Capital One 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 45

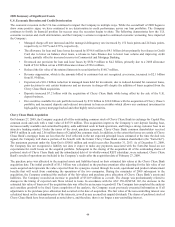

Stress Test Results

On May 5, 2009, examiners from the Board of Governors of the Federal Reserve System, the Federal Reserve Bank of Richmond, the

Office of the Comptroller of the Currency and representatives from other federal bank supervisors (together the “Supervisors”)

delivered a report to the Company under the U.S. Department of the Treasury’s completed Supervisory Capital Assessment Program,

also known as its “Stress Test.” In this report, the Supervisors provided the results of their estimates of the Company’s credit losses,

resources available to absorb those losses and any necessary additions to capital under the “more adverse” Stress Test scenario.

Resources available to absorb losses included the Company’s estimated pre-provision net revenues in 2009 and 2010, estimated loan

loss allowance levels in 2009 and 2010, and existing capital resources. The Supervisors concluded that the Company did not need to

raise any additional Tier 1 capital or Tier 1 common equity under the “more adverse” Stress Test scenario. It should be noted that this

was a point in time analysis and changes in assumptions could negatively impact the results.

U.S. Treasury Department’s Capital Purchase Program

On June 17, 2009, the Company repurchased all 3,555,199 Series A Preferred Shares, at par. The total amount repurchased, including

accrued dividends, was approximately $3.57 billion, compared to a book value of $3.1 billion. The difference represented unaccreted

discount of $461.7 billion, which was recorded as a dividend in the second quarter of 2009, reducing income available to common

shareholders. On December 11, 2009, the Warrants were sold by the U.S. Treasury for $11.75 per warrant. The sale by the U.S.

Treasury had no impact on the Company’s equity and the Warrants remain outstanding and continue to be included in paid in capital.

FDIC Assessment

In June 2009, The Federal Deposit Insurance Corporation (“FDIC”) issued a rule that would impose a 5 basis point special assessment

on a bank’s assets minus its Tier 1 capital as of June 30, 2009. The rule would also allow the FDIC to impose additional special

assessments if it believes that the Deposit Insurance Fund reserve ratio will fall to a level that would adversely affect public

confidence or would be close to or below zero. The special assessment was, and any future special assessment will be, capped at 10

basis points times a bank’s assessment base for the relevant quarter’s risk-based assessment. As a result, the Company recorded an

expense of $80.5 million during 2009.

Sale of MasterCard Shares

During the second quarter of 2009, the Company recognized a gain of $65.5 million in other non-interest income from the sale of

404,508 shares of MasterCard class B common stock.

Equity Offering

On May 11, 2009, the Company raised approximately $1.5 billion in proceeds through the issuance of 56 million shares of common

stock at $27.75 per share.

Debt Issuances

On May 19, 2009, the Company issued Senior Notes of $1.0 billion aggregate principal amount of non-guaranteed unsecured parent

debt at 7.375% due May 23, 2014.

On June 18, 2009, COBNA issued $1.5 billion aggregate principal amount of 8.800% Subordinated Notes due July 15, 2019.

On July 29, 2009, the Company issued $1.0 billion of trust preferred securities at a fixed rate of 10.25% due August 15, 2039.

On November 13, 2009, the Company issued $1.0 billion of trust preferred securities at a fixed rate of 8.875% due May 15, 2040.

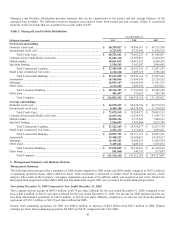

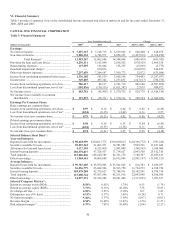

Year Ended December 31, 2008 Compared to Year Ended December 31, 2007

The Company had a net loss of $46.0 million, or $(0.21) per share (diluted) for the year ended December 31, 2008, compared to net

income of $1.6 billion, or $3.97 per share (diluted) for the year ended December 31, 2007. The net loss for 2008 included an after-tax

loss from discontinued operations of $130.5 million, or $(0.35) per share (diluted), compared to an after-tax loss from discontinued

operations of $1.0 billion, or $(2.58) per share (diluted) in 2007.

Income from continuing operations for 2008 was $84.5 million, a decrease of $2.5 billion, or 96.7% from $2.6 billion in 2007. Diluted

earnings per share from continuing operations for 2008 was $0.14, a decrease of 97.9% from $6.55 in 2007.