Capital One 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

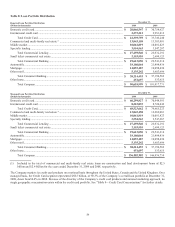

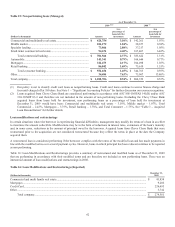

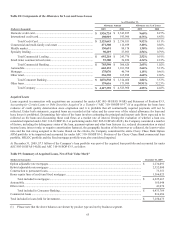

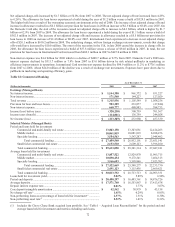

Table 17: Summary of Allowance for Loan and Lease Losses and Table 18: Components of the Allowance for Loan and Lease Losses

provide additional summary information on the activity in the allowance for loan and lease losses and the allocation of the allowance

to the Company’s loan portfolio.

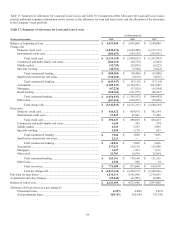

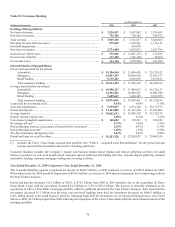

Table 17: Summary of Allowance for Loan and Lease Losses

As of December 31,

(Dollars in thousands)

2009 2008

2007

Balance at beginning of year .............................................................................. $ 4,523,960 $ 2,963,000 $ 2,180,000

Charge-offs

Domestic credit card ................................................................................. (3,049,676) (2,244,488) (1,315,172)

International credit card ............................................................................ (284,453) (255,145) (252,691)

Total credit card .............................................................................. $ (3,334,129) $ (2,499,633) $ (1,567,863)

Commercial and multi-family real estate ................................................. (208,163) (46,755) (2,463)

Middle market .......................................................................................... (52,759) (22,035) (6,223)

Specialty lending ...................................................................................... (48,761) (9,706) (3,812)

Total commercial lending ............................................................... $ (309,683) $ (78,496) $ (12,498)

Small ticket commercial real estate .......................................................... (134,264) (8,619) (4,616)

Total commercial banking .............................................................. $ (443,947) $ (87,115) $ (17,114)

Automobile ............................................................................................... (1,109,347) (1,236,251) (865,881)

Mortgages ................................................................................................. (87,226) (37,926) (18,394)

Retail banking .......................................................................................... (160,364) (121,375) (80,367)

Total consumer banking .................................................................. $ (1,356,937) $ (1,395,552) $ (964,642)

Other loans ............................................................................................... (207,010) (168,931) (30,600)

Total charge-offs ............................................................................. $ (5,342,023) $ (4,151,231) $ (2,580,219)

Recoveries

Domestic credit card ................................................................................. $ 446,822 $ 424,979 $ 392,544

International credit card ............................................................................ 51,825 65,041 71,869

Total credit card .............................................................................. $ 498,647 $ 490,020 $ 464,413

Commercial and multi-family real estate ................................................. 1,645 295 234

Middle market .......................................................................................... 2,923 2,397 2,995

Specialty lending ...................................................................................... 3,360 1,176 667

Total commercial lending ............................................................... $ 7,928 $ 3,868 $ 3,896

Small ticket commercial real estate .......................................................... 2,113 — —

Total commercial banking .............................................................. $ 10,041 $ 3,868 $ 3,896

Automobile ............................................................................................... 237,831 158,159 125,990

Mortgages ................................................................................................. 3,627 1,472 3,311

Other retail ................................................................................................ 21,703 18,559 22,054

Total consumer banking .................................................................. $ 263,161 $ 178,190 $ 151,355

Other loans ............................................................................................... 2,540 982 14

Total recoveries............................................................................... $ 774,389 $ 673,060 $ 619,678

Total net charge-offs ....................................................................... $ (4,567,634) $ (3,478,171) $ (1,960,541)

Provision for loan losses .................................................................................... 4,230,111 5,101,040 2,716,653

Acquisitions and other changes .......................................................................... (59,042) (61,909) 26,888

Balance at end of year ........................................................................................ $ 4,127,395 $ 4,523,960 $ 2,963,000

Allowance for loan losses as a percentage of:

Period-end loans ....................................................................................... 4.55% 4.48% 2.91%

Non-performing loans .............................................................................. 320.74% 562.44% 753.34%