Capital One 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 33

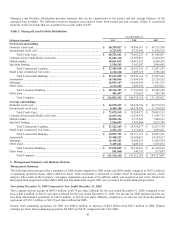

Nonperforming Assets

Nonperforming assets include nonaccrual loans, impaired loans, foreclosed and repossessed assets and certain restructured loans on

which interest rates or terms of repayment have been materially revised.

Commercial loans, consumer real estate and auto loans are placed in nonaccrual status at 90 days past due or sooner if, in

management’s opinion, there is doubt concerning full collectibility of both principal and interest. All other consumer credit card loans

and small business credit card loans are not placed in nonaccrual status prior to charge-off. For other consumer loans, the Company

places the loans in a non-accrual status, which prevents the accrual of further interest income, when a loan reaches a pre-determined

delinquency status, generally 90 to 120 days past due.

At the time a loan is placed on nonaccrual status, interest and fees accrued, but not collected and systematically reversed and charged

against income. Interest payments received on nonaccrual loans are applied to principal if there is doubt as to the collectibility of the

principal; otherwise, these receipts are recorded as interest income. A loan remains in nonaccrual status until it is current as to

principal and interest and the borrower demonstrates the ability to fulfill the contractual obligation.

Upon foreclosure or repossession, loans are adjusted, if necessary, to the estimated fair value of the underlying collateral and

transferred to other assets, net of a valuation allowance for selling costs. We estimate market values primarily based on appraisals

when available or quoted market prices on liquid assets.

Valuation of Mortgage Servicing Rights

Mortgage servicing rights (“MSRs”) are recognized at fair value when mortgage loans are sold in the secondary market and the right

to service these loans is retained for a fee; changes in fair value are recognized in mortgage servicing and other income. The Company

continues to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing operations. To

evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan type, note rate

and investor servicing requirements. Fair value of the MSRs is determined using the present value of the estimated future cash flows

of net servicing income. The Company uses assumptions in the valuation model that market participants use when estimating future

net servicing income, including prepayment speeds, discount rates, default rates, cost to service, escrow account earnings, contractual

servicing fee income, ancillary income and late fees. This model is highly sensitive to changes in certain assumptions. Different

anticipated prepayment speeds, in particular, can result in substantial changes in the estimated fair value of MSRs. If actual

prepayment experience differs from the anticipated rates used in the Company’s model, this difference could result in a material

change in MSR value.

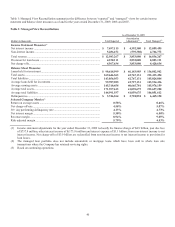

As of December 31, 2009 and 2008, the MSR balance was $239.7 million and $150.5 million, respectively. Included in the

December 31, 2009 MSR balance is $109.5 million added by the acquisition of Chevy Chase Bank. In January 2010, the Company

was notified by the insurer of certain Chevy Chase Bank mortgage securitization transactions that it will be removed as servicer of

mortgage loans with an aggregate unpaid principal balance of $3.1 billion as of December 31, 2009. The fair value of mortgage

servicing rights at December 31, 2009 reflects this expected loss of servicing.

Upon adoption of ASU 2009-16 (ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167), certain mortgage loans that have

been securitized and accounted for as a sale will be subject to consolidation and accounted for as a secured borrowing. Accordingly,

effective January 1, 2010, mortgage securitization trusts that contain approximately $1.6 billion of mortgage loans and related debt

securities issued to third party investors will be consolidated at their respective carrying values. The mortgage servicing rights related

to these newly consolidated trusts will be eliminated in consolidation. See “Note 1- Significant Accounting Policies” for expected

financial statement impacts and “Note 15—Mortgage Servicing Rights” for further information about the accounting for mortgage

servicing rights.

Valuation of Representation and Warranty Reserve

The representation and warranty reserve is available to cover probable losses inherent with the sale of mortgage loans in the secondary

market. In the normal course of business, certain of the Company’s subsidiaries certain originated residential mortgage loans and sold

them to various purchasers. Most of these mortgage loans were resold to securitizations trusts and others. In connection with its sales,

the Company’s subsidiaries entered into agreements containing representations and warranties about, among other things, the

mortgage loans and the origination process. The Company’s subsidiaries may be required to repurchase the mortgage loans in the

event of certain breaches of these representations and warranties. In the event of a repurchase, the subsidiary is typically required to

pay the then unpaid principal balance of the loan together with interest and certain expenses (including, in certain cases, legal costs

incurred by the purchaser and/or others), and the subsidiary recovers the underlying collateral. The subsidiary is exposed to any losses

on the repurchased loans after giving effect to recoveries on the collateral. The subsidiary may also be required to indemnify certain

purchasers and others against losses they incur in the event of breaches of representations and warranties and in various other

circumstances, and the amount of such losses could exceed the repurchase amount of the related loans.