and has written off the entire amount of the

advances as incurred. The maximum potential amount of future advances related to all third-party securitizations where GreenPoint is

the residual interest holder is $77.1 million, an amount which represents the total loan amount on the home equity lines of credit

within those eight securitizations. The total unutilized amount as of December 31, 2009 is $20.3 million.

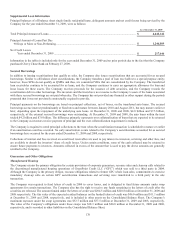

Litigation

In accordance with the provisions of SFAS No. 5, Accounting for Contingencies, (“ASC 450-20/SFAS 5”), the Company accrues for a

litigation related liability when it is probable that such a liability has been incurred and the amount of the loss can be reasonably

estimated. In addition, the Company’s subsidiary banks are members of Visa U.S.A., Inc. (“Visa”). As members, the Company’s

subsidiary banks have indemnification obligations to Visa with respect to final judgments and settlements of certain litigation against

Visa (the “Visa Covered Litigation”). The Company accounts for its indemnification obligations to Visa in accordance with the

provisions of ASC 460-10/FIN 45.

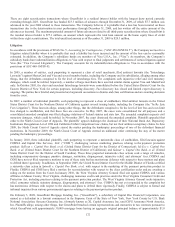

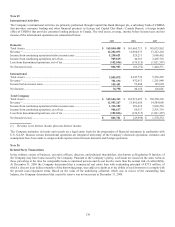

In 2005, a number of entities, each purporting to represent a class of retail merchants, filed antitrust lawsuits (the “Interchange

Lawsuits”) against MasterCard and Visa and several member banks, including the Company and its subsidiaries, alleging among other

things, that the defendants conspired to fix the level of interchange fees. The complaints seek injunctive relief and civil monetary

damages, which could be trebled. Separately, a number of large merchants have asserted similar claims against Visa and MasterCard

only. In October 2005, the class and merchant Interchange lawsuits were consolidated before the United States District Court for the

Eastern District of New York for certain purposes, including discovery. Fact discovery has closed and limited expert discovery is

ongoing. The parties have briefed and presented oral argument on motions to dismiss and class certification and are awaiting decisions

from the court.

In 2007, a number of individual plaintiffs, each purporting to represent a class of cardholders, filed antitrust lawsuits in the United

States District Court for the Northern District of California against several issuing banks, including the Company (the “In Re Late

Fees Litigation”). These lawsuits allege, among other things, that the defendants conspired to fix the level of late fees and over-limit

fees charged to cardholders, and that these fees are excessive. In May 2007, the cases were consolidated for all purposes and a

consolidated amended complaint was filed alleging violations of federal statutes and state law. The amended complaint requests civil

monetary damages, which could be trebled. In November 2007, the court dismissed the amended complaint. Plaintiffs appealed that

order to the Ninth Circuit Court of Appeals. The plaintiffs’ appeal challenges the dismissal of their National Bank Act, Depository

Institutions Deregulation Act of 1980 and California Unfair Competition Law claims, but not their antitrust conspiracy claims. In June

2009, the Ninth Circuit Court of Appeals stayed the matter pending the bankruptcy proceedings of one of the defendant financial

institutions. In November 2009, the Ninth Circuit Court of Appeals entered an additional order continuing the stay of the matter

pending the bankruptcy proceedings.

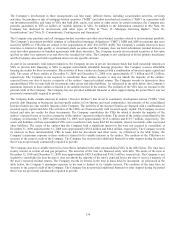

In January 2010, three individual plaintiffs, each purporting to represent a nationwide class of cardholders, filed lawsuits against

COBNA and Capital One Services, LLC (“COSI “) challenging various marketing practices relating to the payment protection

product: Sullivan v. Capital One Bank, et al, (United States District Court for the District of Connecticut); McCoy v. Capital One

Bank, et al. (United States District Court for the Southern District of California); and Salazar v. Capital One Bank, et al. (United

States District Court for the District of South Carolina). These three purported nationwide class actions seek a range of remedies,

including compensatory damages, punitive damages, restitution, disgorgement, injunctive relief, and attorneys’ fees. COBNA and

COSI have not yet filed responsive motions to any of these suits but has meritorious defenses with respect to these matters and plans

to defend them vigorously. In addition, in September 2009, the United States District Court for the Middle District of Florida certified

a statewide class action in Spinelli v. Capital One Bank, et al. with respect to the marketing of the payment protection product in

Florida. COBNA and COSI have filed a motion for reconsideration with respect to the class certification order and are awaiting a

ruling on the motion from the Court. In January 2010, the West Virginia Attorney General filed suit against COBNA and various

affiliates in Mason County, West Virginia, challenging numerous credit card practices under the West Virginia Consumer Credit and

Protection Act, including practices relating to the payment protection product. The West Virginia Attorney General seeks injunctive

relief, consumer refunds, statutory damages, disgorgement, and attorneys’ fees. COBNA has not yet responded to the complaint but

has meritorious defenses with respect to the claims and plans to defend them vigorously. Finally, COBNA is subject to formal and

informal inquiries from various governmental agencies relating to the payment protection product.

On February 5, 2009, GreenPoint Mortgage Funding, Inc. (“GreenPoint”), a subsidiary of Capital One Financial Corporation, was

named as a defendant in a lawsuit commenced in the Supreme Court of the State of New York, New York County by U.S. Bank

National Association, Syncora Guarantee Inc. (formerly known as XL Capital Assurance Inc.) and CIFG Assurance North America,

Inc. Plaintiffs allege, among other things, that GreenPoint breached certain representations and warranties in two contracts pursuant to

which GreenPoint sold approximately 30,000 mortgage loans having an aggregate original principal balance of approximately $1.8